“Businesses which have witnessed a rise in brand value…have all transcended their established category norms and play a more significant and meaningful role in society and consumers’ lives,” we learn in the Interbrand Best Global Brands 2023 report, subtitled, “How Iconic Brands Lead Across Arenas.

Most brands stagnated or lost ground in terms of brand value in 2023, with average growth rate of 5.7% compared to 16% in 2022. But those who rose fast bucked the stagnation trend, and included the fastest risers Airbnb (growing brand value by 21,8%) and Microsoft (increasing in brand value by 14%, the highest growth rate among the Top 10 companies in the study).

Quite relevant for the health/care ecosystem is Interbrand’s observation of a long-term trend contributing to stagnation: that brands operating “exclusively in one sector, taking an incremental approach, have experienced slower brand value growth.”

In the 2023 update of this annual report, many of those arenas blur into health and well-being.

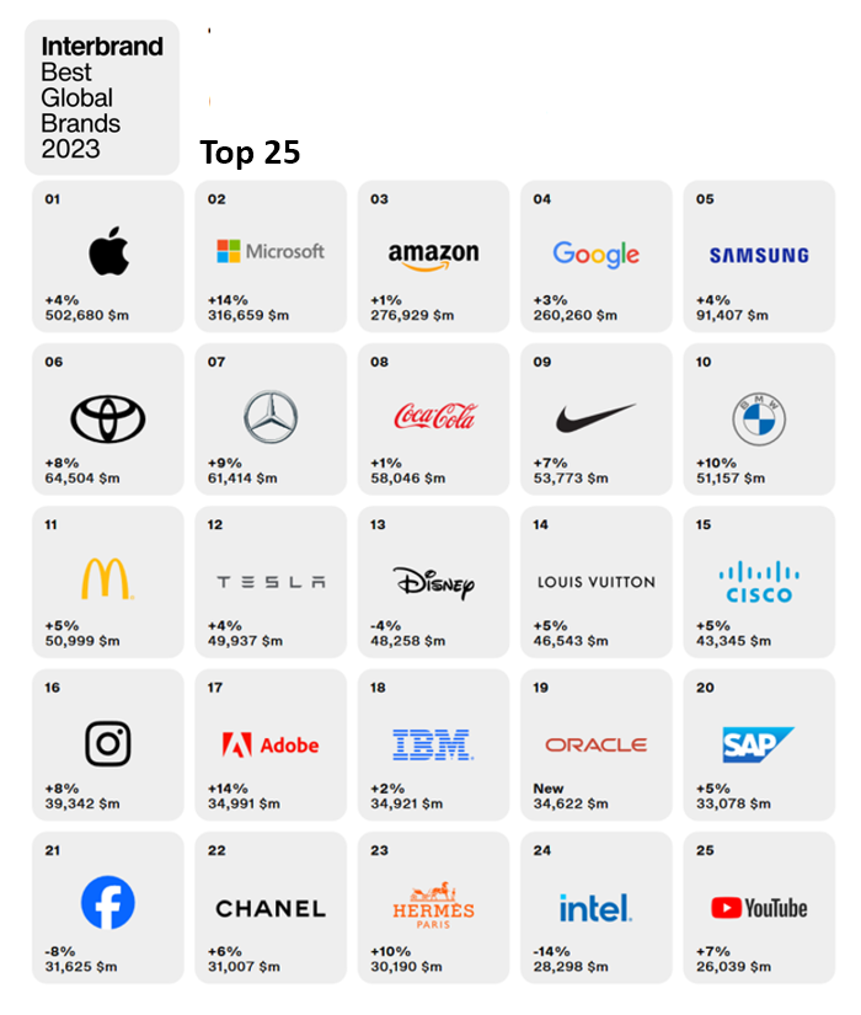

Here’s a view of the Top 25 of the 100 iconic brands. Note that every company on the top line of 5 serves the health care market in some way, and I allude to Interbrand’s pointing to operating beyond a core business to bolster growth.

So we see Apple, Microsoft, Amazon, Google, and Samsung, all providing some aspect of health care products and/or services, on top of the 100 companies’ brands.

In the remaining Top 20, we see Nike in the wellness/fitness space, Oracle (via Cerner and O’s legacy business) in EHRs and health data, and the social networks Instagram, Facebook, and YouTube quite prominent as platforms for consumers and health care organizations alike sharing information and supportive content.

