With only weeks remaining in 2015, more than half of companies responding to a  recent survey say they have not made much progress toward meeting the reporting requirements of the Affordable Care Act.

recent survey say they have not made much progress toward meeting the reporting requirements of the Affordable Care Act.

In addition, more than a third of the 422 employers who responded to the survey admit that they don’t have a solid understanding of the reports they will have to file in February or March of next year.

The findings were based on responses to a questionnaire distributed in September by the International Foundation of Employee Benefits Plans, whose 33,000 members have over 25 million employees. Topics ranged from the ACA excise or “Cadillac” tax to preparation for reporting to the IRS.

More than 36% of the companies responding to the survey said they were “somewhat,” “not very” or “not at all” far along in their understanding of ACA reporting requirements. Just over 63% described themselves as “extremely” or “very” far along in their understanding of what they are required to report.

When it comes to actually making progress toward meeting those requirements – which can include getting familiar with the IRS forms that must be filed, collecting the necessary information about their employees and providing mandated disclosure documents to them – the employers acknowledged they are lagging.

More than 51% said they have just started working on these tasks or have not even done that. Less than 45% described themselves as “advanced” in their progress, taking such steps as collecting detailed data about their employees and providing health insurance coverage information to their workers.

A stumbling block for many employers is collecting social security numbers of dependents of employees covered by company-sponsored health plans. Nearly 58% said gathering this information, required for IRS reports, is “somewhat,” “very” or “extremely” challenging, and another 8% either haven’t begun trying to collect the information or are not sure how difficult the process will be.

Many companies are turning to specialized vendors to help them handle the IRS report.

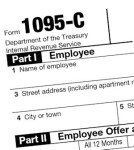

More than one out of four say they are using specialist firms to deal with forms 1094-C and 1095-C, which deal with the offer of coverage of employer-provided health insurance for employers with 50 or more covered workers.

While the survey indicates that many employers are lagging in their ACA-related reporting, the results may actually understate the problem. Nearly a third of the companies responding to the survey were in the insurance, banking or health care sectors. Firms in these highly regulated sectors may be more experienced at collecting and reporting data to meet government reporting requirements than employers in other industries.