Most U.S. consumers will continue to spend their disposable incomes on connected consumer devices, but will be looking for more balance in their digital lives according to Deloitte’s fourth annual 2023 Connected Consumer Survey.

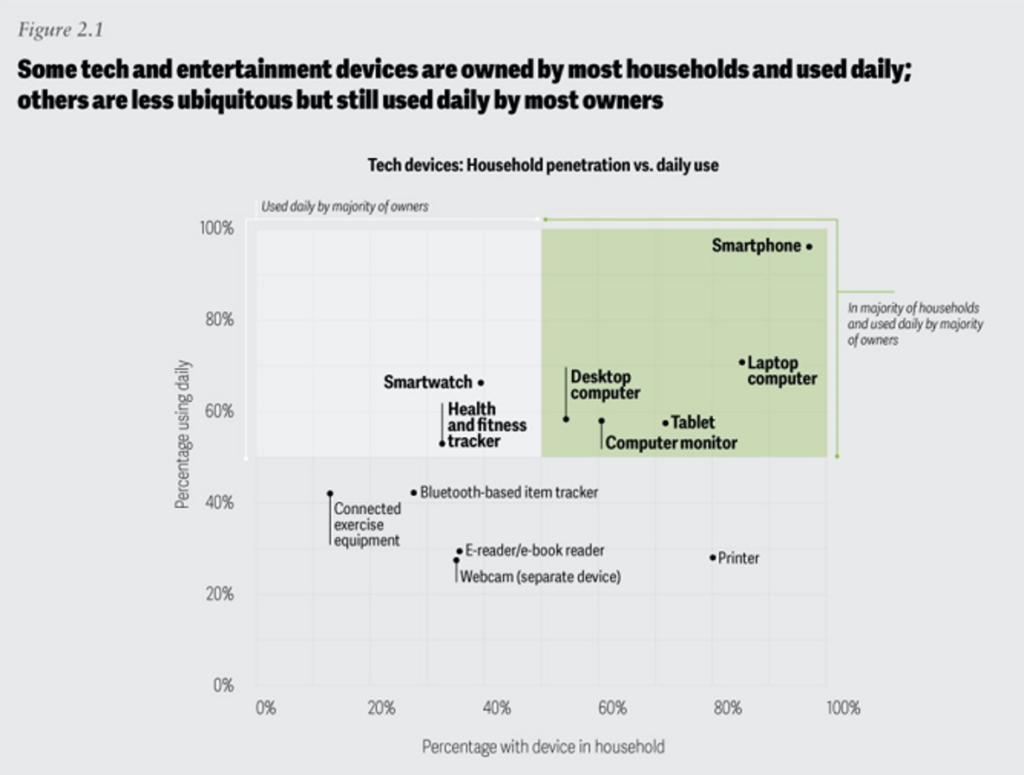

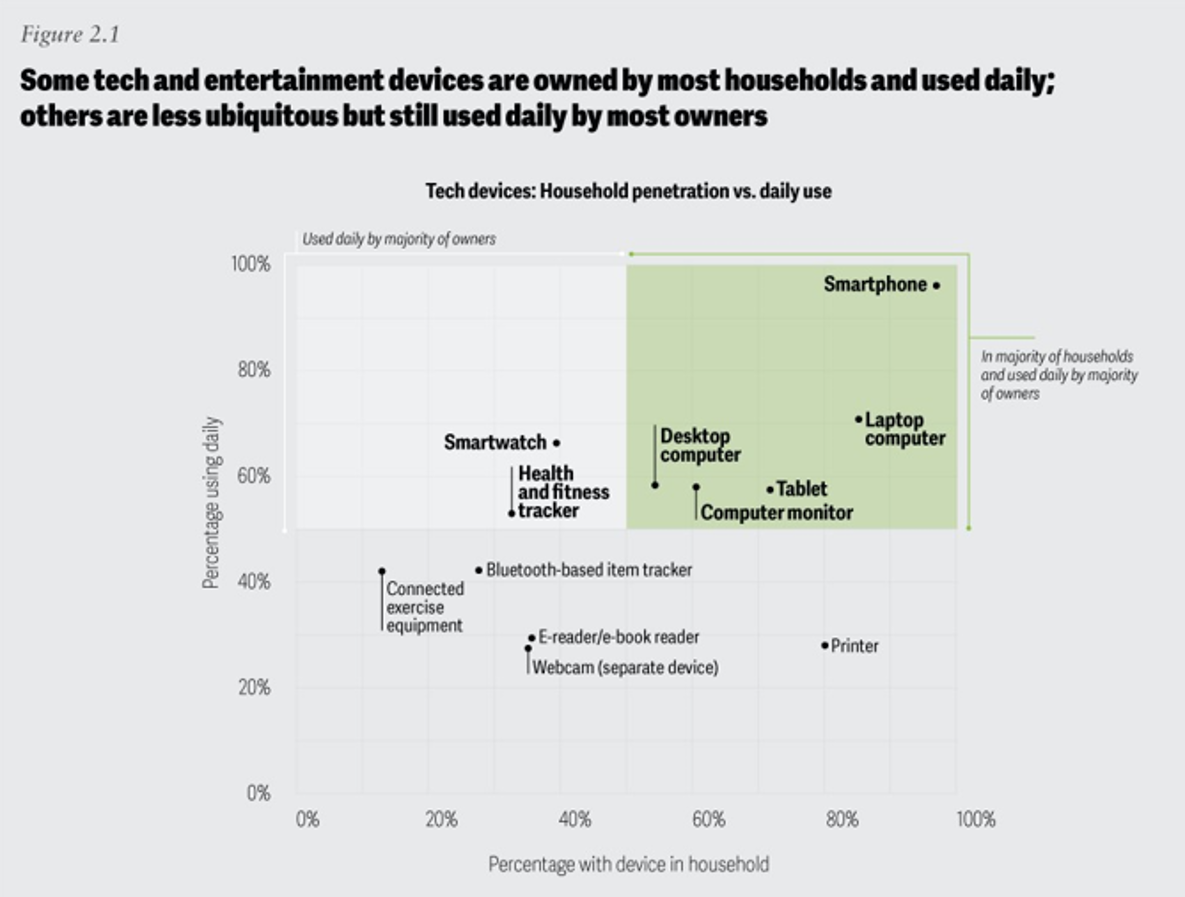

In this year’s update, the Deloitte Center for Technology, Media & Telecommunications found that most households use five key digital devices daily: above all, smartphones, followed by laptop and desktop computers, tablets, and computer monitors.

Most consumers who own smartwatches and health and fitness trackers also use those devices every day, as shown in the household penetration/usage chart here from the report.

I’ve been tracking this study since its inception, when it focused on “Connectivity and Mobile Trends.”

Four years later, Deloitte’s research has expanded to peoples’ everyday digital lives and lifestyles — gauging peoples’ adoption and use of:

- Technology, entertainment, smart home, and smartphone devices

- Connectivity via home internet and mobile

- Virtual experiences for working remotely, education, and health care, and,

- Wearable technology (those smartwatches and fitness trackers).

For the survey, Deloitte polled 2,018 U.S. adults in the second quarter of 2023.

