In January 2020, before we knew how to spell “coronavirus,” millions of consumers were already “Amazon-Primed” for everyday life-flows and consumer behaviors. The pandemic has accelerated consumer trends already in motion early this year when the Consumer Technology Association (CTA) convened the annual CES 2020 in Las Vegas.

I covered the event here in Health Populi, as I have for most of the past decade, highlighting the growth of digital health and, this year, the expanding Internet of Healthy Things called-out by Dr. Joseph Kvedar in 2015.

What a difference a public health crisis makes, accelerating digital health beyond fitness geeks, Quantified Self adherents, and smartwatch adopters.

CTA has published a report on the Future of Consumer Behavior After COVID-19; in this post, I’ll highlight the health care implications. Beyond health, the report also addresses a landscape of sectors, including retail and eCommerce, fitness, commuting (for work), and travel, along with various lifestyle areas.

CTA conducted a survey among 2,000 U.S. adults ages 18 and over in the second half of July 2020. The study assessed peoples’ attitudes and behaviors during the COVID-19 crisis, asked what a “new normal” might look like, measured consumer impacts across industry segments, and expectations on consumers future plans to “re-engage” in various daily activities.

FYI, I am sharing these data with permission from CTA, grateful to be able to do so.

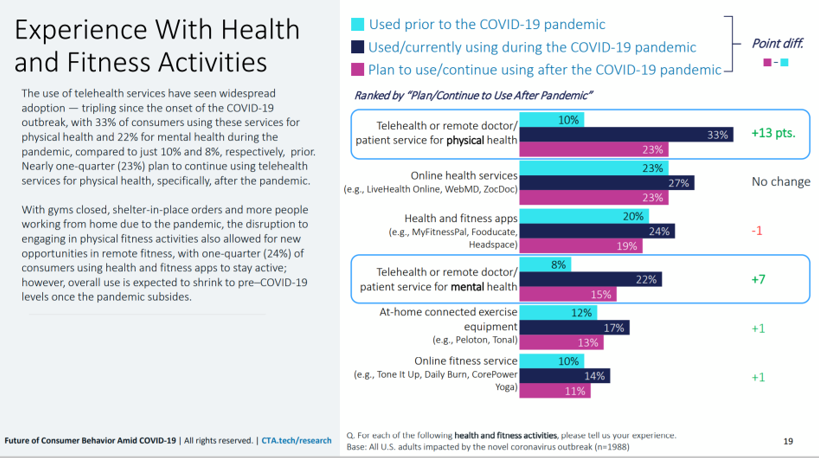

The first chart lays out 3 timelines for consumers’ experience with health and fitness activities: those used before the COVID-19 pandemic, those currently using, and those people plan to use after the pandemic.

The first line is the most dramatic shift, illustrating the use of telehealth or remote medical services used pre-pandemic by 10% of consumers. During the pandemic, this peaked to 33%.

After the pandemic, consumers rank telehealth use equal to their use of online health services like WebMD, which increased in use only a few percentage points in the pandemic.

Use of health and fitness apps ranked third, with telehealth for mental health services ranking fourth in growing use in the pandemic

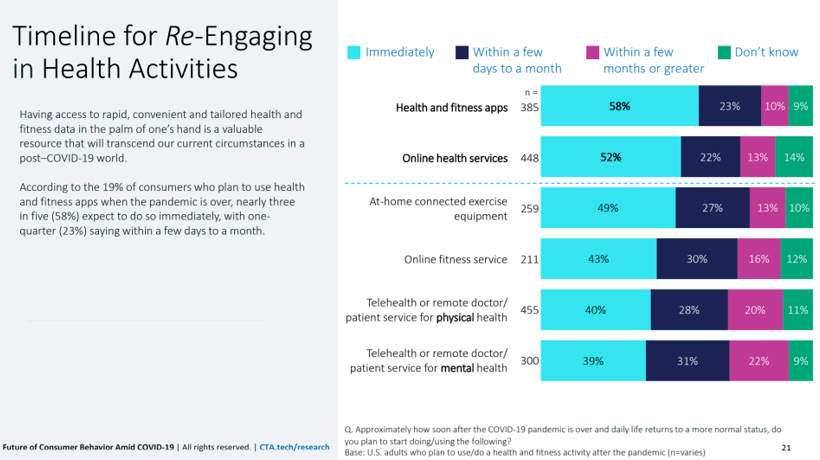

Considering timing for re-engaging in health activities, apps, online health services, and connected exercise equipment are already in use by over one-half of U.S. consumers in the pandemic. Telehealth, too, is embraced by 3 in 5 people for both physical and mental health services. In the very near term, days to one month, another one-fourth to one-third of people would use telehealth and online fitness services.

Considering timing for re-engaging in health activities, apps, online health services, and connected exercise equipment are already in use by over one-half of U.S. consumers in the pandemic. Telehealth, too, is embraced by 3 in 5 people for both physical and mental health services. In the very near term, days to one month, another one-fourth to one-third of people would use telehealth and online fitness services.

