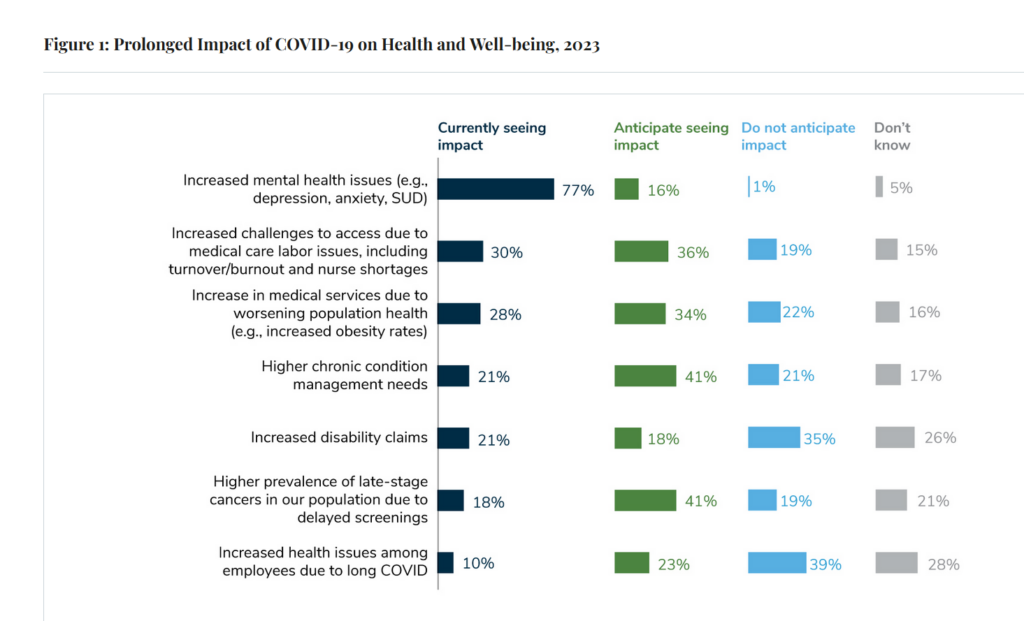

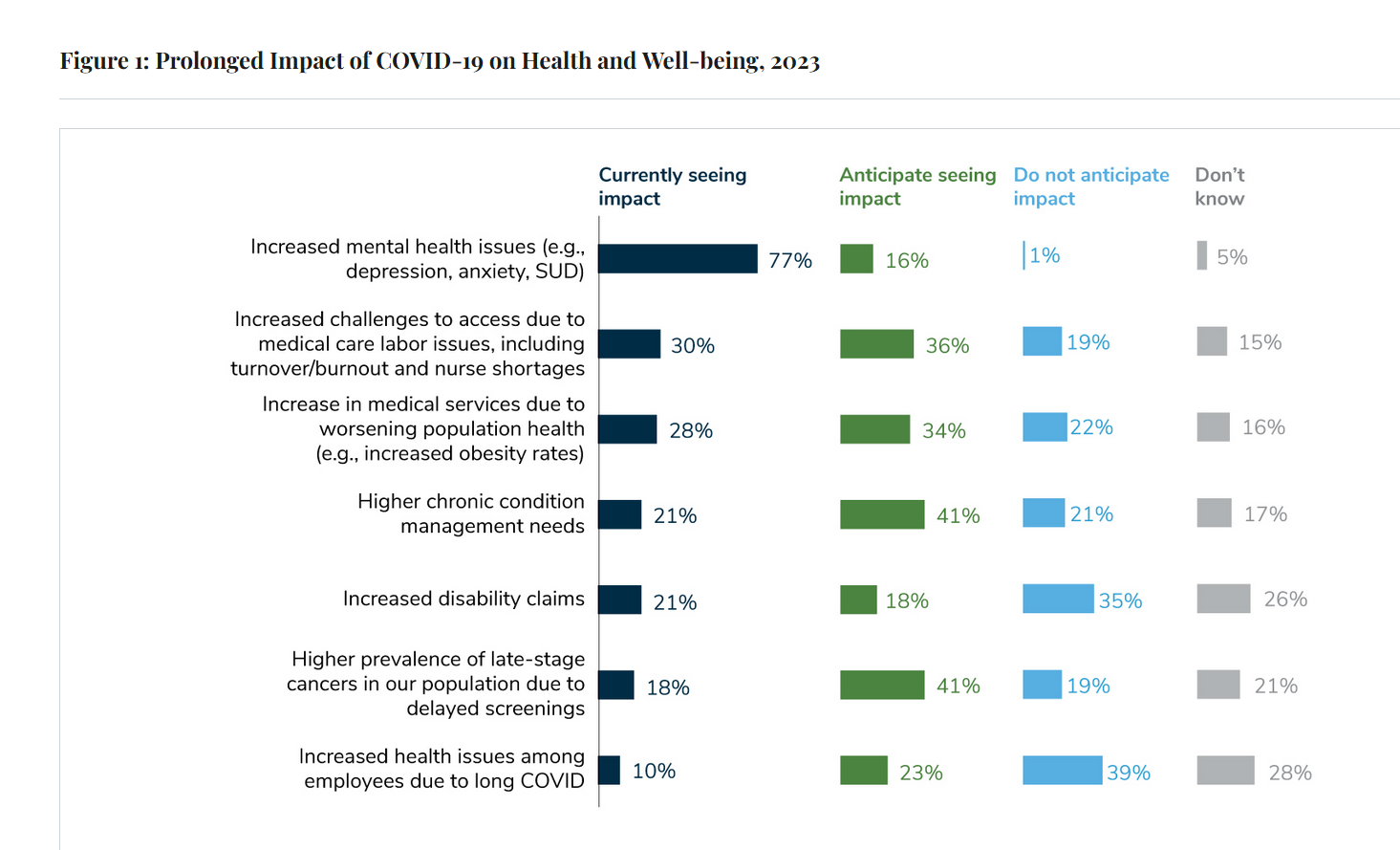

Due to their delayed return to medical services and diagnostic testing in the COVID-19 pandemic era, U.S. employees are expected to sustain serious health impacts that will drive employers’ health care costs, envisioned in the 2024 Large Employer Health Care Strategy Survey from the Business Group on Health (BGH).

Dealing with mental health issues is the top health and well-being impact workers in large companies are addressing in 2023.

Looking forward, large employers foresee their workers will be seeking care for chronic conditions and later-stage cancers that are diagnosed due to delayed screenings.

In addition, big companies anticipate seeing the (negative) impact of growing clinician burnout and growing demand for medical services related to worsening population health — such as greater levels of obesity.

