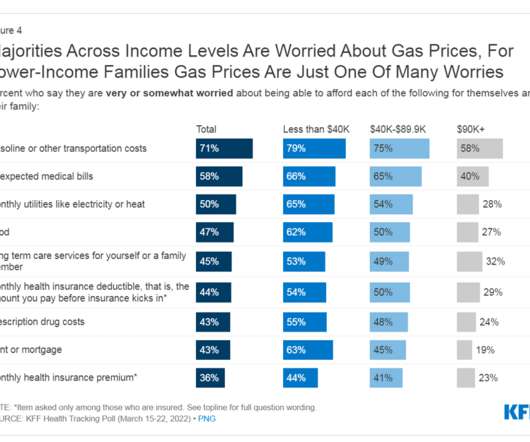

3 in 4 Insured Americans Worried About Medical Bills — Especially Women

Health Populi

DECEMBER 9, 2021

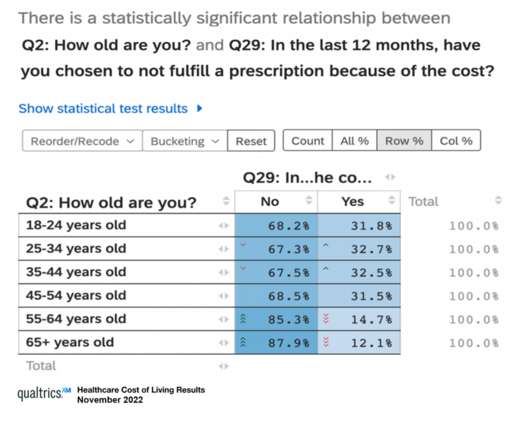

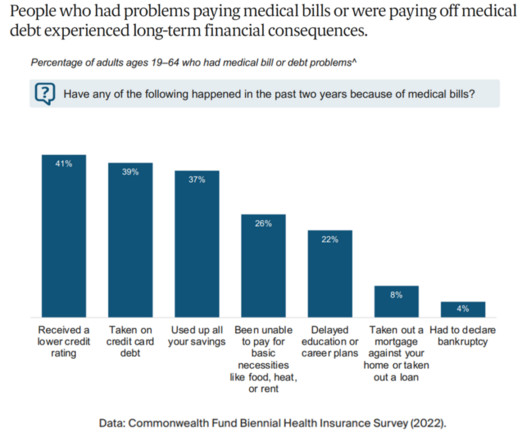

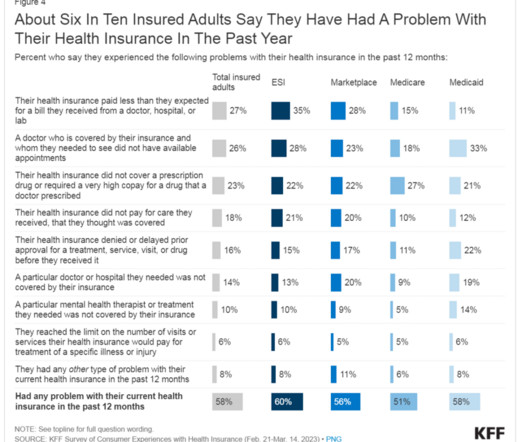

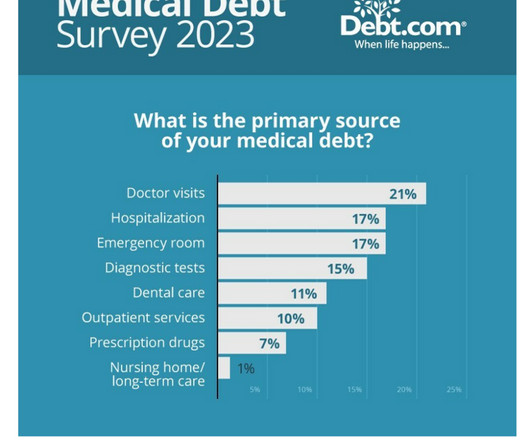

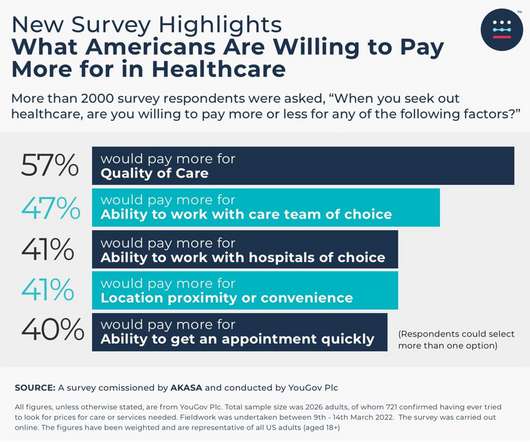

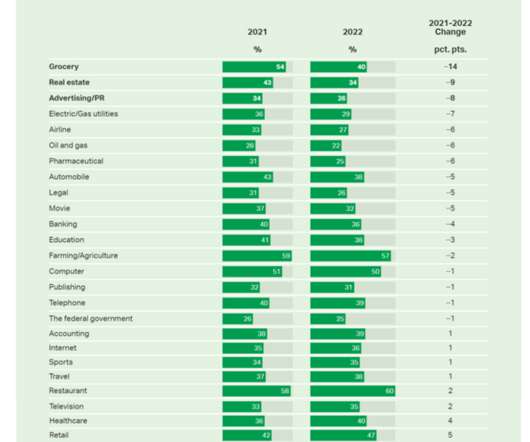

Both employees accessing employer-sponsored health care via the private sector and commercial insurance, as well as health citizens covered by public sector plans Medicare and Medicaid had concerns about medical bills. ” This is the current state of play for health citizens and health care payments in America, circa 2022.

Let's personalize your content