While the past is usually an excellent teacher about the future, the healthcare industry has typically bucked standard conventions of business and even the laws of economics.

However, it has not been immune to the market's post-COVID rebalancing act this year—with inflation overall rising faster than medical costs for the first time in three decades—which means executives at every healthcare business (hospitals and health systems, insurers, health tech companies and PBMs) should be listening to the data and insights from ghosts of recessions past.

It turns out there is a lot they can learn from the Great Recession—insights that allow them to read the tea leaves as they look to their 2023 strategies and beyond.

Reading the tea leaves of recessions past

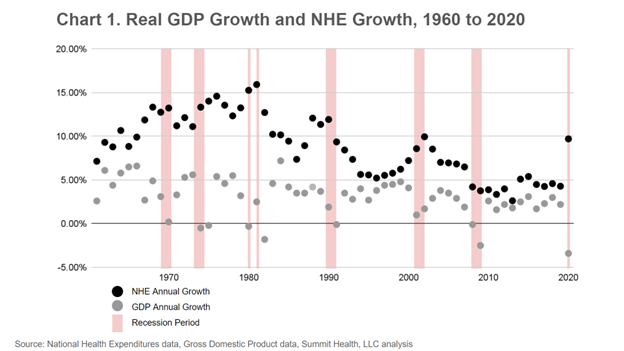

Two common indicators of economic strength are national spending and GDP growth. Focusing specifically on the healthcare industry, from 1960 to 2020, U.S. national healthcare expenditures (NHE) grew at an 8.7% cumulative annual growth rate, precisely 3x the average rate of growth for the country’s economy as a whole. Even during times of a shrinking economy (as measured by negative annual GDP growth), NHE never declined—in fact, healthcare expenditures spiked during seven of those eight periods (chart 1).

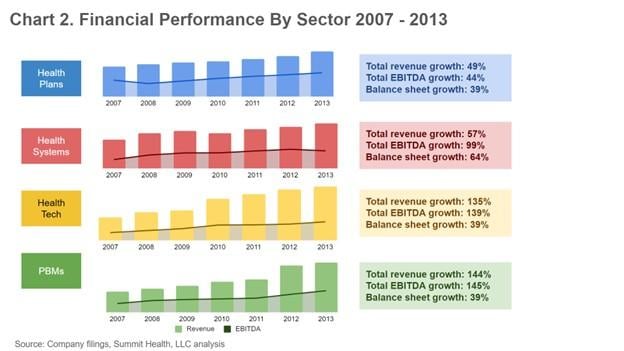

Another economic barometer is stock market performance. One important takeaway from the Great Recession is that falling stock prices were not an indicator of company profitability. Stock prices for healthcare companies may have dropped significantly during the Great Recession, but company financial performance (as measured by revenue growth and profitability/EBITDA), did not, according to Summit Health analysis of publicly traded healthcare companies from 2007 to 2013.

No payers, health systems, healthcare technology companies or PBMs saw negative revenue growth or took a profitability hit of more than one year (chart 2).

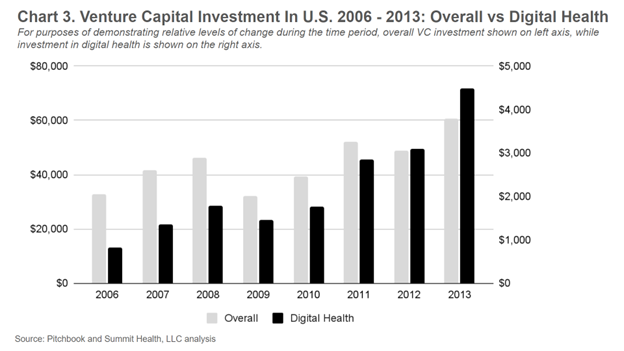

Looking closer at healthcare stock performance during the Great Recession, one important trend was the digital health sector’s fast-paced recovery. After an initial ~17% drop from 2008 to 2009 (going from $1.77 billion to $1.5 billion), digital health investment almost completely rebounded the following year, reaching $1.76 billion in 2010. In comparison, broader VC activity in the U.S. dropped by 30% from 2008 to 2009 and didn’t rebound until two years later in 2011 (chart 3).

The U.S. also saw many of the same issues as it does today regarding consumer healthcare behaviors and costs during the Great Recession, including increasing behavioral health issues, more medical debt, increasing drug prices and patients skipping their medications due to cost, and an increase in people who have delayed or foregone care altogether. Each of these trends will have downstream effects that will impact both healthcare consumers and businesses.

What does this mean for the healthcare economy and all of its players?

