Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

Health Populi

AUGUST 23, 2021

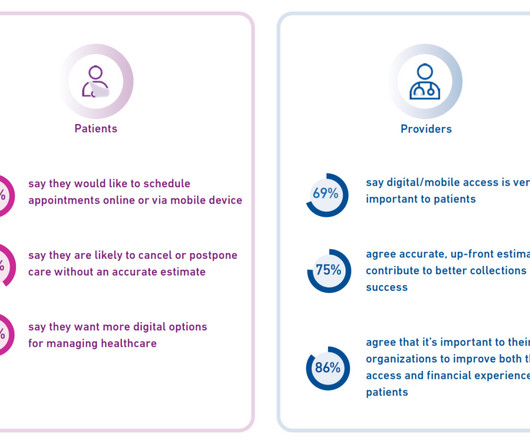

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. Patients have been much more forthcoming than hospitals, the journalists have found. .”

Let's personalize your content