The definition of “convenience” in the eyes of patients, consumers, and caregivers is multi-faceted, with the concept of “location” shifting both physically and digitally. We learn this in new research from JLL, the global real estate services company.

“Why is a real estate services company doing research into consumers’ views on health care?” you might ask. See my Hot Points below, discussing my views on the morphing of health care real estate from Pill Hill and inpatient hospitals to the home and closer-to-home sites.

In the 2023 Patient Consumer Survey report, the topline lesson is that “cost and location drive patient decisions, while service and comfort drive experience.”

JLL polled 4,037 U.S. adults in April 2023 to gauge peoples’ experiences with healthcare received in the past year (think back to April 2022 and the next 12 months for the time horizon).

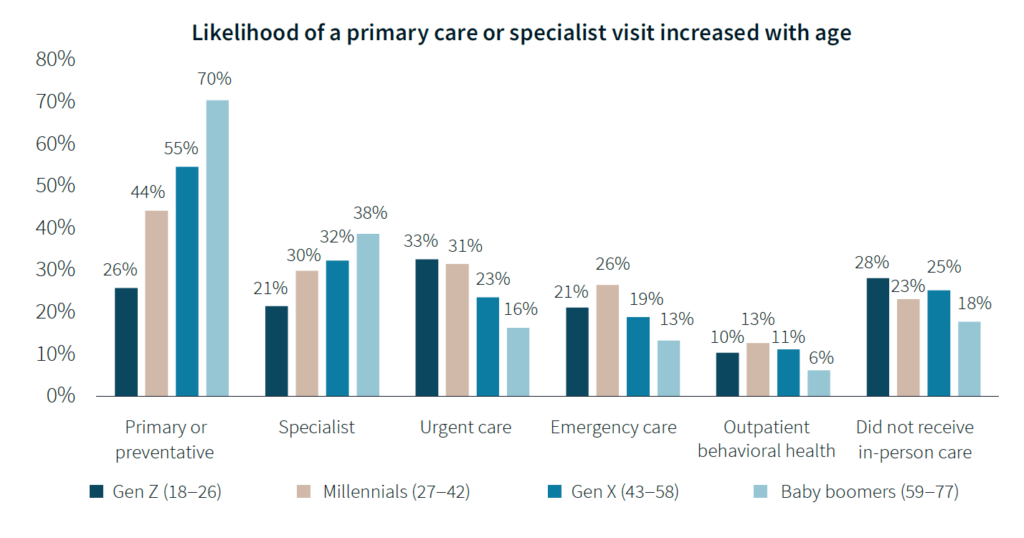

Patients most frequently make visits for primary or preventive care, followed by seeing a specialist, and seeking urgent care, the first bar chart illustrates. Underneath that macro statistic, check out the differences across age groups — Boomers (ages 59-77) were the most frequent visitors for primary/preventive care, but seeking specialty care was more common from ages 27 (Millennials) on to Boomers . See that urgent care visits were more likely sought by younger patients under 43.

