In U.S. health care’s negative-sum game, stakeholders who survive and win that game will have to deliver value-for-money, we learn from Trilliant Health’s 2023 Trends Shaping the Health Economy Report.

“Report” is one word for this nearly 150-page compendium of health care data that is an encyclopedic treasure trove for health service researchers, marketers, strategists, journalists, and those keen to explore questions about the current state of health care in America.

As Sanjula Jain points out in the Report’s press release, the publication resembles another huge report many of us appreciated for its all-inclusive approach to describing the Internet — which I most recently wrote about here in Health Populi in 2019 when Mary Meeker published her last update in that influential series.

“As a long-time admirer of Mary Meeker’s Internet Trends Report, I have always thought our industry lacked an analogous, data-driven view of emerging healthcare trends,” Sanjula explains. The Report synthesizes a database covering “300M American lives and 2.7M practicing providers” largely found in Trilliant Health’s data trove.

So thanks to Sanjula and the Trilliant Health team, you too can immerse yourself in data that inform the 2023 ten trends, which are shown in the first graphic from the Report.

I’ll be referring to and relying on the research, with gratitude, over the coming months for my own work with clients spanning the health/care ecosystem. For today’s Health Populi blog, I’ll focus in on a key theme in my work right now — the convergence of retail health, primary care, consumers’ home economics, health care access, and the future of U.S. health care financing.

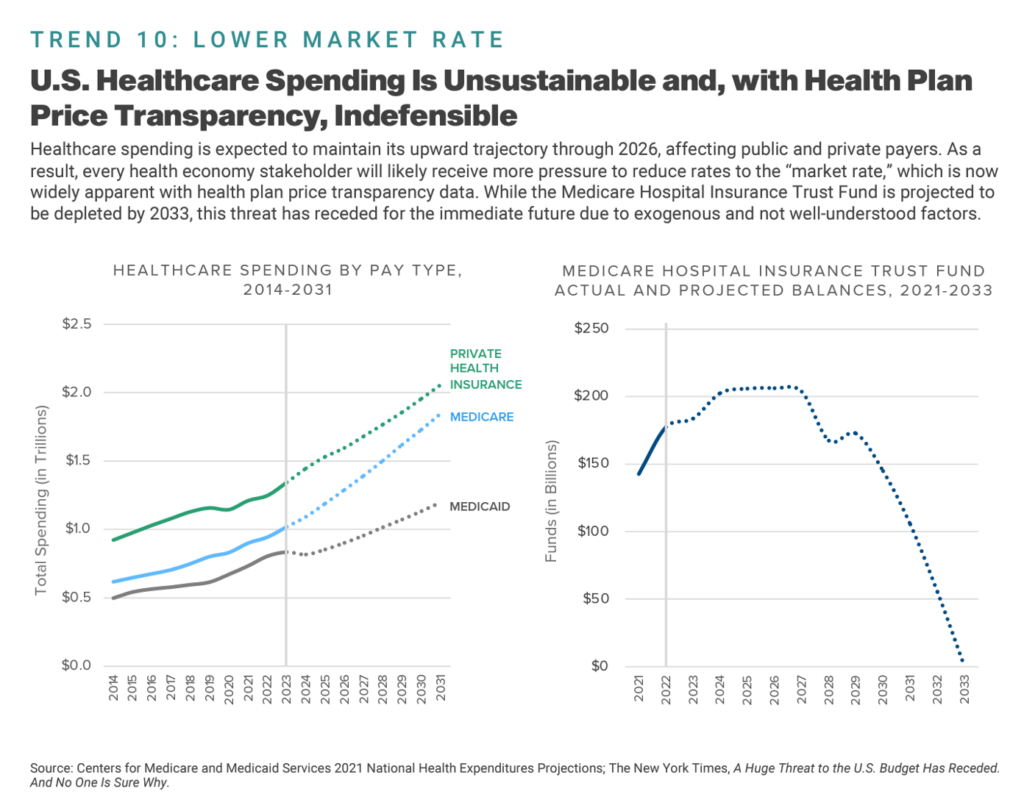

For this discussion, I’ve selected six exhibits from the Report’s roughly 140 info-packed graphics — starting with the big picture of the unsustainable nature of U.S. healthcare spending, with curves moving up and to the right, and the Medicare Hospital Insurance Trust Fund moving into the opposite direction toward insolvency by 2033.

