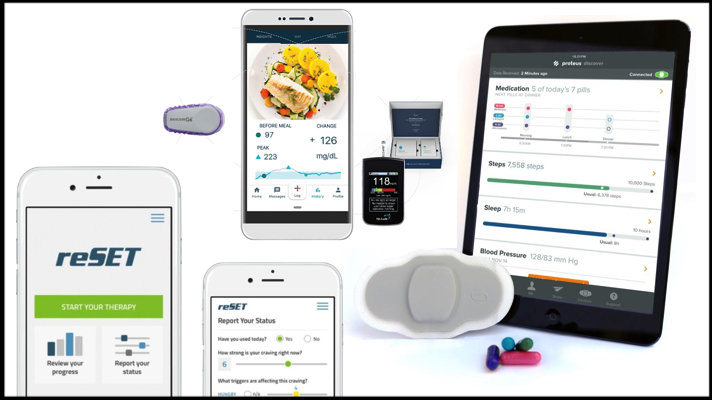

It has been a tumultuous week in the realm of digital health partnerships. It started with word of Proteus Digital Health’s floundering business and failed investment round, which reports say was partially driven by cooling relations between the digital pill maker and its longtime patron Otsuka Pharmaceuticals. A few days later, Sanofi announced a company-wide strategy shift that found Onduo, its pricey diabetes management joint venture with Verily, kicked to the curb in favor of the pharma’s higher margin therapeutics.

Take both of these updates alongside the premature conclusion of Pear Therapeutics and Novartis subsidiary Sandoz’s commercialization partnership back in October and it isn’t hard to recognize a persistent and worrying trend: several of the industry’s best publicized marriages of digital health and pharma don’t seem to be panning out quite as well as each party (not to mention their investors) might have hoped.

While the proximity of these cases will certainly make waves across the digital health landscape, these kinds of setbacks aren’t coming as a major shock to others similarly embedded in these types of uncharted collaborations.

“These are all risky,” Chris Hogg, chief commercial officer at digital respiratory health company Propeller Health, told MobiHealthNews. “[Digital health and pharma are] doing partnerships that haven’t existed before and we’re trying new ways of development and deployment. It’s kind of inevitable that certain things won’t work, and certain things will work. So, it’s not really surprising to me that maybe some of these partnerships haven’t worked out the way people thought they would. If they all worked out perfectly, this market would be a lot easier and there would be more companies in it.”

Pharmas, investors are unlikely to back off

Among the biggest concerns with these kinds of high-profile falling outs is that they might trigger a ripple effect across the rest of the market, with bearish stakeholders deciding to hold off or pivot away from making new deals.

That hasn’t been the case so far, Bill Evans, managing director of digital health venture fund and research group Rock Health, told MobiHealthNews. A key reason for this is the unique factors driving each of these breakups, the majority of which don’t suggest a failure of the digital health products themselves.

“The Sanofi one is a great case in point where the corporation as a whole is moving away from the therapeutic area that is the focus of this Verily partnership, so it would be unwise for them to continue in that partnership simply because of what they need to do as a business,” Evans said. “It’s sort of like a no fault divorce, as far as I can tell. I could be wrong, it could be that Verily was the breaking point for Sanofi to dial back diabetes, but I wouldn’t be inclined to believe that. There’s bigger dynamics at work in Sanofi.”

The key going forward will be for investors and other stakeholders to learn from these hiccups, Evans said, because healthcare still has plenty of room for digital health products able to demonstrate their value.

“I don’t see paradigm-level problems, … I see an industry that needs to take away individual, and individually valuable, lessons from each of three so that we move forward in a productive way that unlocks the value and potential for these kinds of partnerships in the future,” Evans said. “I diagnose it as a go-to-market execution problem, not as a value creating problem. That’s unfortunate, but it doesn’t materially change my outlook on the sector. These are the kinds of problems that can be solved.”

Investors aren’t alone in this mindset, Evans said. While a few biopharmas have experienced their own share of digital health stumbles, the common mindset is that the designs and strategies of these arrangements are very much a work in progress.

“What we’ve heard from the biopharma companies that we work with … is pretty consistent,” Evans said. “There are some that are troubled by what’s going on, but even in [these cases] I haven’t heard them say ‘This is done, digital will never happen, patients will never benefit, and this will never be our role’. What I’ve heard in every case is ‘We might be reevaluating how we deploy this stuff.’”