From an economic perspective, the healthcare industry has proven to be incredibly resilient. As the past data suggest, demand for healthcare services will remain robust. However, that does not mean the industry itself will escape challenges in the short term. There are significant underlying structural changes to the industry that will continue to drive both disruption and opportunity.

Using the past as a guide, healthcare organizations can make smarter, more measured strategy decisions, set more realistic expectations with company leadership and investors and be in a better position to weather any recession-related storms. There are four specific ideas healthcare leaders across healthcare should pay attention to.

1. Don’t let the cart lead the horse. Think strategically about necessary cuts

With labor costs rising faster than revenue and patient volumes still below pre-COVID levels, even health systems are looking at budget cuts (or freezes, at a minimum). As capital markets have dropped and funding has slowed to a dribble, companies across healthcare segments are also considering operating and capital expenditure cuts.

Rather than make cuts hastily, unplanned, in response to board mandates, leaders should view the inevitable (reductions) as an opportunity to proactively think critically about their future. What initiatives started during boom years haven’t panned out the way envisioned? What capabilities and assets are unique, and which reflect “me too” thinking? How is demand shifting, who is taking share and what service lines are most critical to the future?

By thinking ahead, leaders can develop a plan for if and when cuts are mandated.

2. Put patients and the basics in mind when innovating

If one thing is certain in the future of healthcare, it is increased consumer empowerment. From more consumer exposure to costs to price transparency rules to more accessible service offerings, we are in the midst of a massive shift in how consumers make healthcare decisions. Whether that shift takes place over a five- or 15-year time horizon, it is coming.

For health systems, leaders should be thinking about how to expand their services and their brand beyond the four walls of the hospital in ways that are more convenient and accessible to patients within and beyond their current catchment area.

For digital health companies who have been riding a fundraising high largely based on hype and growth at all costs, this means refocusing on the basics. They must dedicate scarce resources to evaluating the impact of their services to patients, conduct clinical validations and partner to study the real-world return on investment of their services.

Health plans have an opportunity to use new technology and tools to meaningfully engage their members. And for PBMs, this means figuring out a way to serve consumers and not just their B2B clients.

3. Embrace network effects and platform thinking

Network effects-driven platforms such as Uber and Airbnb have radically upended formerly staid industries, efficiently connecting consumers and suppliers. And while healthcare is behind, the platform revolution is coming to healthcare.

Already, paper prescriptions have been replaced by e-prescribing via the two-sided platform Surescripts, which connects doctors using EHRs directly to pharmacies.

As more of healthcare gets connected, consumers will increasingly turn to platform aggregators that can match supply with demand. There are countless opportunities for platforms to allow providers and provider systems to interact via platforms as well: Just last year, primary care Oak Street Health acquired RubiconMD, a platform facilitating e-consults between primary care providers and specialists.

Forward-looking healthcare companies are recognizing the walls that can be broken down and replaced with lower cost, more efficient platforms. Mayo Clinic Platform, for instance, was envisioned as a data platform to aggregate, normalize and de-identify vast patient data sets to make them available to researchers in a secure and privacy-preserving way.

Figuring out which platforms to utilize, and which ones to form themselves, will be important for an industry facing substantial change.

4. Pay attention and position yourself for policy changes

Some of the biggest forces behind healthcare’s resilience (and growth) during and coming out of the Great Recession were policy tailwinds. For PBMs, it was the implementation of the Medicare Modernization Act of 2003 and the newly created Part D prescription drug plan. For health plans and health systems, it was the Affordable Care Act and the expansion of Medicaid and subsidized insurance plans. For health technology companies, it was the Health Information Technology for Economic and Clinical Health Act, which was enacted as part of the rescue plan and provided financial incentives for physicians hospitals to adopt electronic health records.

Given that Medicare and Medicaid represent 38% of total national health expenditures, it will be important for healthcare leaders across segments to stay attuned to policy changes at state and federal levels. This past year’s Inflation Reduction Act had major implications for drug prices, and while we may not expect major policy changes during the next session’s Congress, with an upcoming presidential election we are likely to see increased focus on costs and accessibility.

Conclusion

Take stock, prioritize, pare down and focus. If the past is prelude, healthcare organizations across the board can rest easy knowing that demand will remain, even during a recession. But organizations that will be best positioned on the other side of the recession are those that take action now.

Seth Joseph is managing director of Summit Health, a recognized expert in digital health technology and an author of several articles on the space. He has been published in Health Affairs, American Journal of Managed Care, JAMIA, and has been cited in numerous industry media on topics ranging from e-prescribing to medication adherence, EHRs to the value that health information technology can deliver for patients and the healthcare system.