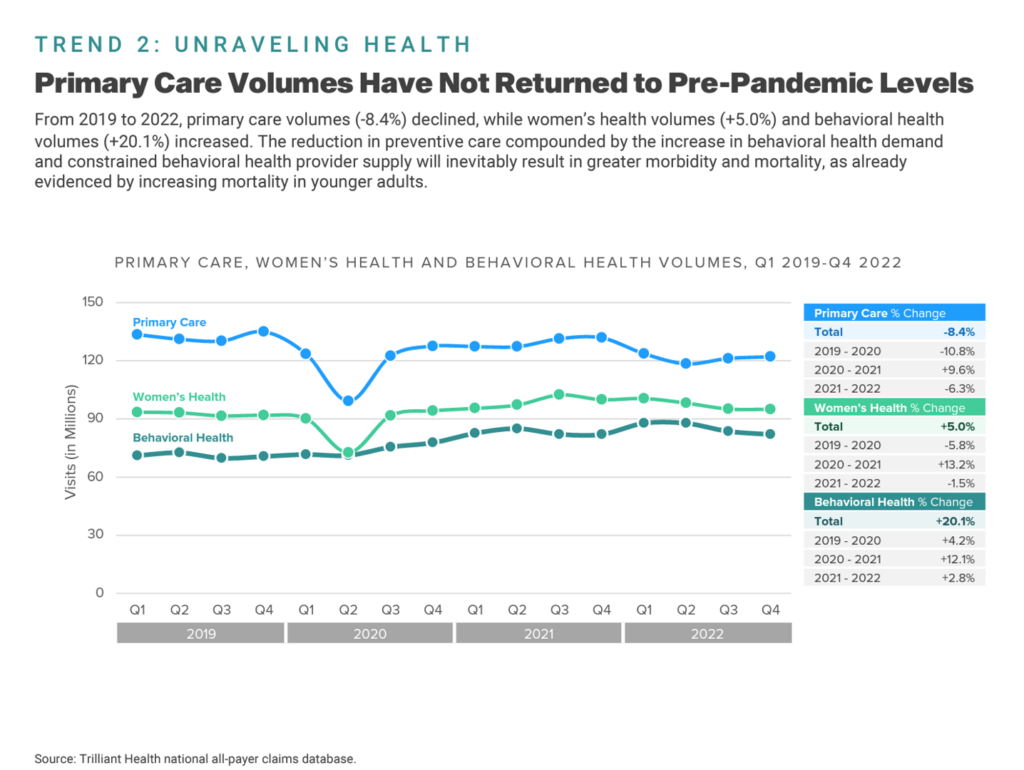

As we consider out-of-control health care spending, we turn to what we-know-we-know about value and ROI for health spending — that is the fact that nations around the world investing in a strong primary care backbone tend to have health citizens living with much better outcomes than people residing in the U.S. [You can read more about the ROI on primary care in Health Populi, most recently in this post].

The line chart here illustrates one piece of the Report’s section on “Unraveling Health,” graphing that primary care volumes in the U.S. had not returned to pre-pandemic levels by the end of 2022.