Propeller, similarly, isn’t expecting any of its existing or prospective pharma partnerships to go up in smoke. If anything, Hogg said, these kinds of headlines are a reminder that digital health’s push into mainstream care has a tough road ahead.

“We don’t see an overall change in the trend of the adoption of digital health and pharma’s belief that digital therapeutics are the next wave of innovation in terms of therapies — probably there’s just a growing awareness that it’s hard and going to take longer than anyone hoped,” Hogg said. “We have our ongoing partnerships; nothing’s really changed with them. We don’t see anyone fleeing. … If I was starting a new digital therapeutics company I wouldn’t read too much into it, other than ‘I have to find the right partner and make sure that we’re both committed to the long term.’”

“You kind of get a flurry of bad news and collaborations not working, and people take that as negative all around,” added Joe Slavinsky, VP of business development at Propeller, told MobiHealthNews. “We’re just not seeing that.”

When exploring the unknown, mitigate risks

Among the chief takeaways from these cases is the danger of overcommitting to a single product or program, Evans said. On the pharma side, this came in the form of big dollar deals and upfront payments for programs that were anything but guaranteed. For the startups, he highlighted the difference between Pear’s broader pipeline of digital therapeutic products, and Proteus’s all-in on Abilify MyCite.

“[These three cases] were all ‘go big or go home,’ and we know now that they’re all going home. Go big or go home is a high risk maneuver in any industry, much less in an industry where the two sides of a new partnership paradigm had not yet hammered out the ideal structure,” he said. “In [the Otsuka-Proteus] case, there were just a bunch of own-goals on both [sides]. Proteus, execution-wise, shouldn’t have put all their eggs in one basket. It was a huge bet, and I think Pear has been a bit more tactical in not relying on one thing. Proteus went all in on one thing, and it was a really challenging area.”

Both sides of the aisle would be best served exploring these partnerships more pragmatically via a portfolio approach, similar to how pharmas already handle biotech startups developing a novel drug, Evans said.

But there are also risks when it comes to the investments these startups are pursuing, Hogg warned. Proteus — which is now cutting hundreds of jobs and closing its facilities amidst a restructuring — is just the latest example of a startup that raised too much money and was unable to live up to the expectations of its backers.

“The more money you raise, the bigger the exit has to be and it’s harder to bring in new investors if you aren’t on a path that’s showing a huge potential exit,” he said. “Maybe some of these investments were made too big and too early, but that doesn’t mean that if you were to make the same investments today that it wouldn’t pay off. I think you’ll have existing investors and new investors come in [and] learn lessons from the past.”

Misaligned expectations

Further complicating these types of deals is the inherent differences between the established pharma industry and digital health startups, the proverbial new kids on the block. For Joe Shields, a pharma veteran now serving as president and cofounder of biopharma branding and communications group Health Accelerators, there’s no shortage of cultural factors that could drive larger entities away from their newest collaborators.

“A pharma may lose patience with its technology partner for many reasons, including a lack of understanding or disregard of regulatory and legal concerns specific to healthcare, misalignment over which entity ‘owns’ the customer, or a new CEO with a different agenda from the one who created the partnership,” he told MobiHealthNews. “Conversely, most tech companies are accustomed to quick decision making, a faster innovation cycle and shipping products that aren’t always finished. … They are bound to be out of sync most of the time.”

Evans said that these kinds of miscommunications between Pear and Sandoz likely led to “different misunderstandings about what the incentive structure for Sandoz to commercialize would look like,” while Hogg said that the decision for Sandoz to step away from its established generics focus to commercialize an entirely new type of health product was laying the groundwork for complications right from the start.

Hogg and Slavinsky themselves are no strangers to the push and pull between these entities, with the latter often advocating that pharmas and startups set appropriate expectations right at the start of a collaboration. The two digital health executives both said that they wouldn’t be surprised if these kinds of misaligned expectations might have played a role in the recent breakups.

“We’ve been around a while, so we know that implementing digital health in healthcare is a big change to workflow, reimbursement, behavior," Hogg said. "These are very hard and are going to take some time … I don’t know exactly what happened in those cases, but I do know if expectations aren’t set appropriately, that things aren’t going to be very fast and easy, there’s going to be disappointment.”

Show me the evidence

One noteworthy wrinkle in the case of Proteus is the role of clinical validation data. Reports on the company’s woes suggest that the early data from its Abilify MyCite program wasn’t up to snuff for Otsuka or the additional investors it was courting. In the end, the company appeared to have run out of funding before it could generate enough evidence supporting a strong return on investment.