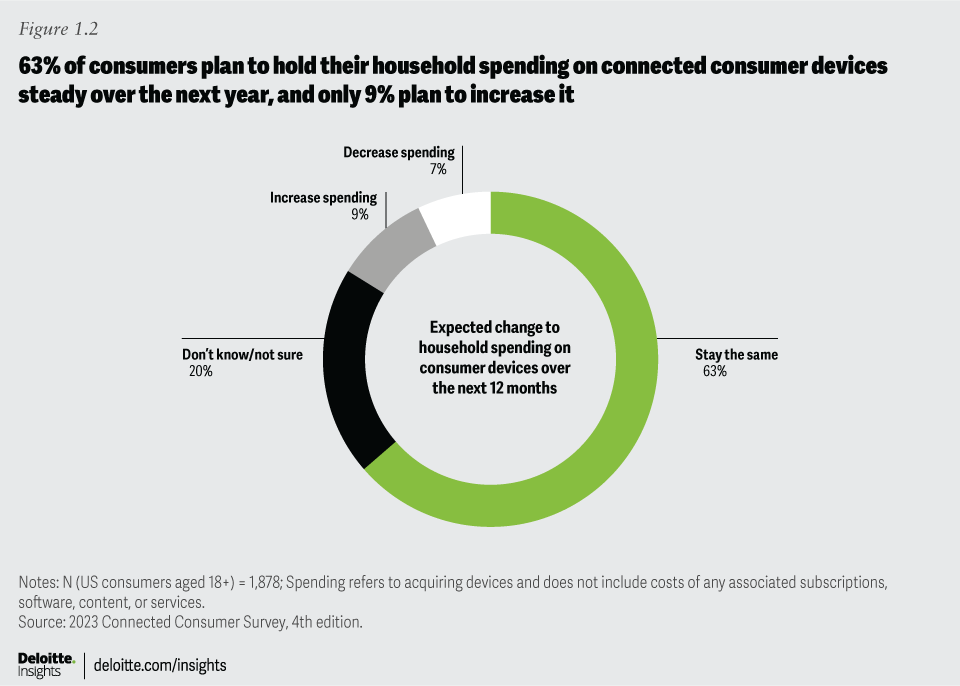

While 2 in 3 U.S. consumers will keep spending on digital stuff at about the same level as they did in 2022, Deloitte found that households have actually pared down the number of devices they had last year. Why the “device pruning?” Deloitte reports that consumers were filling the functionality by fewer devices, avoiding spending on things they felt were over-priced, or eliminating a device due to its being outdated.

Only 1 in 10 people will spend more on connected devices int he coming year.

Now let’s focus on the health-consumer aspect of digitally connected people. To give you a sense of their topline for digital health, Deloitte titled that section of its report, “Virtual health and fitness find their rhythm.”

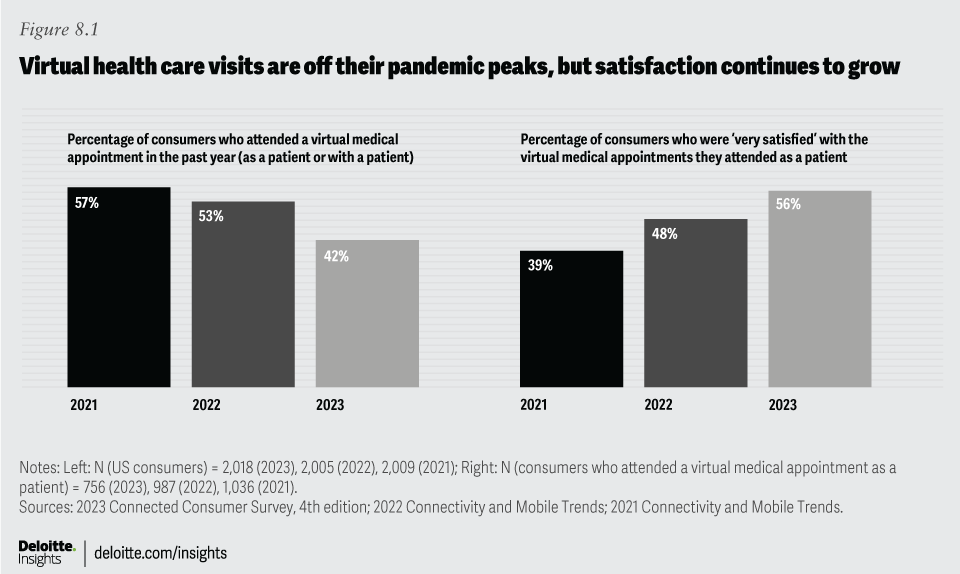

The bar chart updates our understanding of U.S. consumers’ virtual visit utilization from 2021 to 2023, showing a downturn in telehealth — from 57% of consumers attending a virtual medical appointment in 2021 falling to 42% of consumers in 2023.

But on the upside, note that a growing percentage of health consumers were very satisfied with the virtual health encounter, up from 39% in 2021 to 56% very satisfied in 2023. Consumers also had a preference for virtual or hybrid options for mental health and therapy sessions, as well as for following up chronic conditions already diagnosed.

As we’ve seen in recent research from the Consumer Technology Association I’ve discussed here in Health Populi, consumers continue to adopt and use smartwatches (for all functions and, to be sure, for health apps), with spending on dedicated fitness trackers softening.