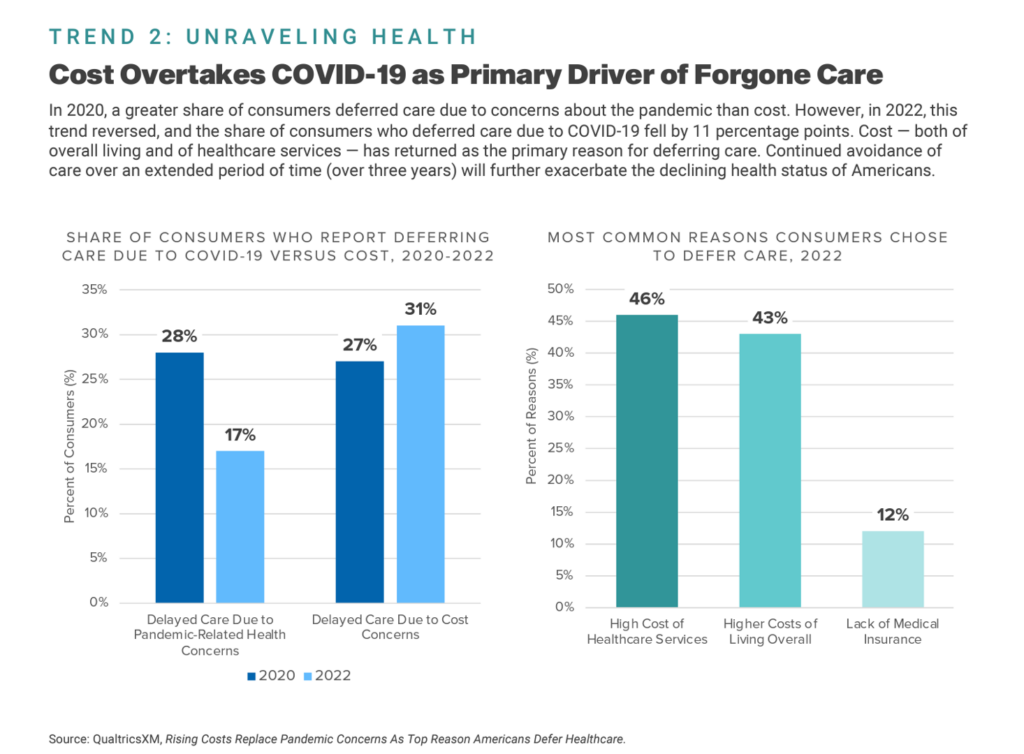

One contributor to lackluster return-to-healthcare volumes is patients’ forgoing care due to cost — a factor which Trilliant Health points out has overtaken COVID-19 concerns as the key driver for people avoiding medical care services in America.

The next chart comes out of the Unraveling Health trend discussion and illustrates this point, showing a big jump from 2020 to 2022 in the share of consumers deferring care due to cost — from 17% to 31% of patients avoiding care.

On the right side of the chart, we see that it’s the high cost of health care services cited as the #1 answer for choosing to defer care in 2022.

That’s the snapshot on the demand side.

