Three in four people in the U.S. have used virtual care, now,

“Table-stakes…here to stay for patients and providers. However, that ubiquity comes with its own set of market pressures…shifting from pandemic-responsiveness to market- and consumer- responsiveness,” according to The new era of consumer engagement, Rock Health’s ninth annual Consumer Adoption Survey published 18 March.

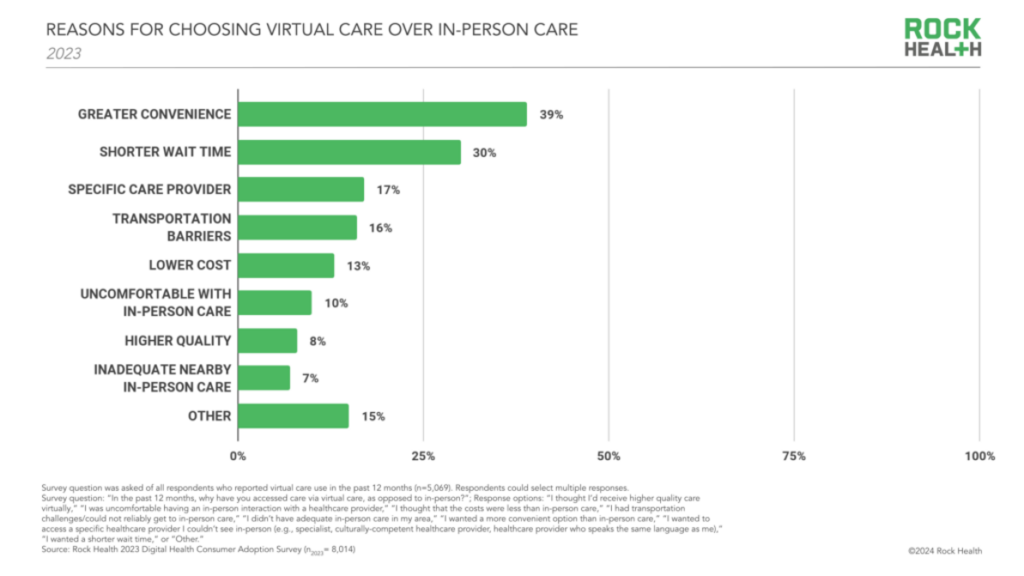

Convenience and waiting time are the top two reasons for choosing virtual over in-person care, Rock Health found. While virtual care is ubiquitous across the U.S. health care delivery landscape, patients-as-health care consumers are becoming more savvy and discriminating based on their “maturity” and exposure to various flavors of telehealth.

Rock Health offers four key themes coming out of the late 2023 consumer health data:

- Virtual care has blended into the “modern care paradigm” in the U.S.

- Consumers’ valuing convenience won’t last forever as they will seek more features to stay with telehealth services.

- The most common home-test by far has been for COVID-19, with other kinds of DTC diagnostic testing still lagging well behind.

- Patients’ willingness to share their personal health information is eroding, varying by age group and race/ethnicity along with the kind of organizations folks would share with.

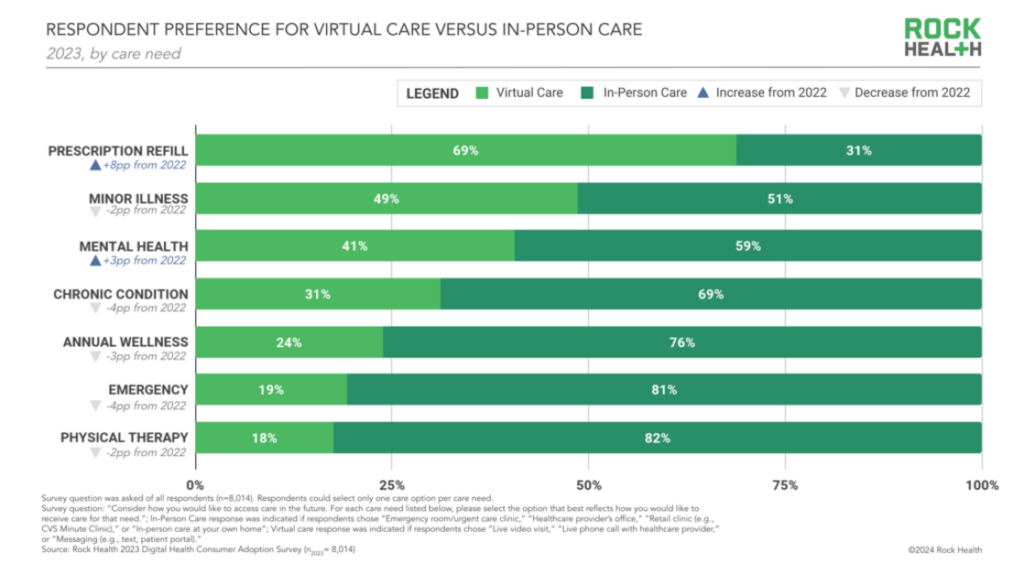

The most likely services consumers would use via telehealth versus in-person care are to refill prescriptions, the #1 preferred virtual care service.