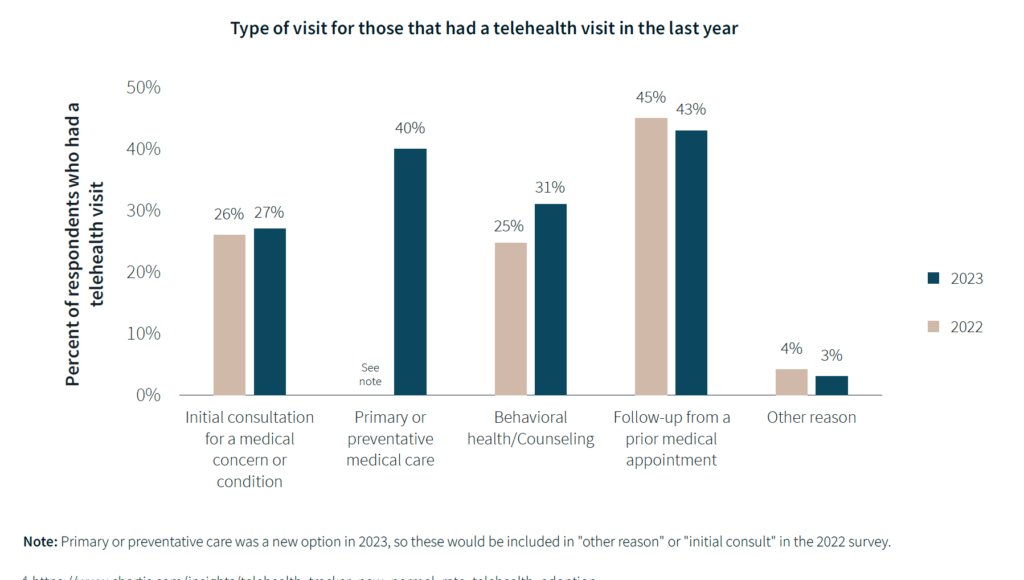

In the last year, 42% of U.S. adults had a telehealth visit, down from 45% the year before.

Telehealth visits were most common for follow-ups from prior medical appointments, primary or preventive care, and behavioral health or counseling — with this category of visits growing by 6 percentage points from 2022 to 2023.

Initial consultations via telehealth were flat for around 1 in 4 people each year.

Importantly, based on their experience, 7 in 10 patients who had a telehealth visit in the past year would prefer telehealth in the future.

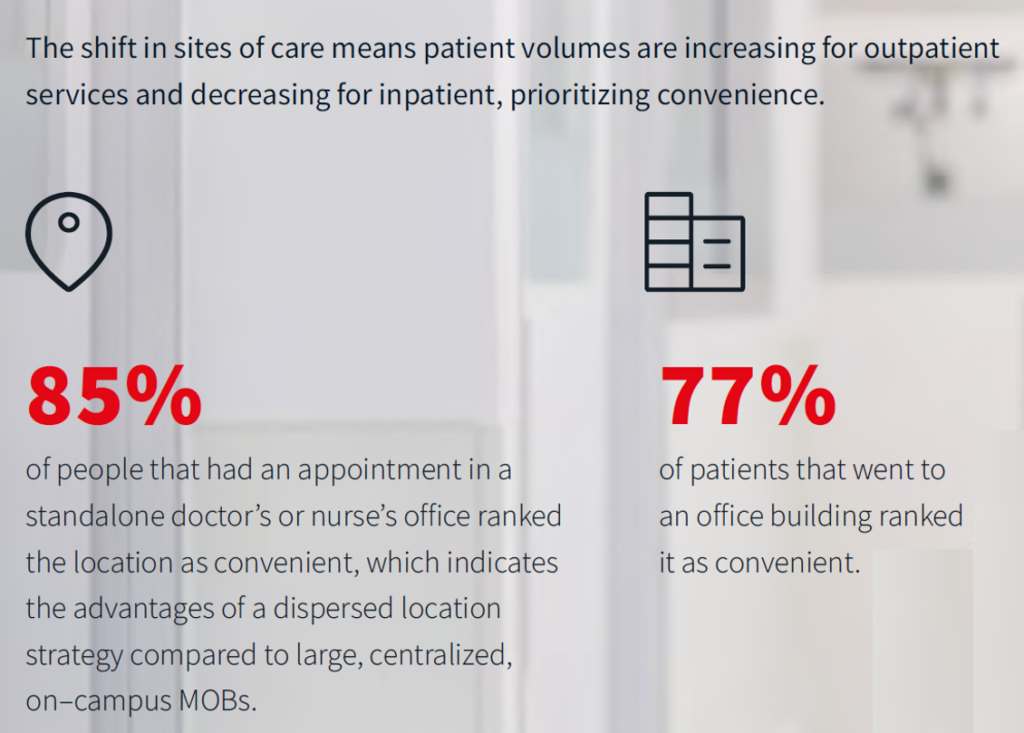

We are witnessing patients-as-health-consumers’ shifting expectations for experience in health care to be convenient — for several aspects of that experience. This translates into time required for one of two things — either to wait for an appointment to see a clinician (in particular, a specialist or mental health counselor) or time to travel to the appointment. In addition to time-cost, there is the convenience of access — parking lots and logistics of wayfinding in and through a large medical center or office building.