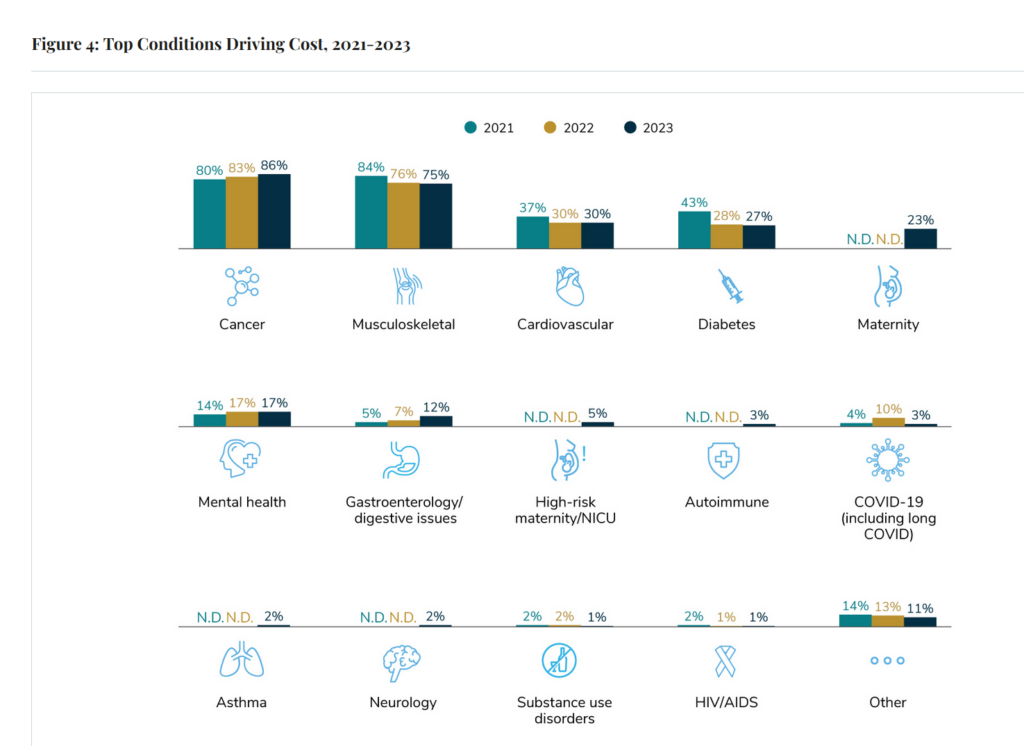

The point about delayed cancer in large companies’ work forces will translate into the top condition driving medical costs, shown in the second graph and cited by 86% of employers in the BGH study. Cancer as a cost-driver will be followed by musculoskeletal conditions (noted by three-fourths of big companies) followed by cardiovascular disease and diabetes, each noted by fewer than one-third of companies as a top cost-driver.

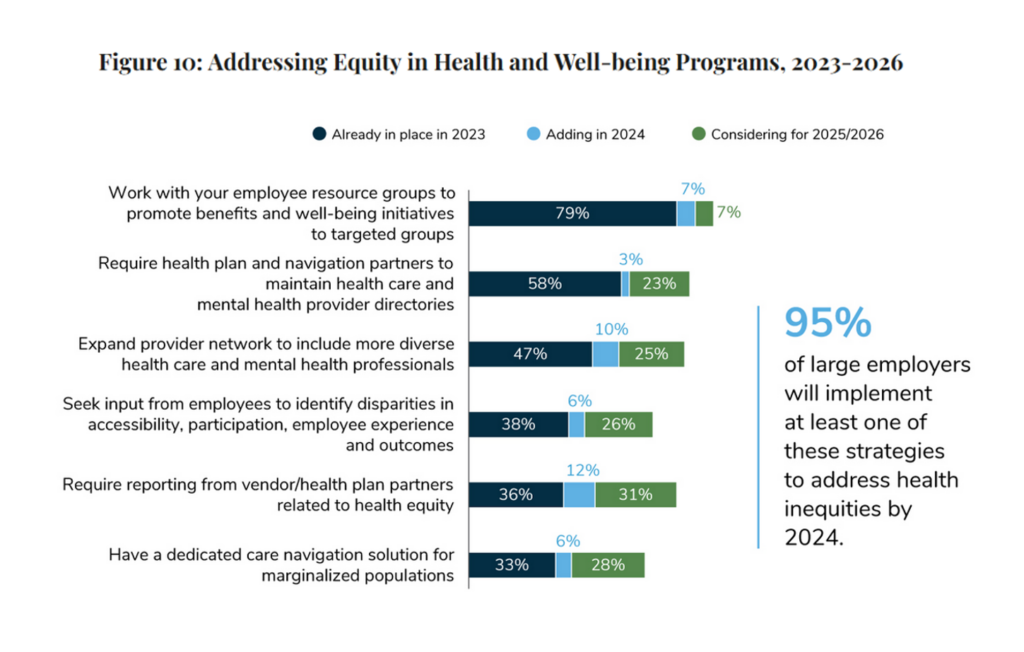

Health equity will be broadly embraced among large U.S. employers looking toward 2026, with the most prevalent approach to programs seeking to work with employee resource groups to promote initiatives to targeted groups of workers; this approach is already in place among 4 in 5 large companies.

