Self-insured employers are set to face plenty of challenges this year, ranging from addressing the mental health needs of their workforces to developing strategies for on-site clinics amid a pivot to larger volumes of remote work.

Those two concerns top a list of healthcare issues that keep officials at large employers up at night, according to a report by the Business Group on Health.

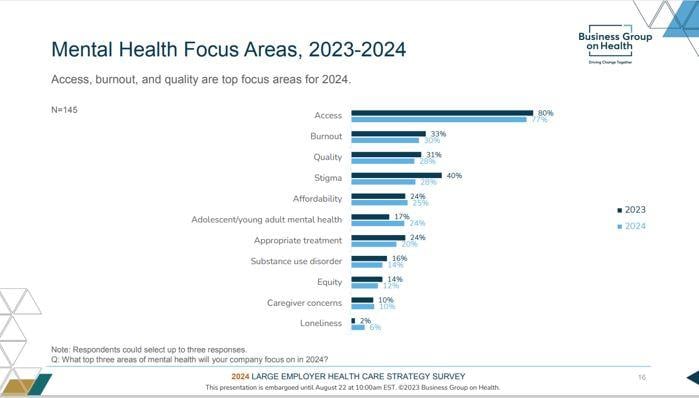

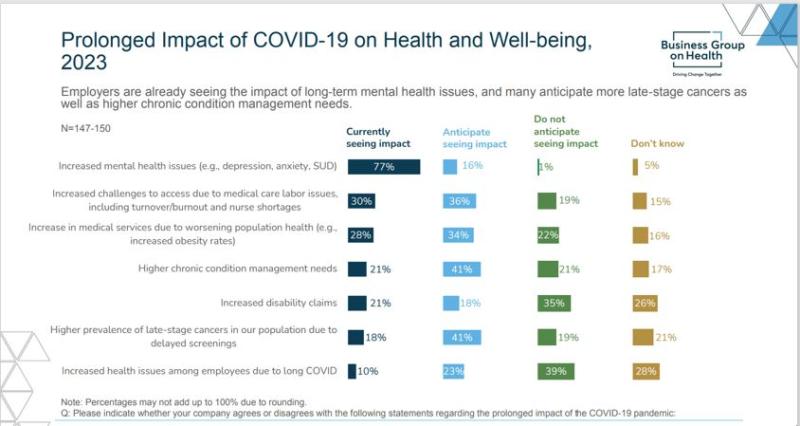

The executive summary of the report states that “whereas last year, 44% of employers saw an increase in mental health concerns, this year, 77% of employers reported an increase, with another 16% anticipating such an increase in the future.”

Ellen Kelsay, president and CEO of the Business Group on Health, told Fierce Healthcare in an email that “this increase is due to a constellation of reasons that include the pandemic, economic uncertainty, political shifts, natural disasters, climate change, overall reduction in stigma for those in seeking treatment, and so on.”

The survey found that employers are focusing especially on providing more options for support, as there are not enough psychiatrists or psychologists to go around, while also decreasing how much it costs employees to get care.

Employers also said that they’re reassessing the need for on-site clinics, or at least taking another look at just how they might function. Employers are “adjusting what is offered on-site to be reflective of their other care delivery priorities," according to the report.

This trend could stem from a focus on growing access to care, including primary care services and behavioral health, as well as to make it easier for workers to connect with specialty care and specialty pharmacy.

The survey of 152 large employers covering more than 19 million lives was taken between June 1 and July 18, 2023. 80% of the companies have more than 10,000 employees, and 78% are multinational companies.

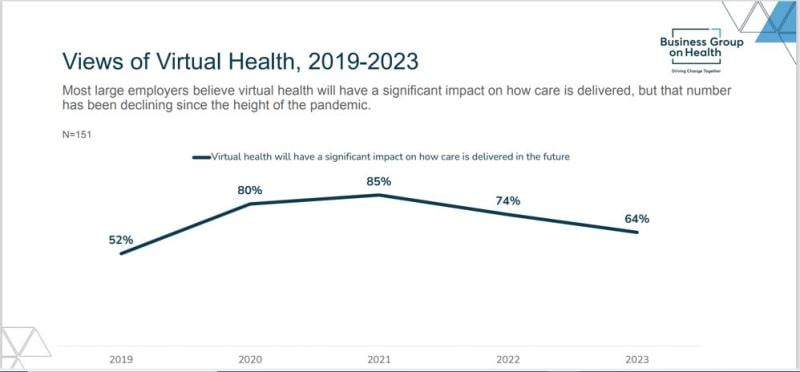

Employers are wrestling with the role of virtual care, too.

Though a growing presence in the healthcare industry for decades, use of virtual services skyrocketed under the COVID-19 pandemic, lessening the stress on flooded hospitals and physician offices.

Now, however, employers seem to be tamping down their expectations regarding just how transformative virtual health can be in the care delivery system.

“Their changing views are due to concerns regarding whether or not all forms of virtual health result in positive impacts on outcomes, quality, cost, experience and integration,” according to the report. “Employers are also concerned that there are too many virtual solutions, leading to market saturation, and too many choices for employees.”

Kelsay acknowledged the trend, noting that in 2021 85% of employers said that virtual health would have a significant impact on healthcare delivery, and in 2022 that dropped to 74%. Kelsay said that the 64% for 2023 “is still extremely high overall. Also, this decrease is not entirely surprising given the prominence and necessity of virtual health during the peak of the pandemic.”

She cited legitimate employer concerns about virtual health including a lack of coordination with community providers, lack of integration, and too many solutions. But she also said that the second priority for employers in 2024 is to implement more virtual health services, while also streamlining the number of vendors.

“Although employers may be looking to expand, they will also be increasingly discerning about those partnerships … and will look to vendors who partner well and integrate with others,” Kelsay said.

These firms are also reevaluating their vendor relationships beyond virtual care, Kelsay said. They're looking to address longstanding concerns about outcomes, cost, experience and quality.

Employers want to streamline partnerships and vendor offerings “and expect to conduct requests for proposals and other evaluations to support this goal," according to the report. "In addition, nearly half of employers will require vendors to report on health equity measures to enable evaluation of progress in this area.”

The surveyed employers also said they want to see evolution in how they work with pharmacy benefit managers; 73% said they would like additional data on compensation and pricing.

“Transparent PBMs provide employers and patients with greater access to information regarding costs,” Kelsay said. “The movement toward transparent PBMs signals employers’ desire to have a line-of-sight into drug pricing. The shift also spotlights misaligned incentives prominent in the pharmacy supply chain.”

The survey found that 92% of employers are concerned or very concerned about the cost of drugs in the pipeline, while 91% worry about the pharmacy cost trend overall.

“Those concerns appear to be well-founded, as employers experienced an increase in the median percentage of healthcare dollars spent on pharmacy, from 21% in 2021 to 24% in 2022,” according to the report.

Cancer care routinely makes the list of employer concerns, and in this report one in two employers rate it the number one driver of healthcare costs. 86% rate it among their top three.

They said they see among their employees more late-stage cancer diagnoses, as many patients delayed screenings during the pandemic.

“In fact, 41% of employers are anticipating more late-stage cancers in their population due to delayed screenings,” according to the survey. “Employers are taking steps to address this by focusing on advanced screening measures and maintaining 100% coverage for recommended prevention and screening services….”

Employers are also monitoring oncological clinical advancements in cancer care such as biomarker testing and immunotherapies, and 53% said that they will offer a cancer focused center of excellence approach this year.

An additional 23% hope to have this approach in place by 2026.