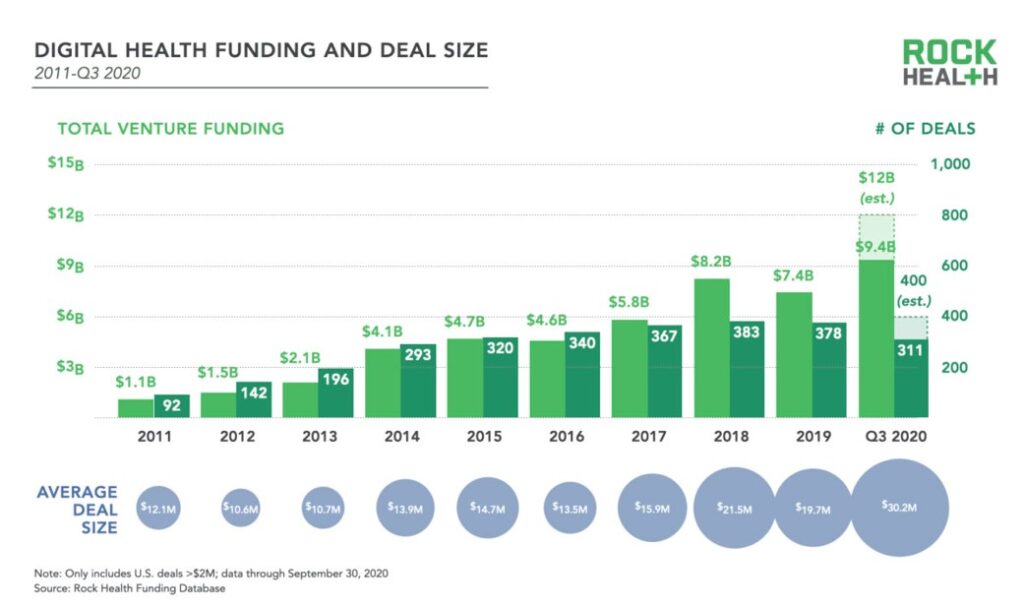

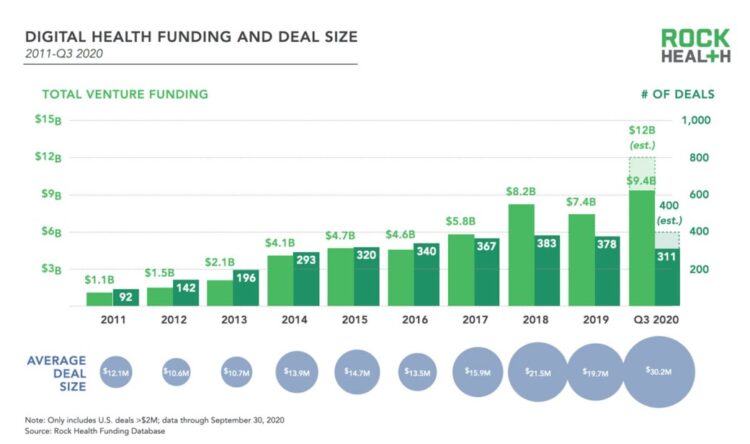

2020 will be remembered for disruption and dislocation on many fronts; among the major blips in the year will be it remembered as the largest funding year for digital health recorded, according to Rock Health’s report on the 3Q2020 digital health funding.

This funding record (“already” before year-end, tallied by the third quarter as Rock Health notes) was driven by “mega”-deals accelerated during the public health crisis of COVID-19.

This funding record (“already” before year-end, tallied by the third quarter as Rock Health notes) was driven by “mega”-deals accelerated during the public health crisis of COVID-19.

In the third quarter of 2020, some $4 billion was invested in U.S. based digital health start-ups adding up $9.4 billion in 2020….so far.

This is $1.2 billion more than two years previous of $8.2 billion, up 22% from 2019.

A quote from Julie Yoo, General Partner at Andreessen Horowitz, sums up the exuberant funding environment for digital health in the public health crisis: “It was a pretty bonkers summer in terms of deal volume,” Yoo asserted at the Rock Health Summit held in September 2020.

Going forward, we should be mindful of some looming uncertainties that could stall this bullish momentum: the rate and scale of economic recovery for both business and job growth; stock market trends; a potential “twin-demic” of flu and COVID-19 these autumn and winter seasons; and, U.S. political/election outcomes that could result in a significantly different payor mix: the major aspect of which will be whether Medicaid will grow as part of a bolstered ACA under a Biden administration, or whether a repealed ACA would diminish the role of Medicaid and underpin a bigger self-pay market.

