Investments in the digital health sector have fast-grown in the past decade, reaching $14bn in 2020 based on Rock Health’s latest read on the market.

The COVID-19 pandemic accelerated the field across many industry segments. With such turbocharged growth on the supply side, Beazley, experts in specialty insurance, explores the risks of digital health and wellness in a new report, Digital health, telehealth and wellness: Attitudes to risk and insurance.

With great potential for both innovation and reward comes great risks: Beazley points to the facts that,

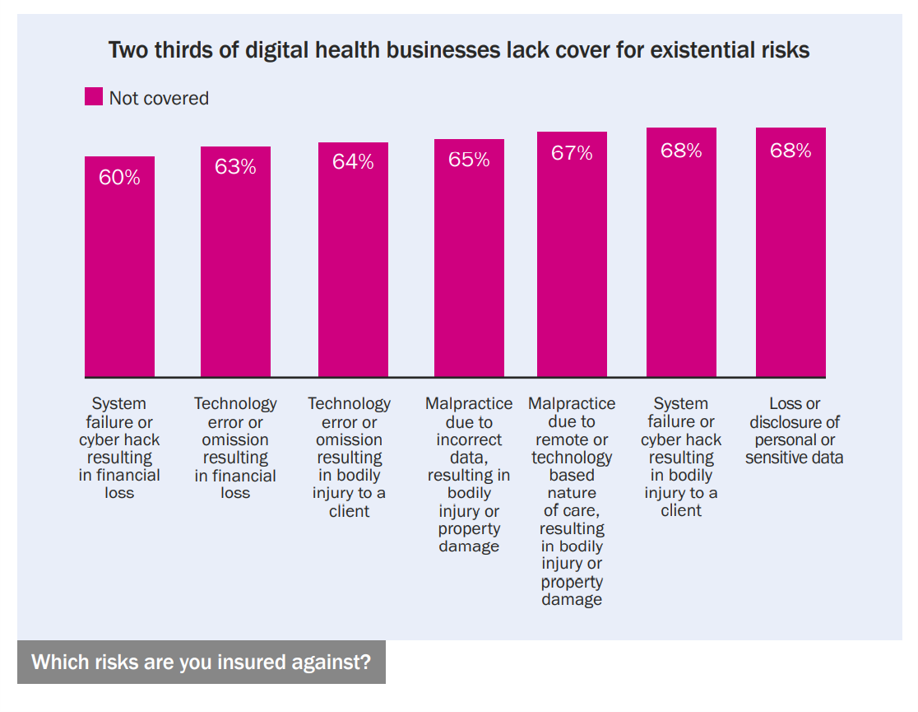

- over two-thirds of digital health companies lack insurance coverage for medical malpractice for providing remote care, sustaining a data breach, or a cyber-hack that result in bodily injury;

- 70% have only one or two of the key insurance coverages they should have; and,

- One in three can’t identify the right coverage lacking understanding of either/both the potential risks or availability of specialty insurance programs from which they could benefit.

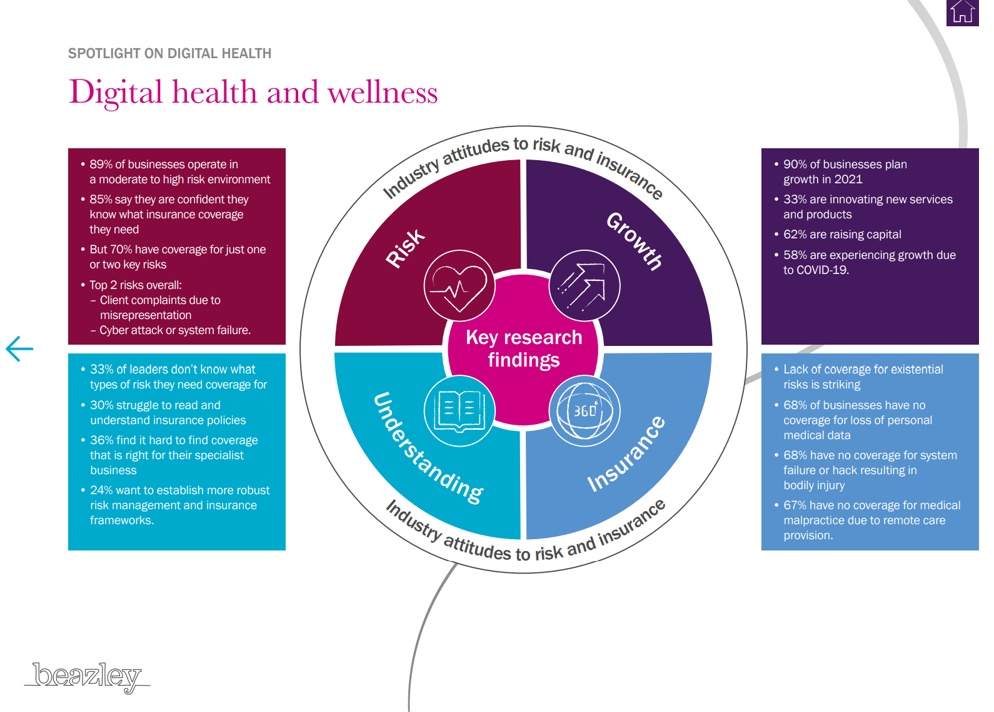

Beazley conducted a survey among 376 digital health and wellness practitioners and divined four key themes from the research on risk, growth, insurance, and understanding.