Furthermore, many patients also visited more than one health care service or office on their visit — partaking in outpatient behavioral health, emergency care, urgent care, or surgical procedures, for example.

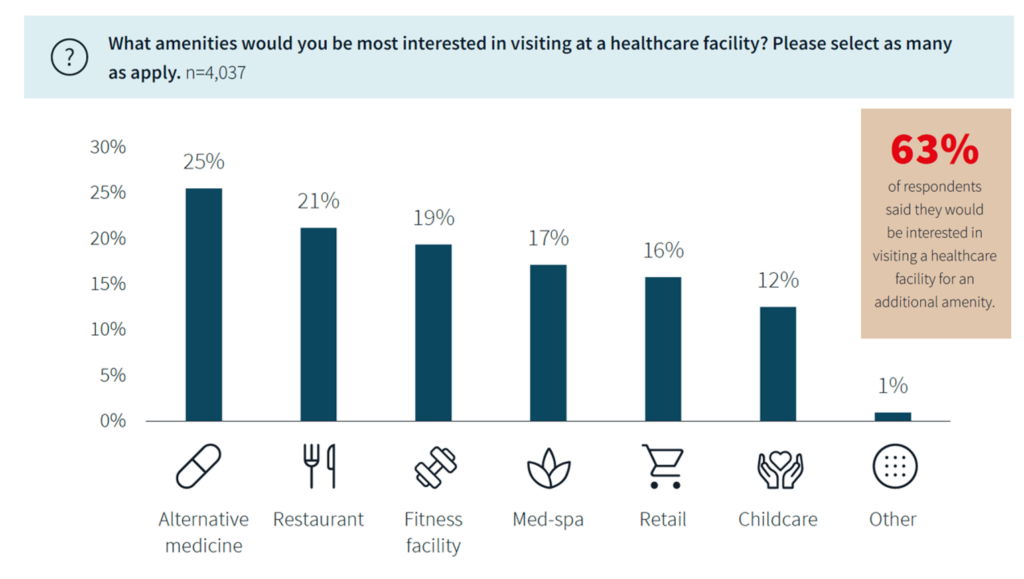

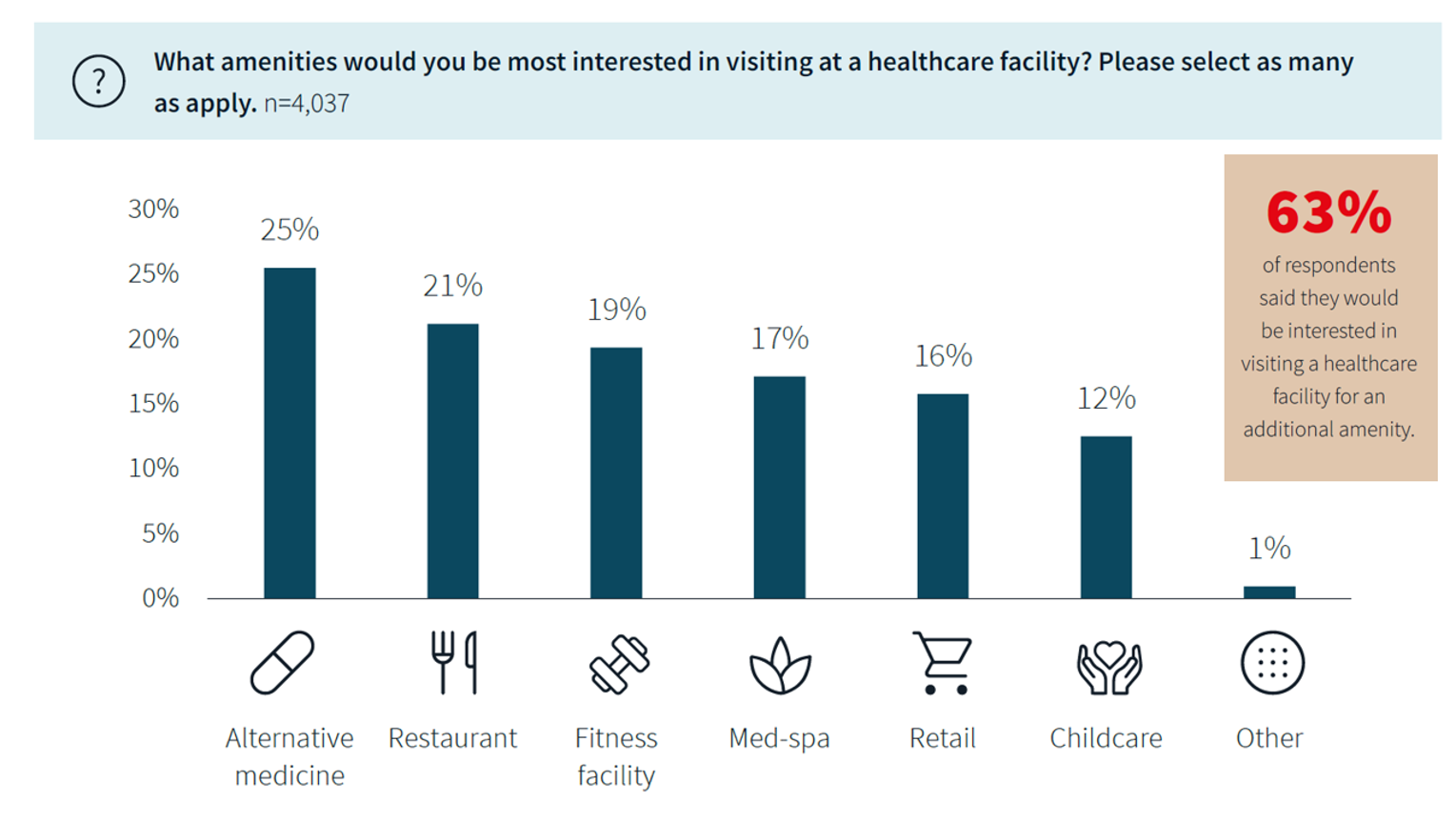

As patients make choices wearing health consumers’ hats, they are also seeking a sort of “bundling” of care experiences and other services the can be consumed during the medical care visit. Note this bar chart on amenities patients would be keen to visit as part of a health care experience — notably alternative medicine, restaurants, fitness/gyms, med-spas, and retail shopping opportunities.

Health Populi’s Hot Points: Now, to answer the question I posed at the top of this post – “Why” JLL explores consumers’ views on health care.

JLL has built up its global expertise in real estate and finance for over 200 years, starting life as Jones Lang LaSalle in 1783 in London.

Since then, the firm expanded internationally and covers every industry segment — including healthcare, per se, but also sectors immediately adjacent to medical services such as life sciences, senior housing technology, retail, and hospitality.

The prescient folks at JLL well understand how commercial real estate was impacted during the coronavirus pandemic, in cities where office towers were vacant and many still under-utilized.

And, to be sure, how hospitals and brick-and-mortal medical centers and MOBs were also impacted by patients’ medical distancing along with the rise of telehealth and virtual care platforms.

Just as health care providers are undergoing transformation to deal with the blurring of patient care, from hospital to ambulatory settings and on to the home and closer-to-home community settings, companies like JLL are also re-formulating their business strategies by better understanding how their clients’ demands are changing.

Those clients include the end-user health care consumer, patient, and caregiver, which JLL’s research helps us better understand in this research report.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.