Surprise, Surprise: Most Americans Have Faced a “Surprise” Medical Bill

Health Populi

SEPTEMBER 4, 2018

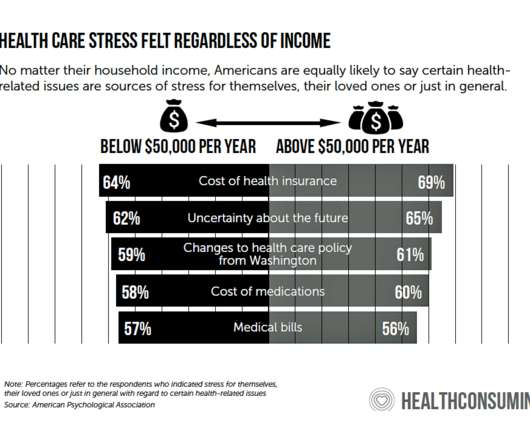

Most Americans have been surprised by a medical bill, a NORC AmeriSpeak survey found. patients blamed doctors and pharmacies, although a majority of consumers still put responsibility for surprise healthcare bills on them (71% and 64% net). In 2017, healthcare made up 18.2% Who’s responsible? Plus ça change.

Let's personalize your content