In the Age of COVID, over 90,000 new health apps were released, as the supply of digital therapeutics and wearables grew in 2020.

Evidence supporting the use of digital health tools if growing, tracked in Digital Health Trends 2021: Innovation, Evidence, Regulation, and Adoption from IQVIA Institute for Human Data Science.

Evidence supporting the use of digital health tools if growing, tracked in Digital Health Trends 2021: Innovation, Evidence, Regulation, and Adoption from IQVIA Institute for Human Data Science.

IQVIA has been closely following the growth, investment in, and clinical evidence for digital health since 2013, when I reviewed their first paper on “mHealth” here in Health Populi.

Then, IQVIA evaluated the universe of about 40,000 apps available in the iTunes store.

In today’s report, the company quantifies more than 350,000 apps, a supply expanding at a rate of 250 apps per day.

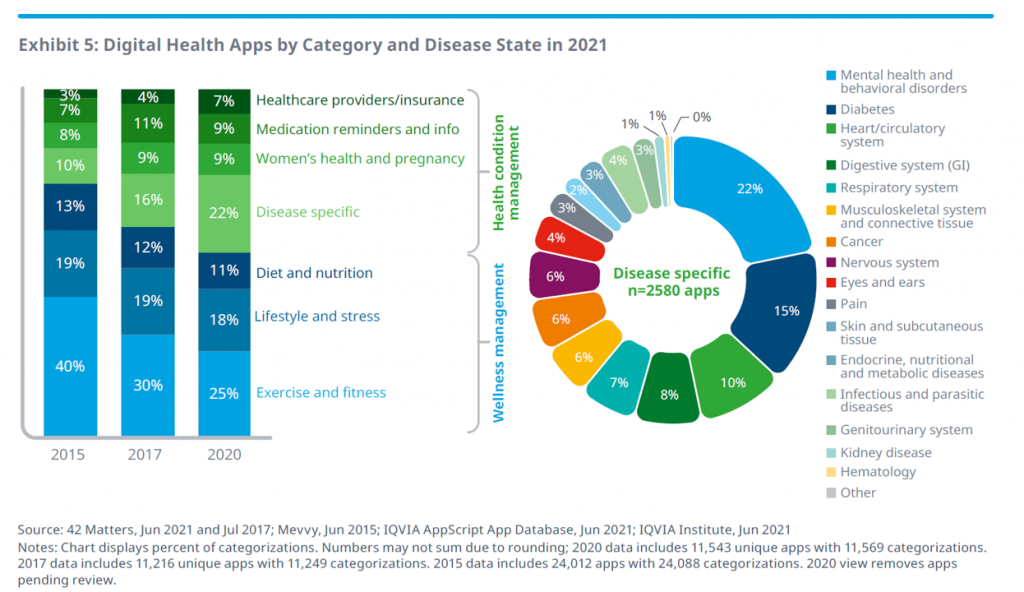

The range of clinical areas covered by these apps is shown in the “wheel” above, illustrating that mental and behavioral health, diabetes, heart and cardiovascular, digestive system, and respiratory applications together represented over one-half of the digital health categories and disease states in 2021.

The range of clinical areas covered by these apps is shown in the “wheel” above, illustrating that mental and behavioral health, diabetes, heart and cardiovascular, digestive system, and respiratory applications together represented over one-half of the digital health categories and disease states in 2021.

Once upon a time in 2015, exercise and fitness comprised nearly one-half of the digital health categories. Today, one-half of the categories speak to more “medical”/clinical areas that are disease specific, addressing women’s health, medication adherence, and healthcare administration workflows.

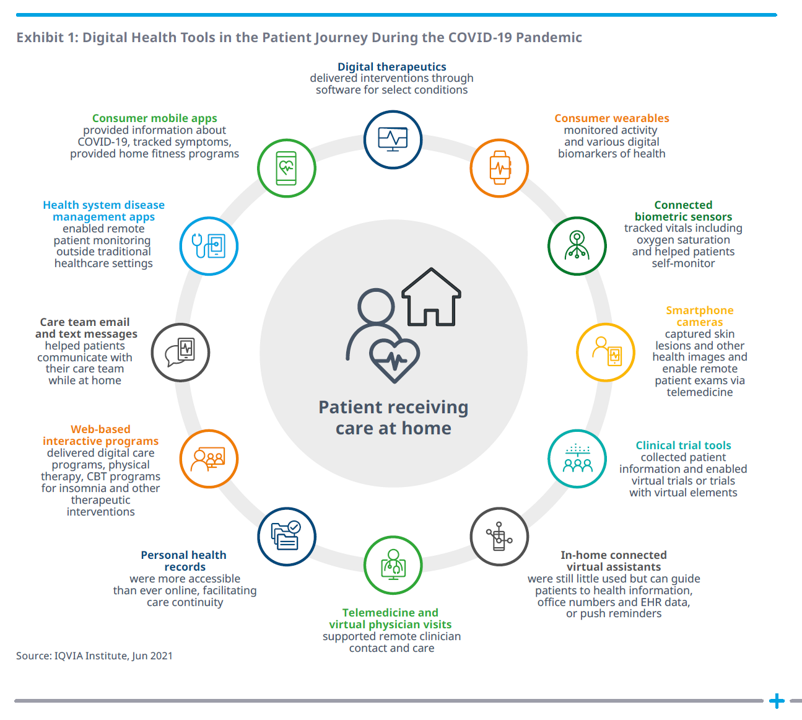

What a difference a pandemic makes, too, in bolstering real-life, relevant, and impactful digital health tools that address public health challenges. The second graphic, titled Exhibit 1 from the report, illustrates the patient journey during COVID-19 and the digital tools supporting people at different points in that journey.