“While big pharma generally has lots of patience for molecular entities — often decades of R&D investment — many still believe that anything digital must show a return in a matter of months because they have seen that with digital marketing,” Shields said. “Pharmas prioritize investments in their high-margin core medicines, devices and diagnostics because the financial and therapeutic returns are orders of magnitude greater than anything digital to date. I give Otsuka credit for its relatively long commitment to the Proteus platform, but in the end 'innovation' must at least cover its own costs.”

On this topic, Evans said that he was “empathetic” to investors and other stakeholders who would choose to hold off on investing in these circumstances, and noted that his own firm only invests in digital health companies that are able to deliver supporting evidence. That being said, he did wonder if Proteus may have shot itself in the foot by tackling an especially difficult challenge — an ingestible tracking tracking device for schizophrenia.

“It looks now like Proteus may have picked [a] therapeutic area with a degree of difficulty that’s an eight or nine out of 10, right? They may be paying the price for that tactical choice because it’s such a challenging therapeutic modality for their particular intervention to take hold,” he said. “If that’s true, it’s unfortunate, but it doesn’t disprove the value of Proteus itself. It simply means the evidence is yet to be seen.”

And for its part, Proteus’ statements this week often highlighted the company’s “extensive body of clinical evidence” for non-schizophrenia applications of its platform.

#NotAllPharmaPartners

Not to be lost in the drama are the other, quieter programs still chugging along in the background. Evans said that he’s heard success stories from roughly half of the 10 biggest pharmas, and that other such partnerships are still gestating, with few obvious causes for concern. Instead of looking solely to the negative cases for guidance, stakeholders would be better served exploring and emulating the industry’s success stories.

“They’re not getting much coverage right now, but I would look to companies like Novo Nordisk which has, with great intentionality and with continued incremental success, has now built up to something really exciting,” he said in reference to the company’s connected (but costly) insulin pens. “They’ve done something very thoughtful and aligned with their business in the digital space. I could be wrong, but I think that that’s supportive of their core strategy as a company and differentiating themselves. They’re an example of one that’s not as splashy, but very thoughtful execution.”

On the flip side, Slavinsky was of the mind that the pharma industry is still searching for its major digital health success story. As soon as these companies can point to a fruitful full-fledged commitment, he said that he expects the rest of the sector to dive in head first.

“From our perspective the ‘fast follower’ mentality is one that is alive and well in pharma culture,” Slavinsky said. “Many of these companies are wary of doing something drastically different, never mind at scale. They’re willing to dip their toes in the water in the form of pilots and smaller programs, but none have really jumped in. Our view is that one jumping in completely will allow the fast followers that are waiting on the sidelines to jump in after them. That has to be our belief, or we wouldn’t be here.

Back on your feet

For now, though impactful, these separations don’t seem to be the end for any of the three digital therapeutics firms. Pear said in October that much of the infrastructure built during its partnership is still in place and will allow the company to distribute its products self sufficiently, while Onduo still has Sanofi’s original investment and the continued support of Verily, as per the tech company’s blog post addressing the situation.

Proteus’ situation is admittedly the most dire, although the company was able to secure a short-term deal to bring back its furloughed employees and still has non-Abilify MyCite options it can pivot toward as it seeks a lifeline.

“I really do think it’s going to be different for each one. They’ve got really smart people at all three of these entities, and they’ve got more than one arrow in their quiver,” Evans said. “Proteus has more than one project going on, but they clearly focused on [Abilify MyCite]. That other remainder [could yield] success and earn them another round of financing, with a haircut. Who knows, but I don’t think we’ve heard the last on this breakup.”

And again, Hogg pointed out that each of these instances are occurring within an isolated sector of the industry. The larger trends here are pointing to increased investment, development and uptake, meaning that pharma will be unlikely to leave digital health behind in the long run.

“In broader context, you’re starting to see digital health companies, digital therapeutics companies partner with large healthcare companies that have been in the healthcare industry for a long time — pharma is one, … you have this Express Scripts announcement where this large PBM is now getting very involved in the payment and distribution of digital therapeutics, you have the partnerships like we’ve announced recently with pharmacies,” Hogg said. “You’re starting to see the slow integration of digital health into the existing digital health ecosystem. Pharma’s a big part of that, and they will continue to be.”