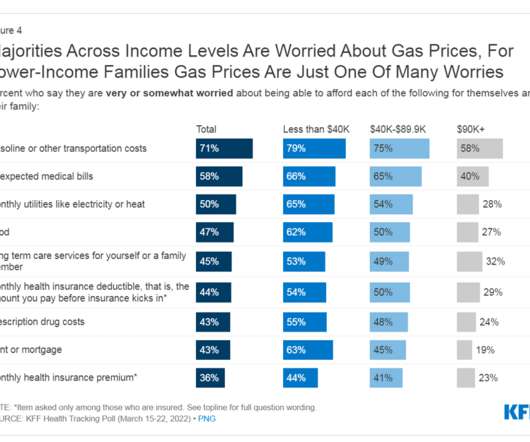

Financial Stress and Mental Health: Considering the New $24,000 Health Plan Cost from KFF

Health Populi

OCTOBER 22, 2023

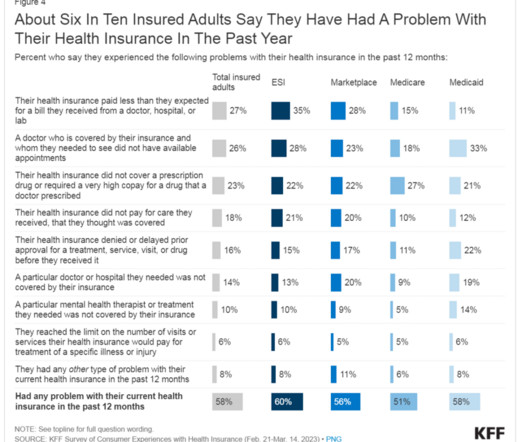

There is growing evidence on the connection between people’s financial health and their mental health, explored and explained in Understanding the Mental-Financial Health Connection , a study published by the Financial Health Network. consumers said paying a health care bill was stressful.

Let's personalize your content