Beazley conducted a survey among 376 digital health and wellness practitioners and divined four key themes from the research on risk, growth, insurance, and understanding.

For risk, Beazley found that 9 in 10 digital health practitioners operated in a moderate to high-risk environment, and nearly the same number were confident that they knew what insurance coverage they needed. The two key risks were client complaints due to misrepresentation, and cyber-attack or system failure.

For growth, Beazley learned that 90% of business were planning for growth in 2021, 62% were raising capital, and one-third were innovating new products and services. Three in five said their growth was due to COVID-19.

On understanding, Beazley perceived a lack of knowledge about risks for which digital health organizations need coverage, with a lack of literacy about the coverage that’s available to them. At the same time, only one-in-four said they wanted to build more robust risk management frameworks.

On the insurance front, Beazley identified a “striking” lack of coverage for what it calls “existential risks.”

Those risks are shown in the second bar chart: over six in ten digital health business lacked coverage for a range of existential risks, including system failure or cyber hacks, technology errors, malpractice cause by incorrect data resulting in bodily injury, and loss or disclosure of personal or sensitive data.

Health Populi’s Hot Points: Even with fast-growth of the sector, Beazley believes that digital health is still not yet mature, with a pattern of insurance claims still emerging.

Health Populi’s Hot Points: Even with fast-growth of the sector, Beazley believes that digital health is still not yet mature, with a pattern of insurance claims still emerging.

Thus, the industry must focus on the range of risks that can be mitigated from cyber-attacks to human error and system failures.

How to deal? Beazley admits that its industry, insurance broadly writ, has not done a good job articulating these risks for the digital health industry. Those risks do not naturally fit, Beazley says, into traditional insurance silos.

At the same time, digital health companies should collaborate with the insurance industry to build a knowledge base about risks and safety to bring some standardization and accountability to the market.

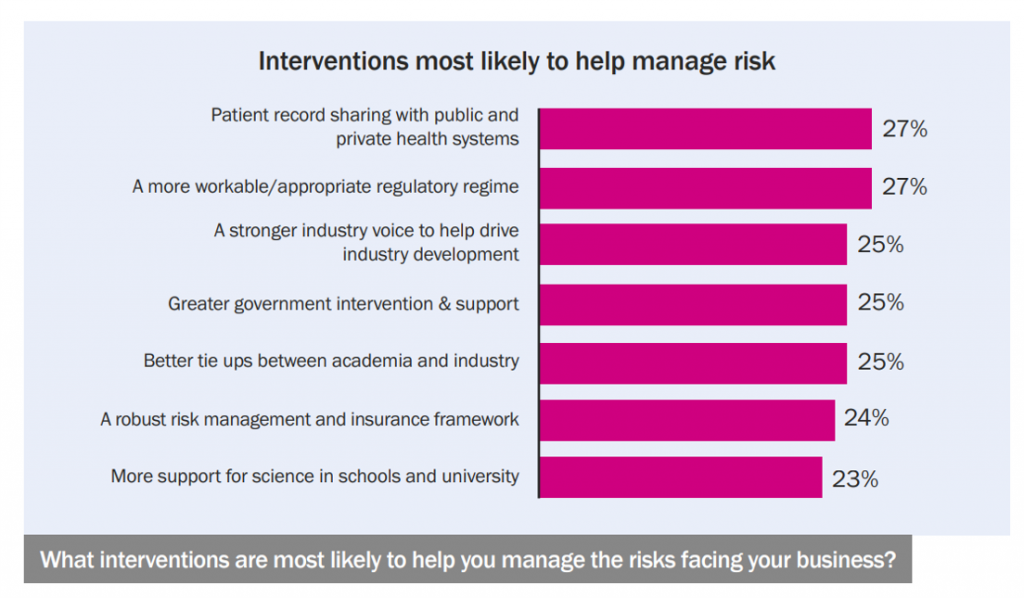

The last chart identifies area Beazley heard from digital health leaders that would help to better mitigate risks; these included patient record sharing, a sensible regulatory regime (always on a list like this from industry’s point of view), a stronger industry voice, government support, closer relationships with academia and industry, and a robust risk management/insurance framework.

The pandemic has accelerated the use of digital health across its many segments: telehealth, mHealth, software platforms, behavioral health, digital therapeutics, among them. With fast growth in the public health crisis comes evolving and growing risks that, in the midst of the pandemic hurricane, have gone unattended. As we emerge now with vaccinations penetrating arms and communities, we can attend to this overlooked opportunity for risk-management in digital health.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.