3 in 4 Insured Americans Worried About Medical Bills — Especially Women

Health Populi

DECEMBER 9, 2021

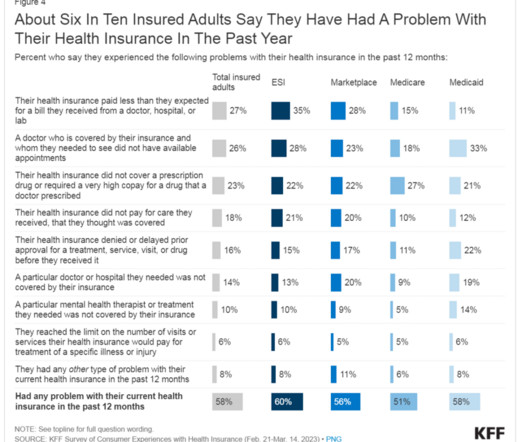

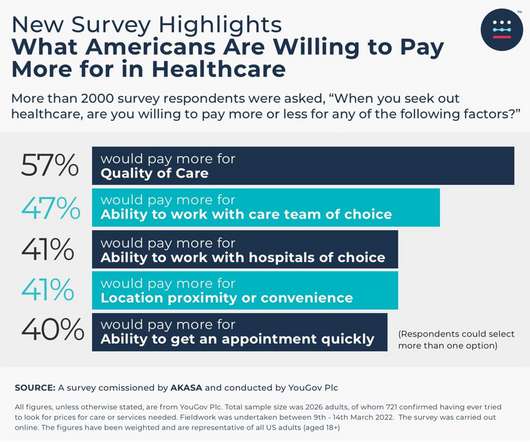

The surveyed health-covered consumers said their biggest frustration with health insurance was trying to figure out what was covered, along with identifying what providers were in their network and finding “someone” to answer their coverage questions. The survey drew on online 1,689 U.S.

Let's personalize your content