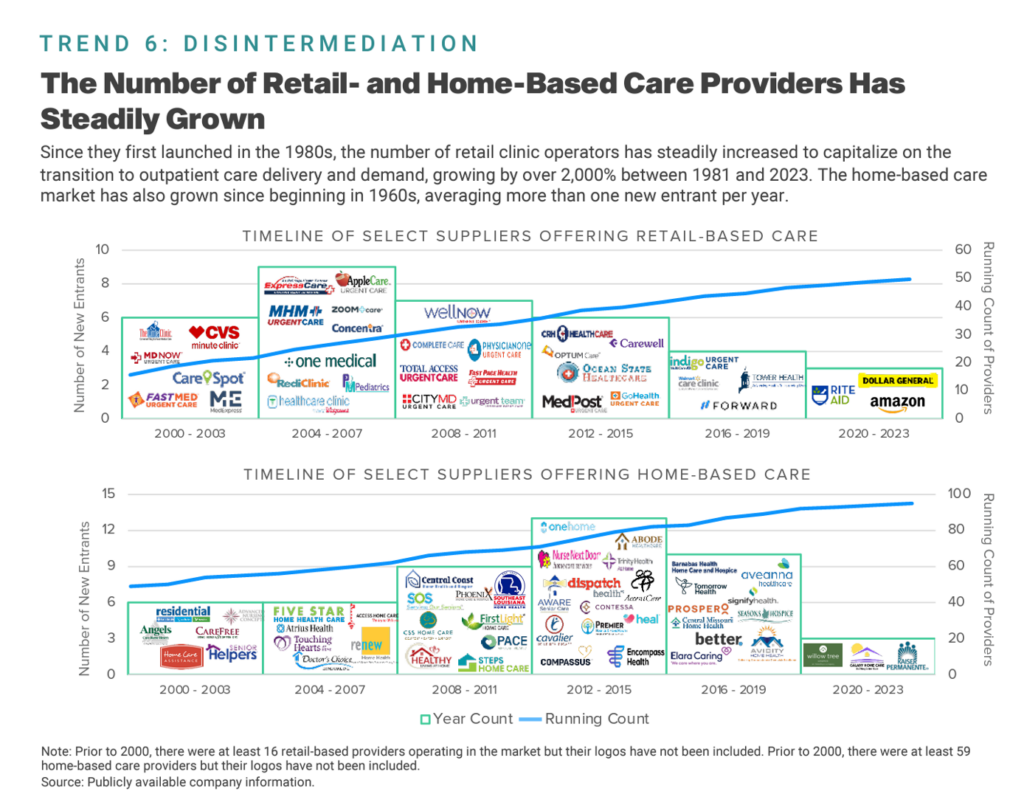

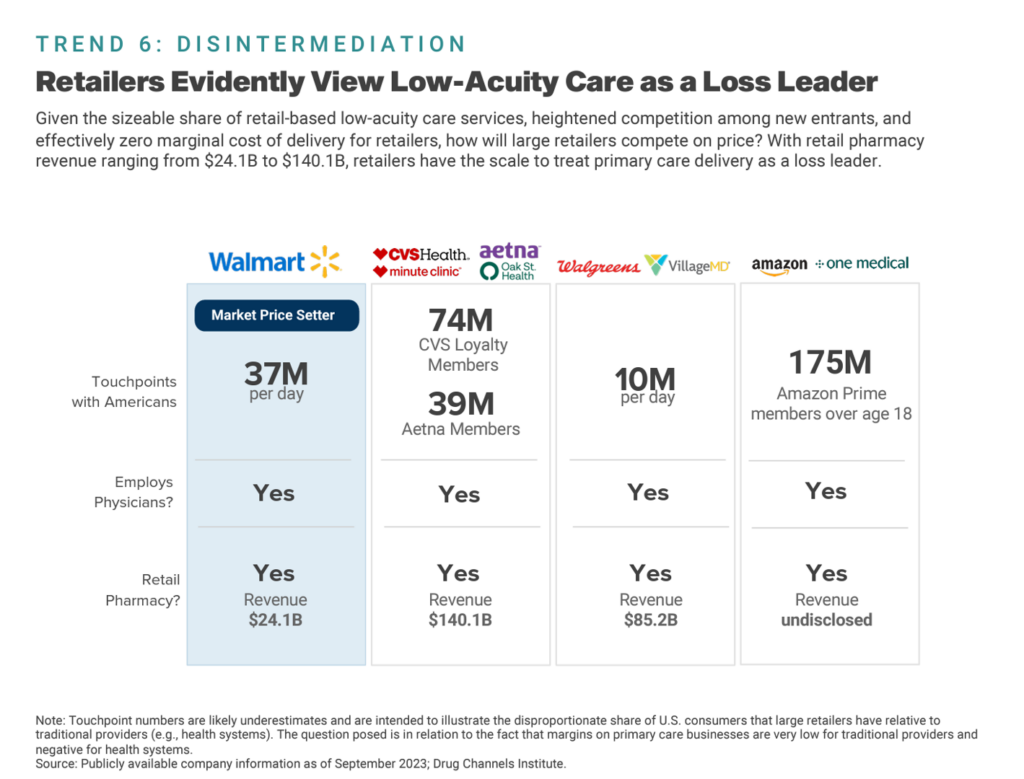

Now check out Trend 6 on Disintermediation — a growing supply side of retail- and home-based care providers.

This market landscape is shape-shifting so quickly that this week’s announcement from Costco growing its portfolio of health care services didn’t make the chart — but I’ll address it below in the Hot Points.

Historically as mapped in the exhibit, we start in the first decade of the 2000’s with CVS Pharmacy’s rebranding as CVS Health, moving into the start-up of One Medical, toward the 20-teens launch of OptumCare, and then the expansion of Amazon and Dollar General in retail health in the 2020s. Home care’s morphing is shown on the bottom of this exhibit, morphing from more mom-and-pop local and regional providers toward more corporate, super-regional and national groups.

And we realize there’s also more inter-play between the north and south parts of this diagram with, for example, CVS Health’s acquisition of Signify Health earlier this year as health care to the home and closer-to-home begins to take shape.

All well and good — a growing supply side to meet what these suppliers assume as health consumer demand for retail health and home care services whether paid-for out-of-pocket or via insurance (perhaps channeled through employers, or self-determined through a high-deductible health plan using “my” money).

