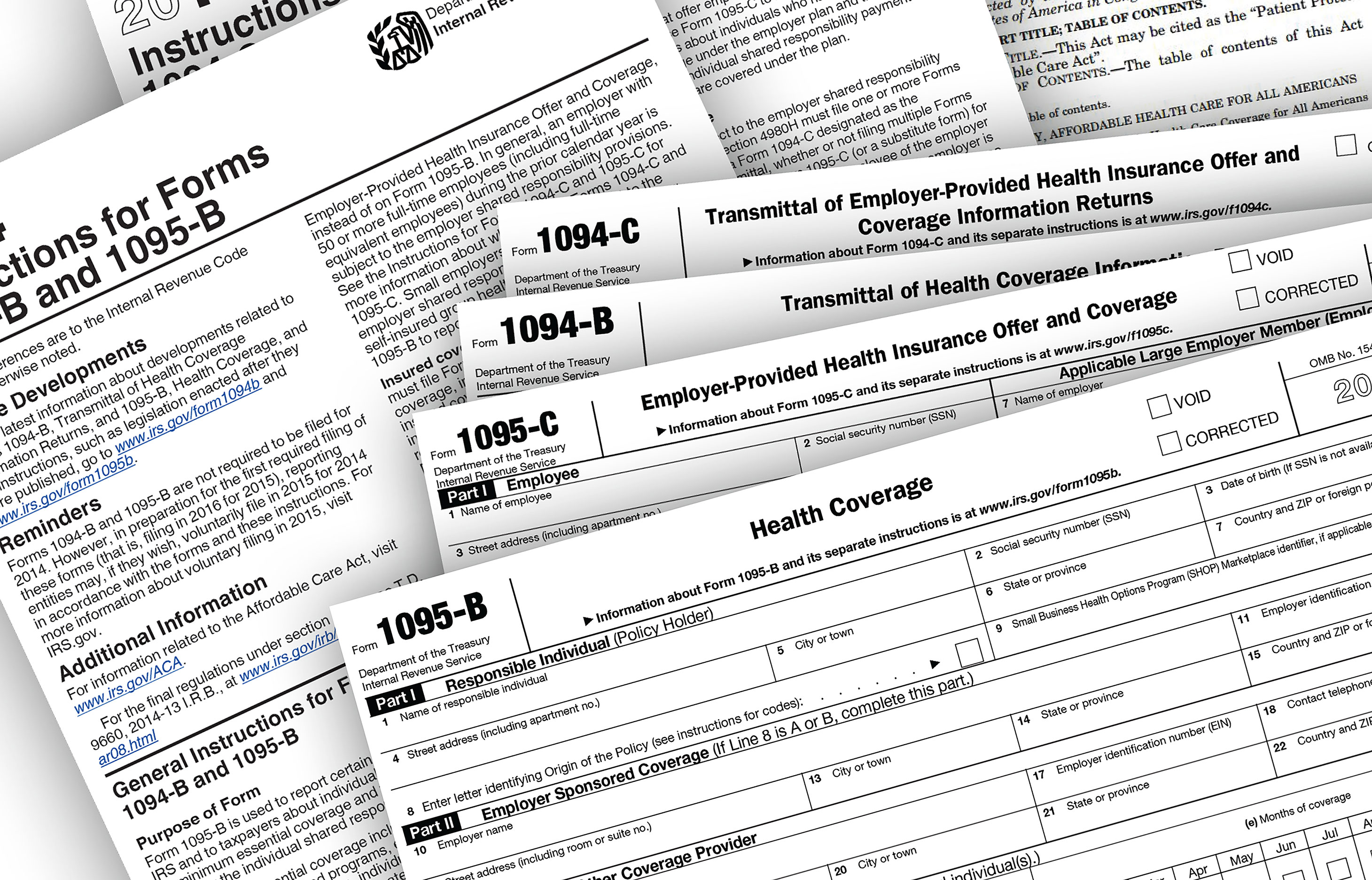

The IRS has issued a detailed explanation for taxpayers of Form 1095-B, as part of  its series of tutorials on the forms that provide information about the information forms related to Affordable Care Act coverage in 2015.

its series of tutorials on the forms that provide information about the information forms related to Affordable Care Act coverage in 2015.

Form 1095-B, Health Coverage, provides individuals with information about their health care coverage if they, their spouses or dependents enrolled in coverage through an insurance provider or self-insured employer last year.

Will I get a Form 1095-B?

You will receive Form 1095-B – which is a new form this year – from your insurance provider if you had insurance for yourself or a family member. This form provides information about your health coverage, who was covered, and when the coverage was in effect.

The term “health insurance providers” includes insurance companies, some self-insured employers, and government agencies that run Medicare, or CHIP.

You are likely to get more than Form 1095-B if: you had coverage from more than one provider; you changed coverage or employers during the year; or if different members of your family received coverage from different providers.

How to use the information on Form 1095-B:

- If Form 1095-B, Part IV, Column (d), shows coverage for you and everyone in your family for the entire year, you can simply check the full-year coverage box on your tax return.

- If you did not have coverage for the entire year, use Form 1095-B, Part IV, Column (e), to determine the months when you or your family members had coverage. If there were months that you did not have coverage, you should determine if you qualify for an exemption from the requirement to have coverage. If not, you must pay a penalty in the form of an individual shared responsibility payment.

- If you are not required to file a tax return, you do not have to file one simply because you received a Form 1095-B.

- Do not attach Form 1095-B to your tax return. Just keep it with your tax records.

What if you don’t get your Form 1095-B?

- If you do not receive a Form 1095-B by the time you are ready to file your 2015 tax return, it is not necessary to wait for it to file.

- Although the information on Form 1095-B may make it easier for you to prepare your tax return, you can use other information about your health insurance to file your return.

- Contact your coverage provider if you did not receive the form. The IRS does not issue Form 1095-B and cannot provide you with a copy.

Depending on their circumstances, consumers may also receive Forms 1095-A and 1095-C. For information on these forms, see the IRS web page on Questions and Answers about Health Care Information Forms for Individuals.