Just about one-half of consumers would choose a virtual platform to deal with a minor illness.

Then there is a bigger delta for mental health via virtual, where 41% of consumers would prefer a tele-mental health visit compared with one in-person (59%). Rock Health notes that mental health may have found a solid consistent base of patient-fans for sustaining virtual mental health services, asserting that, “many consumers now consider it more ‘typical’ to see a mental health provider virtually than in person. Digital platforms for mental health can empower consumers to choose from a wider range of providers with different identities, affirming practices, or treatment approaches—qualities of care that are especially relevant to mental health.”

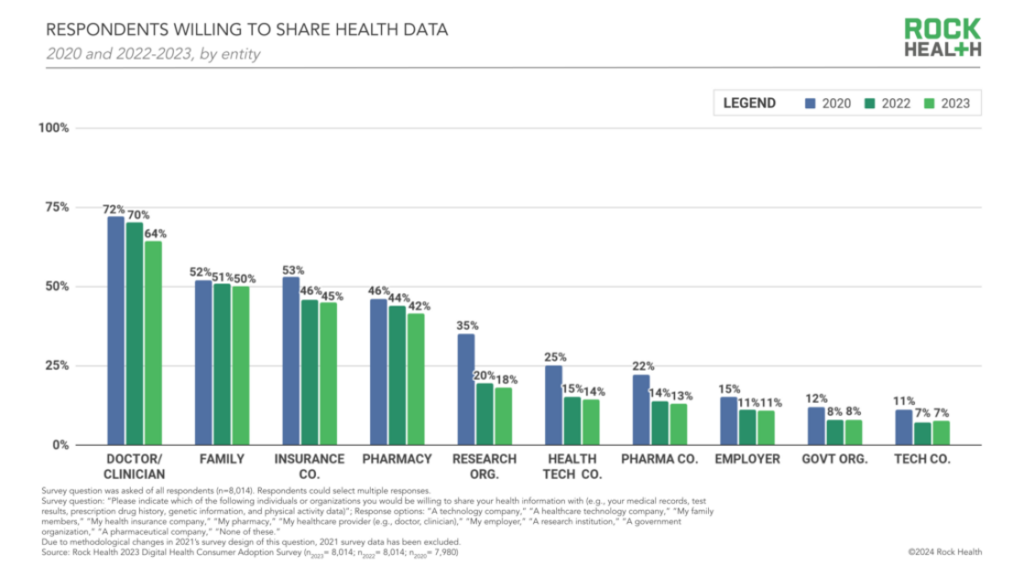

The third bar chart here from the Rock Health survey is worth digging into to gauge how consumers’ views on sharing personal health information may be shifting over the past couple of years.

We first note overall that fewer patients, year on year 2021-2023, seem willing to share data with ANY entity. While consumers’ most-trusted data steward is still physicians, even willingness to share health data with physicians fell from the high of 72% of consumers in 2020 to 64% in 2023.

Other precipitous falls in willingness-to-share-health-data occurred between consumers vis-a-vis research organizations (a stunning drop of roughly 50% (from 35% of consumers in 2020 to 18% in 2023), insurance companies (53% to 45%), health tech companies (falling from 25% to 14%), and pharma companies (dropping 22% to 13%).

In general, older people/patients are much more likely to show willingness to share health data with clinicians compared with younger consumers, as well as White patients compared with Asian/Asian American (69% White willingness to share with clinicians vs 56% Asian/Asian American), with even lower levels of willingness to share data with clinicians expressed by Black patients (49%), American Indian/Alaskan Native (47%), Hispanic/Latin (46%), and Hawaiian Native/Pacific Islander (39%).

Rock Health polled 8,014 U.S. adults in October and November 2023 to gauge peoples’ perspectives on various digital health topics.

Health Populi’s Hot Points: Rock Health points out that younger people and people of color are less likely to have ongoing relationships with primary care doctors or as the phrase goes “medical homes.” This lack of an ongoing personal relationship with such a medical home, which can help to build trust between a patient-consumer and the larger health system could be a contributing factor to the eroding data-altruism we’re seeing in the Rock Health survey for 2023 patient experiences.

The Rock Health report on the survey believes that,

“A spectrum of omnichannel offerings—traditional, virtual, and retail—will always be needed to meet all consumers’ preferences and circumstances. The important takeaway is that, for most consumers, virtual care is now a fixed expectation on that spectrum.”

To re-build trust in sharing health for those patients lacking such trust-equity, the omnichannel health care experience could help to address some of the gap. For some patients, perhaps, trust in a particular retailer or tech company might bring an opportunity to build a bridge for data-sharing. For others, capitalizing on trust with an academic institution or retail pharmacy might be a trusted touchpoint. And certainly, in some communities local non-profits and other neighborhood organizations (say, the “Y” or faith-based on-ramps to health and well-being) might partner in a local/regional health data ecosystem.

Let’s stay tuned to those potential drops, further down the trust-equity continuum, in 2024 and beyond. Sharing data with health researchers is key to finding cures and engaging patients in shared decision making and self-care. These stats are moving in the wrong direction.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.