Key to note: the patient is at the center, receiving care at home, one of the key digital transformations of consumers during the pandemic as we morphed our homes into digital hubs for work, education, faith, cooking and baking, fitness, and of course, for health care. Note that telehealth was not nearly the only digital health tool employed by consumers and clinicians during the pandemic; clinical trials leveraged connected devices, care team emails proliferated (part of telehealth, broadly defined), and disease management apps supported patients managing chronic conditions from home.

The IQVIA team are serious about getting to the clinical evidence, and this year point out a growing base of over 2,000 studies published since 2007 — 1,500 of which were published in the past five years, so the pace of change is tilting dramatically up and to the right.

The IQVIA team are serious about getting to the clinical evidence, and this year point out a growing base of over 2,000 studies published since 2007 — 1,500 of which were published in the past five years, so the pace of change is tilting dramatically up and to the right.

More of that research is in the form of meta-analyses, in addition to clinical trials incorporating connected medical devices and remote patient monitoring equipment to prove out indications for cardiovascular condition management among other disease states.

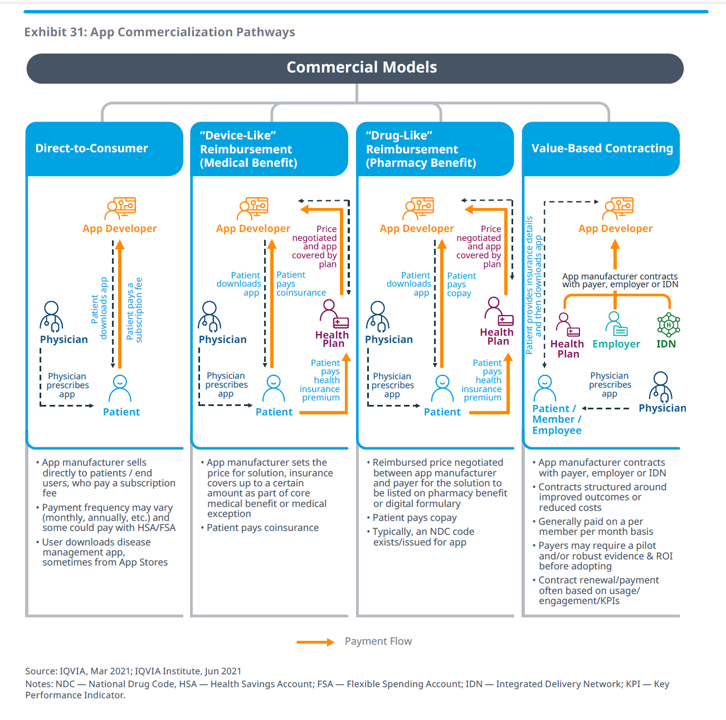

As evidence grows for digital health tools, the key barrier historically — reimbursement — is overcome with the recognition that the app, service, or tool can bring value to an episode of care, a bundled payment, an outcome, or a capitated plan member.

We are seeing the curation and expansion of digital health “formularies” as we understand approved lists of medicines that undergo scrutiny for cost-effectiveness. Cigna, UnitedHealthcare, Anthem, Aetna, CVS Health, and Kaiser-Permanente all have some kind of digital health formulary, most frequently covering behavioral and mental health, diabetes care, cardiovascular care, and other areas.

Business models are emerging to support the adoption of apps, four general commercial models shown in the picture Exhibit 31. These business models include direct-to-consumer, a medical benefit with “device-like” reimbursement, a pharmacy benefit that deploys “drug-like” reimbursement, and value-based contracting where the app might be paid for on a per-member per-month basis.

“Reimbursement is a final frontier,” IQVIA rightly concludes, recognizing some forward-looking countries already establishing policies to support the adoption of digital health tools that modernize their national health systems.

Health Populi’s Hot Points: One of those forward-looking nations embracing the promise of digital health tools is Germany, whose Medical Device Regulation (MDR) is changing the way new technologies are evaluated. In so doing, the MDR will demand a higher standard of evidence to receive the valuable CE mark which enables a medical product to be marketed in Europe.

Health Populi’s Hot Points: One of those forward-looking nations embracing the promise of digital health tools is Germany, whose Medical Device Regulation (MDR) is changing the way new technologies are evaluated. In so doing, the MDR will demand a higher standard of evidence to receive the valuable CE mark which enables a medical product to be marketed in Europe.

That means that digital health innovators must treat the European health citizens as “Missourian” in spirit: in other words, “Show Me [Them] the Evidence.”

This is good, if also rigorous and challenging, standard operating procedures for digital innovation the world over.

This is good, if also rigorous and challenging, standard operating procedures for digital innovation the world over.

These investments will yield maximum returns across the health/care ecosystem if the data they generate mash up with other data about that patient receiving care at home, as illustrated in the above wheel on digital health in the COVID era, and for our health citizens shown here in their home health hubs. A key part of the innovation and proof-points must be based on interoperability of the data generated by the digital health tool under consideration and the value it adds to the overall care, treatment, coaching, behavior change, and personalized diagnostics for that patient.

Thank you, IQVIA team, for another rich and insightful annual report on digital health, bringing pragmatism and focus to a health care segment in need of greater clarity and definition.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.