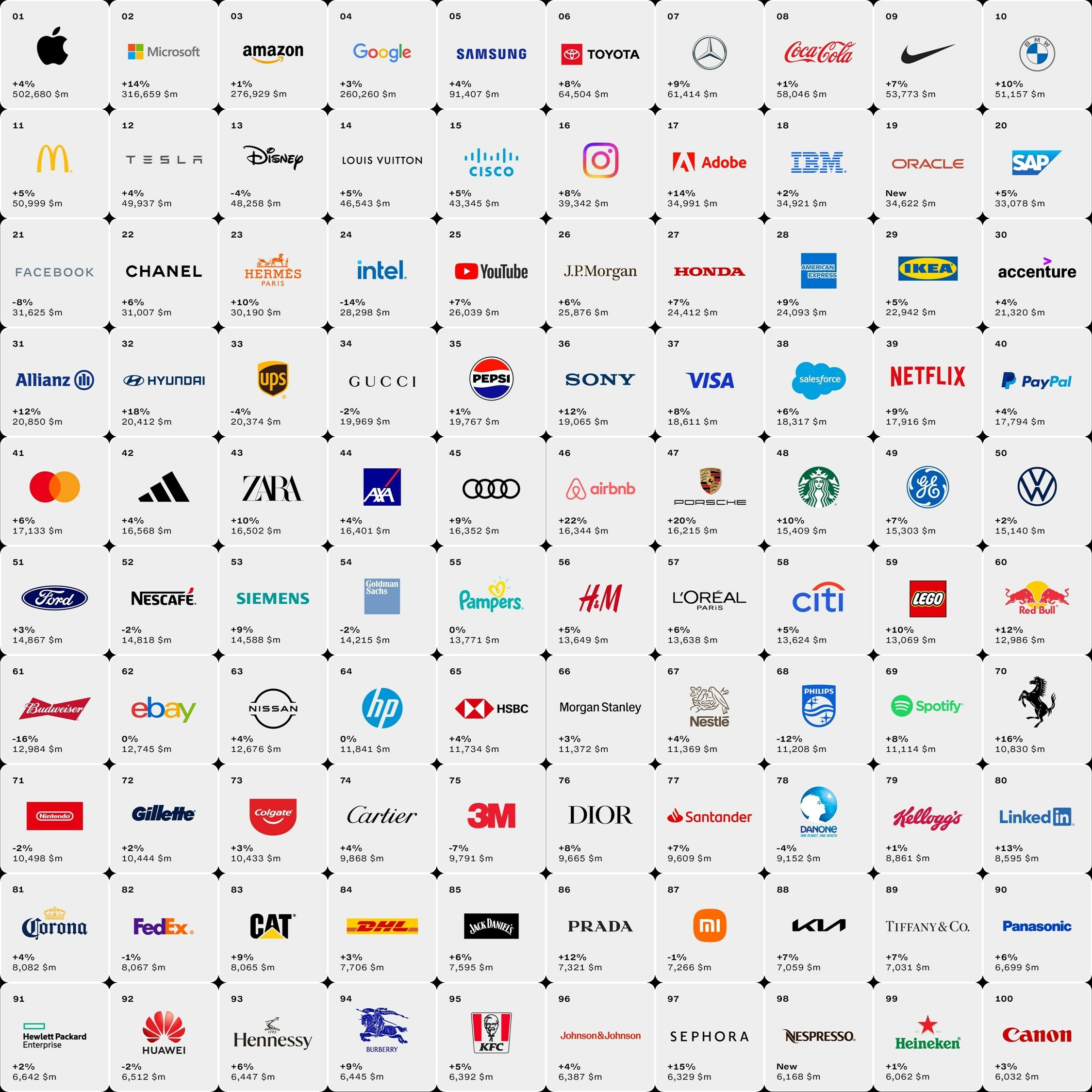

Among the other 75 best global brands, there’s lots of health and well-being channeled in different ways and for different ends; for example,

- Allianz, active in health and sports

- Adidas, long active in fitness still in growth mode

- Siemens, whose Healthineers have a growing focus on personalized medicine

- L’Oreal, bolstering AI for beauty and well-being

- LEGO, whose products increasingly attract adults and families for well-being and mental health

- Nestle, continuing to enhance nutrition in its portfolio

- Philips, growing global markets for imaging and consumer health

- Danone, as a B Corp, focused on health and sustainability

- Xiaomi, a global powerhouse, with wearable technology a key product area

- Johnson & Johnson, still growing even with a bumpy 2023 in reorganizing the enterprise, and,

- Kellogg’s, reorienting part of the company toward more nutritious food with the growing question of how GLP-1 drugs might affect the category.

Within the report, there are mentions of health and medical care, with prominent graphics and column inches on Amazon featuring One Medical, and GE HealthCare’s Global CMO Linda Boff in conversation with Interbrand discussing the reinvention of three GE brands, one of which was focused on health care. What could health care have in common with the two brand-company sisters in Aerospace and Vernova in energy?

Boff points to the commonality of “innovation, trust, reliability, invention, and a global view of the world.”

Health Populi’s Hot Points: The Interbrand folks are great communicators, and the 2023 report has quotes from interviewees and the rapporteurs peppered throughout. I pulled out six I felt could be useful in our learnings for the health/care ecosystem for the next year ahead.

Consider:

The goal is no longer personalization, it’s individualization at scale.

These brands stand out by blending in, because people measure the entire experience by how much it adds to their lives and how little it disrupts it.

There’s almost no part of the marketing challenge today that isn’t about desire for immediate return. You have six seconds to make someone care. That’s a really hard job.

This art of crafting purpose — is crafting something that is relevant every day and inspiration for the long term.

Smart partnerships and alliances are the ways we put our brands into the world in ways that are harmonious and interesting with consumers.

And finally this one that speaks to the universality of experience and patients’ expectations of their healthcare experience….

It’s dangerous to think about parity in category. One of the reasons expectations are rising is because there’s greater agency across arenas for customers. So, if I have a great experience with Apple and I dive back into my banking app — my expectations are raised.

This is particularly apt as Apple grows its expertise and evidence for its products in health and medical settings — as well as recognizing the patient as payer, where financial health and life-flows sync with the health care experience.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.