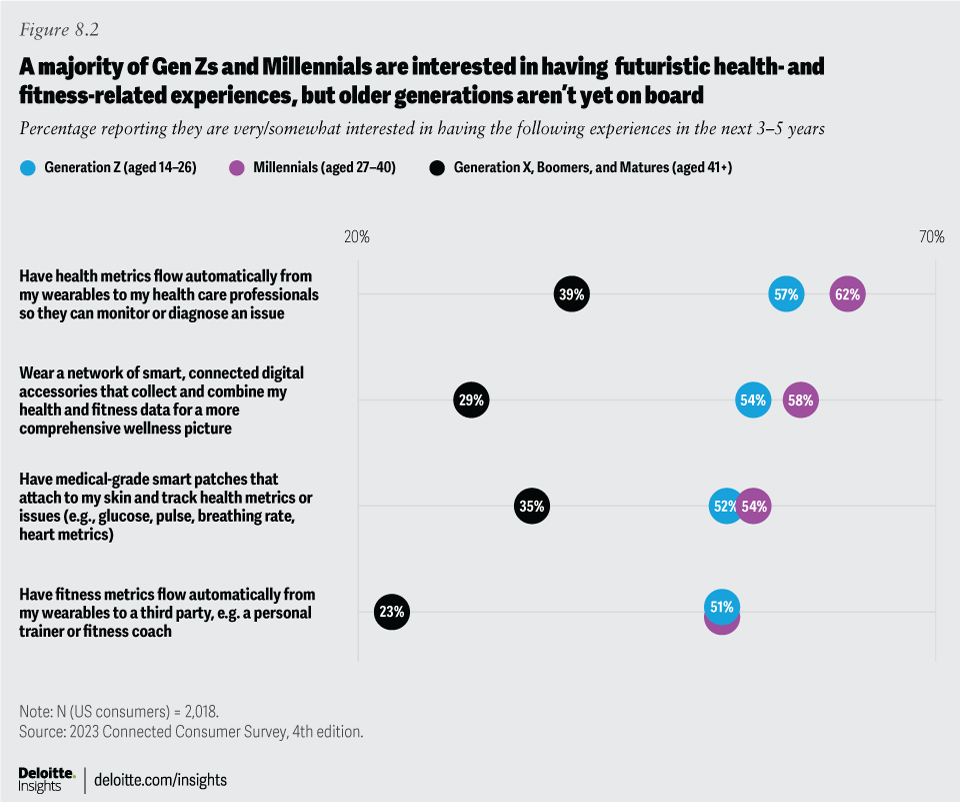

Looking at more emerging digital health connectivity scenarios, Deloitte found that across four options, younger consumers were more keen on the concepts than members of the Gen X, Boomer, and Mature generational cohorts.

As the chart labeled Figure 8.2 tells us, older consumers were least interested in fitness metrics flowing from wearable devices to a third party (such as a coach), with greater interest in those metrics flowing to their health care professional (39% of older people, connecting with say a doctor or other licensed clinician) as well as having a medical-grade smart patch on the skin to track metrics such as blood glucose or heart health (35%).

Deloitte’s research also gauged consumers’ views on the balance of convenience of digital connectivity vs. their concerns about privacy, security, and monitoring/tracking movements and personal behaviors. In 2023 compared with 2022, more consumers overall are worried that their devices are vulnerable to security breaches, as well as concerned that organizations or individuals could track them through their devices. Related to these concerns, fewer consumers trust online services to protect their data, and feel less confident that the benefits of the convenience of digital connection outweigh privacy concerns.

Health Populi’s Hot Points: “An opportunity for device makers, health care providers, and the wellness ecosystem may lie in streamlining experiences and connecting wearable and phone data feeds to deliver personalized recommendations for users and their health care providers,” Deloitte recommends in its report. The key to making that work is to adopt and deploy interoperable data standards and baked the connections and user-facing technology with enchanting design passionately focused on the users — consumer-patients, caregivers, and clinicians all.

This also speaks to health consumers’ growing demand and appreciation for care delivered via omnichannel — where I want it, when I want it, how I want it. As Deloitte’s annual report on the connected consumer has morphed from the “mobile” consumer to the “connected” person, it’s underpinned by omnichannel-everything.

That demand spans generations, we learned in the pandemic, so health care touchpoints from Medicare Advantage to commercial plans, from primary care to mental health and well-being, and from the kitchen to the bathroom medicine cabinet and Bluetooth-enabled weight scale to the connected car — all stakeholders in the health care ecosystem can heed Deloitte’s call-to-action in this year’s report finding folks seeking digital balance for healthy, happy lives.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.