Within the mega-deal trend, Rock Health pointed to three facets of the go-go digital health investment climate: expanding virtual care, research and development digital transformation, and fitness and wellness demand.

Rock Health expects telemedicine encounters to be at a greater volume in 2021 versus 2019, with some “settling” to a less hyped level than seen at the height of the pandemic. The growing use of remote health monitoring, which continuously tracks patients’ managing chronic conditions at home, will drive telehealth/virtual care volumes, along with the transactional use of virtual visits for both chronic and acute care reasons.

Corporate investors comprised two-thirds of financiers into digital health, making 149 investments in digital health in the first nine months of 2020. Four groups made up most of this investment cohort: health care providers, technology companies, biopharma/life science, and health care payers.

Corporate investors comprised two-thirds of financiers into digital health, making 149 investments in digital health in the first nine months of 2020. Four groups made up most of this investment cohort: health care providers, technology companies, biopharma/life science, and health care payers.

Rock Health points out that the growth in provider organizations funding digital health innovation was “remarkable” due to providers’ challenges in responding to the coronavirus.

A major driving force occasioned by the COVID-19 pandemic was the importance of patients and clinicians managing exposure to the virus — in both directions, from patient to provider, and provider setting to patient.

This has underpinned the growth of “digital front doors,” examples of which are shown in the third graphic from Rock Health’s report. Several of these organizations launched IPOs during the pandemic, and others plan to go public early in 2021.

Concluding this report, Rock Health remains hopeful for more digital transformation in health care based on growing, “legitimization of business models” that drive favorable clinical and economic outcomes.

Health Populi’s Hot Points: These so-called “digital front doors” are the on-ramps for health consumers/patients to access health care services away from brick-and-mortar doctors’ offices and hospital clinics.

Health Populi’s Hot Points: These so-called “digital front doors” are the on-ramps for health consumers/patients to access health care services away from brick-and-mortar doctors’ offices and hospital clinics.

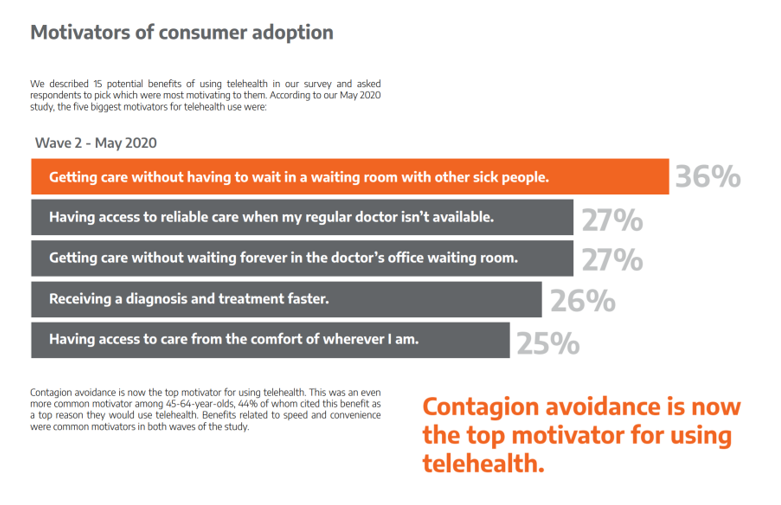

A consumer survey from MDLIVE published last week found that one-third of consumers were motivated to use telehealth to get care without having to wait in a waiting room with other sick people. Secondly, one-fourth of people wanted access to reliable care when their usual doctor wasn’t available or to get care without “waiting forever” in the doctor’s office. Two other key reasons for demand virtual care, again cited by 1 in 4 consumers, were to receive a diagnosis and treatment more quickly, to have access to care from the comfort of “where I am.”

These factors all point to people looking to their homes as safe, hygienic and convenient health hubs for accessing health care services.

In my new book, Health Citizenship: How a virus opened hearts and minds, I track the pandemic’s role in opening patients’ hearts and minds for care at home, using DIY platforms like smartphones, tablets and computers, along with downloading and employing mobile health apps.

In my new book, Health Citizenship: How a virus opened hearts and minds, I track the pandemic’s role in opening patients’ hearts and minds for care at home, using DIY platforms like smartphones, tablets and computers, along with downloading and employing mobile health apps.

The growing investment ethos for virtual care covers the continuum of care across all aspects of health care: from wellness and fitness to primary care and urgent care, as well as mental health and hospital-at-home remote health monitoring tools.

Looking forward, regulatory and payment regimes will be re-forming policies for licensure and reimbursement that will foster — or slow — the role of telehealth as part of the continuum of health care. When this shakes out in 2021, we’ll see virtual care a component of a portfolio of consumer-facing services that is the new omnichannel delivery system for health care.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.