But wait – that also assumes there will be a supply of human capital, augmented through technology, to staff these delivery models — omnichannel, hybrid marrying brick-and-mortar, virtual care, telecomms and in-person visits.

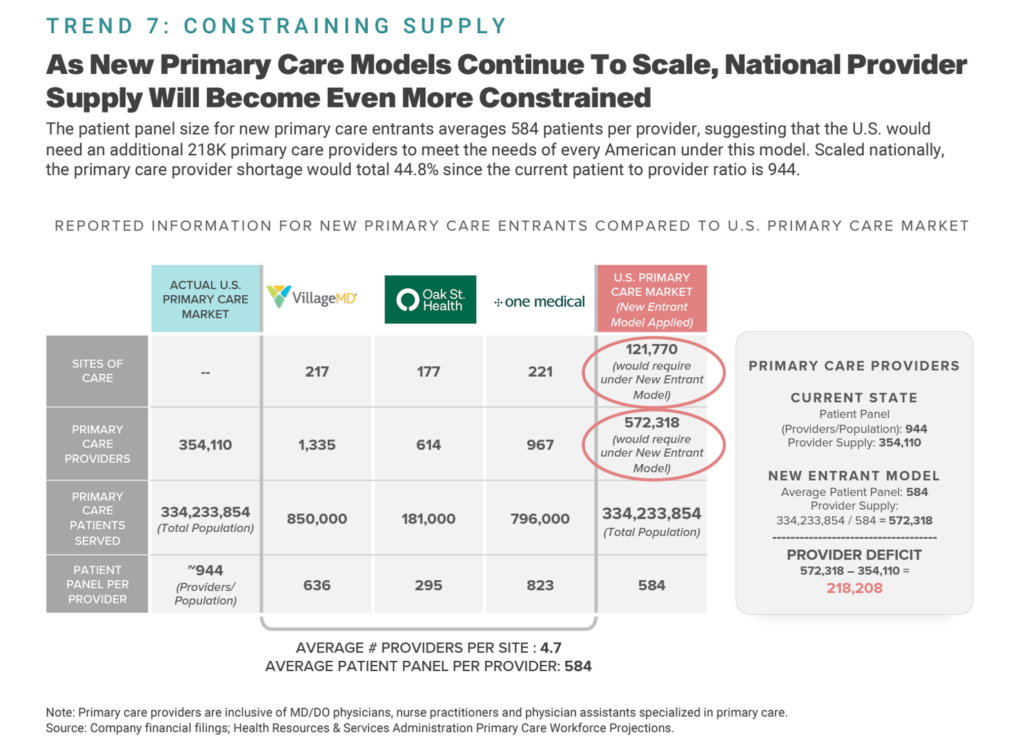

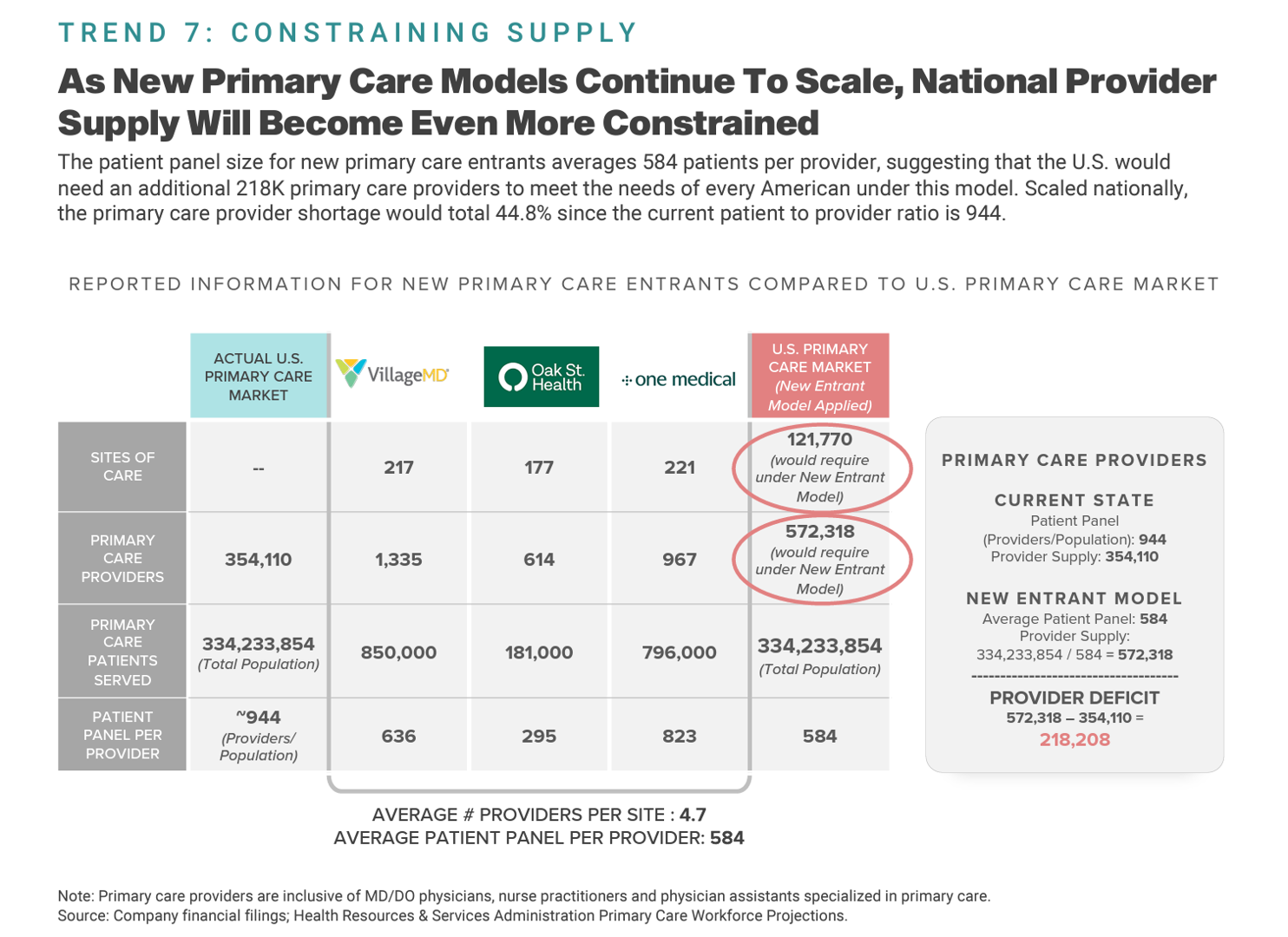

So we confront Trend 7 with this Constraining Supply slide that explains that as new primary care models proliferate and scale, the provider supply will become even more constrained. Based on Trilliant Health’s calculations in this analysis, we project a provider deficit of over 200,000 primary care providers.

Now for my scenario planning exercise, I’ll add in one more data slide from the Report — back to Disintermediation, focusing on the business model reality that retailers may be viewing low-acuity health care as a loss leader for other revenue-generating opportunities in the business enterprise.

For example, the chart tells us that Walmart welcomes 37 million U.S. consumers every day, and while there’s health care happening there — in aisles, in the pharmacy, and in clinics — the store also has many other aisles where Walmart generates margin beyond health care. And this includes, to be sure, revenue generated from the pharmacy and prescription drug channel.

You can connect these dots for other retail health players….but you get the point.

I will be using these ideas weaving them into 2024-2026 scenario planning for retail health and consumers’ home- and self-care….paying close attention to the evolving dynamics and the Retail Health Battle Royale dynamics between hospitals and clinicians’ practices on one corner of the supply side vs. the retail health purveyors at the other corner of the wrestling match. [You can read more of my Retail Health Battle Royale scenarios here].

Health Populi’s Hot Points: Who knew when I wrote up a week-long discussion in July 2022 about the Retail Health Battle Royale that I’d be so prescient as to discuss the iconic $1.50 Costco hot dog in the context of the evolving retail health ecosystem.

So we come full circle to the Costco’s news this week about the company expanding its health/care service and product portfolio, collaborating with Sesame, a virtual and in-person care provider.

I’ve been keenly watching the press coverage of this announcement since it went public earlier this week on Monday 27th September as reported by John Tozzi of Bloomberg.

