The Patient as Consumer and Payer – A Focus on Financial Stress and Wellbeing

Health Populi

MAY 30, 2022

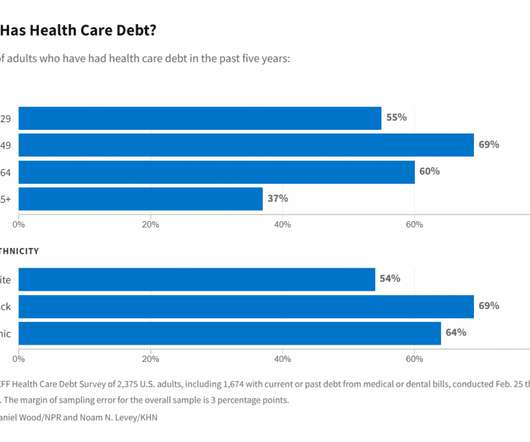

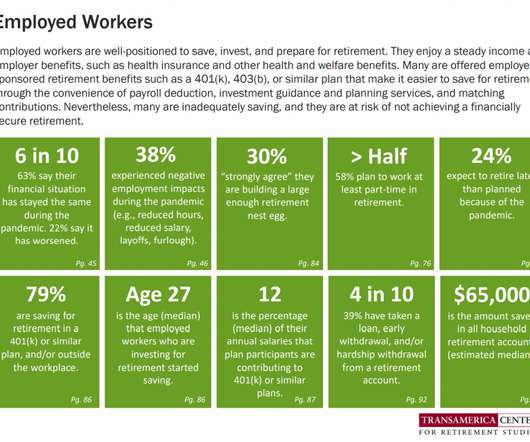

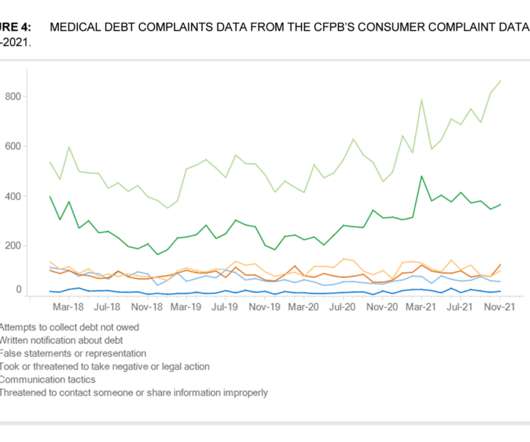

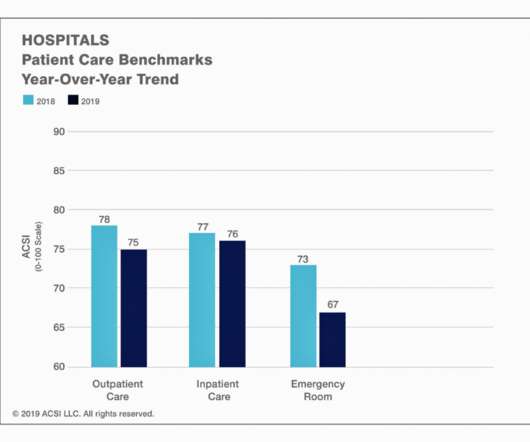

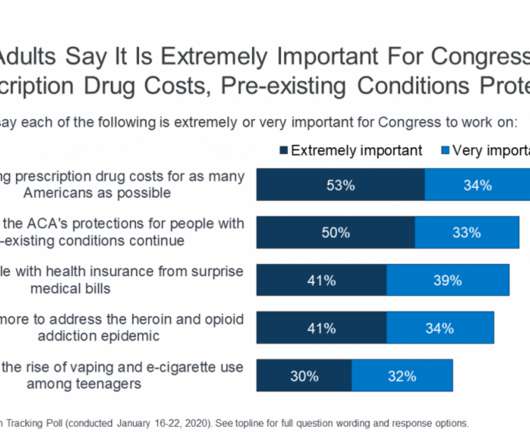

Year 3 into the COVID-19 pandemic, health citizens are dealing with coronavirus variants in convergence with other challenges in daily life: price inflation, civil and social stress, anxiety and depression, global security concerns, and the safety of their families. Medical debt has become such a financial burden and stress in the U.S.

Let's personalize your content