Among these areas, we can expect online fitness to persist after the pandemic. Several studies I’ve gleaned in the past several months have shown consumers to be risk-managing their returns to in-person gyms and health clubs, among them this poll from

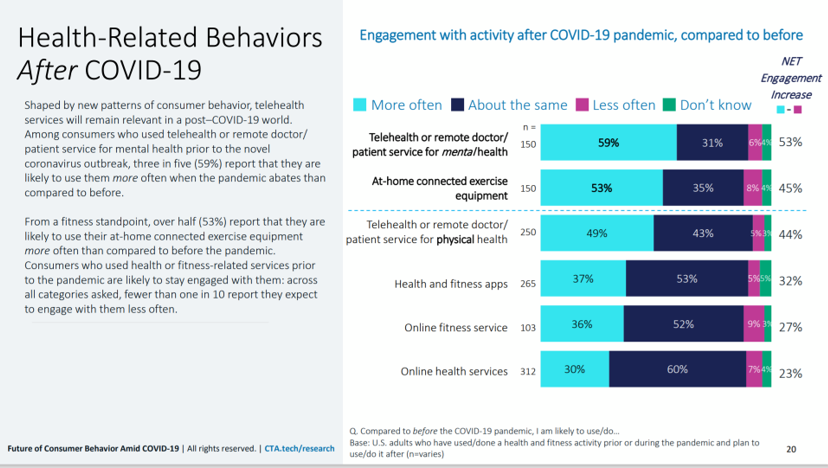

After the pandemic, one in two consumers look forward to using telehealth for both mental health and physical health more often. Most people using at-home connected exercise equipment also foresee doing so after the coronavirus fades. Finally, one-third of consumers project using online health and fitness services more frequently after the pandemic.

CTA’s research shows that the public health crisis has expanded consumers’ healthcare behaviors at home via telehealth for mind, body and spirit, and for adapting the home as the new gym space for fitness.

There are many other daily life-flows not health-care related that a majority of consumers believe they will engage with after the COVID-19 pandemic. For over 60% of U.S. consumers, these avoided behaviors include:

- Using shared bikes and scooters (80%)

- Flying internationally (80%)

- Using a taxi (72%)

- Flying domestically for business (72%)

- Taking a cruise (66%)

- Using public transportation (63%)

- Ridesharing (63%)

- Taking a train (63%)

- Staying in a rental property (62%).

The most popular non-healthcare behaviors in which people are currenting engaging are in-store grocery shopping, using a personal automobile, restaurant dine-in, local retail shopping in-store, ordering items online, and shopping in a Big Box store.

When will life get back to a “new normal?” CTA asked people. Over 90% of folks said daily life will get normal once there is a vaccine (56%), there are no new cases of infection (53%), and/or lifting of requirements to wear masks (50%).

Health Populi’s Hot Points: Taking together, the commuting and travel data points in the CTA survey indicate that consumers have be re-shaped in the pandemic as sticking closer-to-home, avoiding airline travel and taking trains until the coronavirus is “crushed.”

For health care, this means a continued shift and consumer preference for care at home virtually and via remote health monitoring and wearable tech, voice-enabled technology and sensors, and closer-to-home in local community touch points and retail health sites. The successful outcome of GoodRx’s initial public offering this week in a milestone event illustrating the bullish view on telehealth. The company will build on its success as a prescription drug shopping service more broadly pivoting to telehealth expanding the HeyDoctor platform. Expect MDLive’s IPO in 2021.

Note consumers’ embrace of tele-mental health, too, in the pandemic that CTA quantified. During the crisis, Ginger, the behavioral health provider, raised $50 million of funding, and Brightline, which provides behavioral health services in pediatrics, scored $20 million in a Series A round. Another category of digital health growing during the pandemic is digital therapeutics; CTA recently formed an initiative to address DTx standards as the field matures from nascent to mainstream, including over two dozen members such as Bose, Doctor on Demand, Ginger, Google Health, Livongo, Philips, and ResMed, among others.

In closing, I note that CTA starts with the letter, “C” for “Consumer.” While detractors of my HealthConsuming concept have debated whether people can actually “be” health consumers, the pandemic has accelerated our self-care, do-it-yourself/DIY healthcare tasks for those people who could undertake these behaviors. We continue to grow self-care healthcare muscles the longer the pandemic continues and keeps many of us at home, risk-managing exposure to the virus and, at the same time, trying to gain more control over our health and well-being. This doesn’t solve the public health crisis and lack of our health citizenship for universal access, digital privacy, and trust — but in the near-and-mid-term, we are muddling through this very bumpy resolution to the COVID-19 crisis in America, enabled by well-designed digital health tools for a new era of consumer-directed virtual care as Glenn Tullman of Livongo Health has coined.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.