Under consideration for 2025-26 will be, in order of employer interest, requiring reporting from vendor/health plan partners related to health equity (31%), having a dedicated care navigation program for marginalized populations (28%), seeking input from employees to identify disparities in employee experience (26%), and expanding provider networks to include more diverse professionals and caregivers (25%).

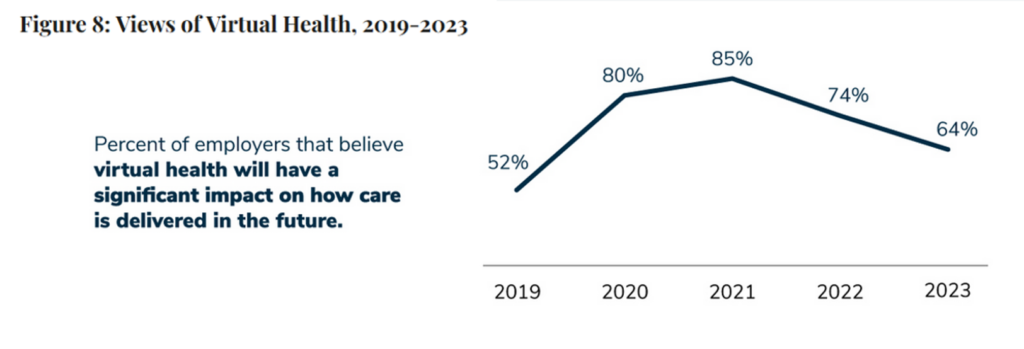

Health Populi’s Hot Points: A surprising finding in the 2024 BGH large employer survey is the one illustrated here in the last line graph: that a declining proportion of large companies believes that virtual health care will have a significant impact on how care is delivered in the future.

Underneath this simple line falling down and to the right, BGH assessed employers’ concerns about virtual care. In this year’s study, the top concerns were,

- Siloed care resulting from a lack of coordination between virtual and community-based providers (noted by 70% of large employers)

- Quality of care (54%)

- Lack of integration between vendors (46%)

- Too many solutions available (43%), and,

- Unnecessary/duplication of services (32%).

These concerns can be mitigated by choosing to collaborate with telehealth providers who have the capability of integrating health records between their own systems and employees’ providers, and assuring clinical protocols both in terms of quality and to avoid costly duplication — again, amenable to designing and deploying digital systems that streamline care for efficiency and productivity.

Touching base with two telehealth industry stakeholders to get their reaction, both observed that virtual care hasn’t proven itself out in terms of improving health outcomes and lowering costs — so perhaps growing caution for telehealth programs on the part of some large companies looking to temper medical spending/trend?

Furthermore, Aon’s latest forecast out today on employers’ health care costs calculates a rise of 8.5% for 2024 — which is back to the high-annual-increase historical past heading up. That 8.5% would be nearly double the cost growth from 2022 to 2023 in Aon’s forecast last year. This will equate to over $15,000 per employee, Aon tallied. FYI, note Aon’s methodology for this forecast – “The projection is applicable in a status quo environment when employers do not make changes or implement care management programs. Aon consultants expect many employers to implement cost-saving changes or programs to help mitigate this increase.”

This possible virtual care re-set among large employers will be an important datapoint to watch in the coming couple of years as employers had been very supportive of telehealth in the pandemic. A drop from 74% of companies believing virtual health would significantly impact the future of care down 10 percentage points to 64% — even if that represents 2 in 3 large companies — is concerning. It is larger companies that provide the most comprehensive health benefits compared to smaller firms, so this is an important call out to understand in more detail as we work to expand care to the home and closer-to-home.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.