Since the news hit the wires, we’ve witnessed all sorts of media channels talking about Costco’s move in health care beyond the usual health care trade publication suspects. I’ve spotted stories in CNN, CBS News, The Seattle Times, Fox Business, USA Today, Forbes, and numerous local news outlets where Costco shoppers live and, well, shop.

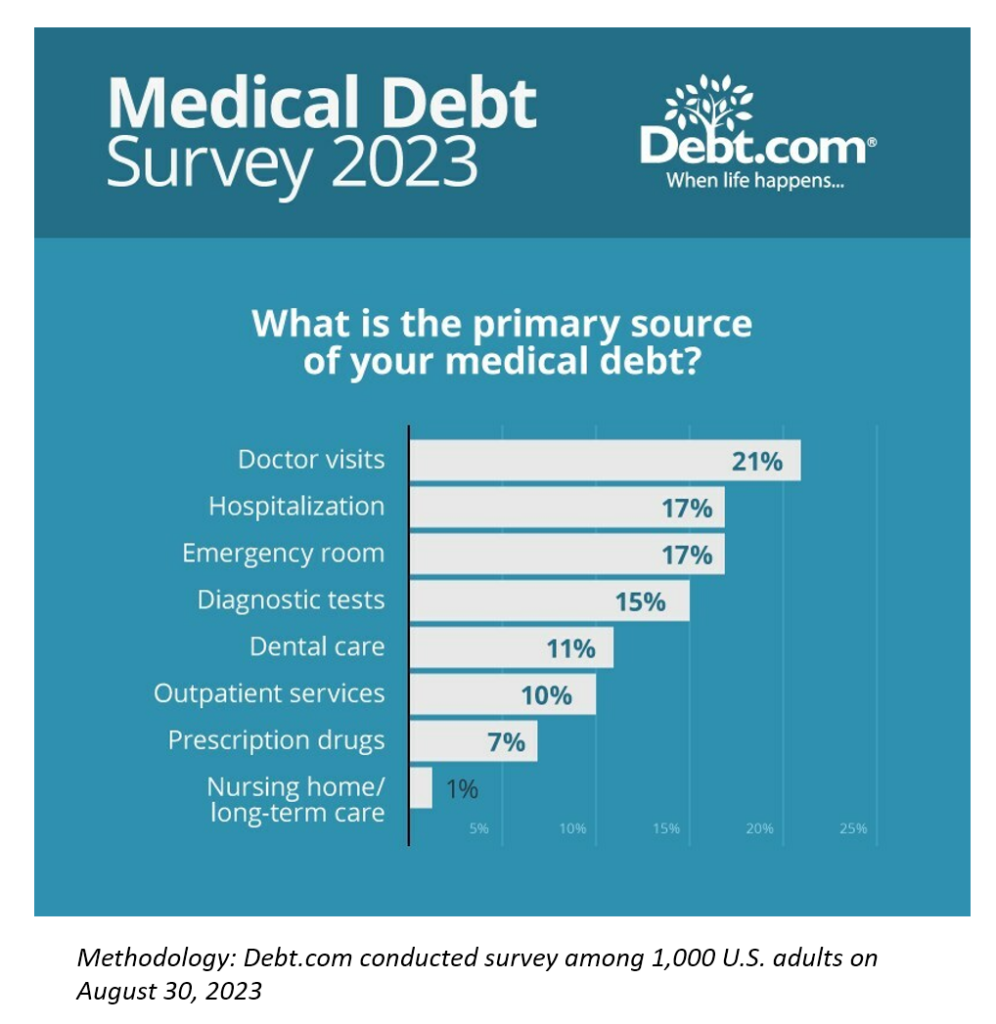

A Debt.com survey out this weeks concludes that inflation is making us sick, physically and financially — with 67% of U.S. adults saying inflation has made it harder to pay medical bills. In particular, 21% of consumers with medical debt say the primary source of that debt was due to the bills from doctor visits.

Given the lightning-fast reporting and proliferation of stories on this, there’s something at play here which is the growing consumer embrace of self-driven care. This isn’t the original definition or conception of so-called consumer-driven health care, but it’s absolutely a rational and normal response by the patient-as-payer, facing growing out-of-pocket costs for many shoppable health care services. People are responding in ways they understand, trust, and I daresay….value.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.