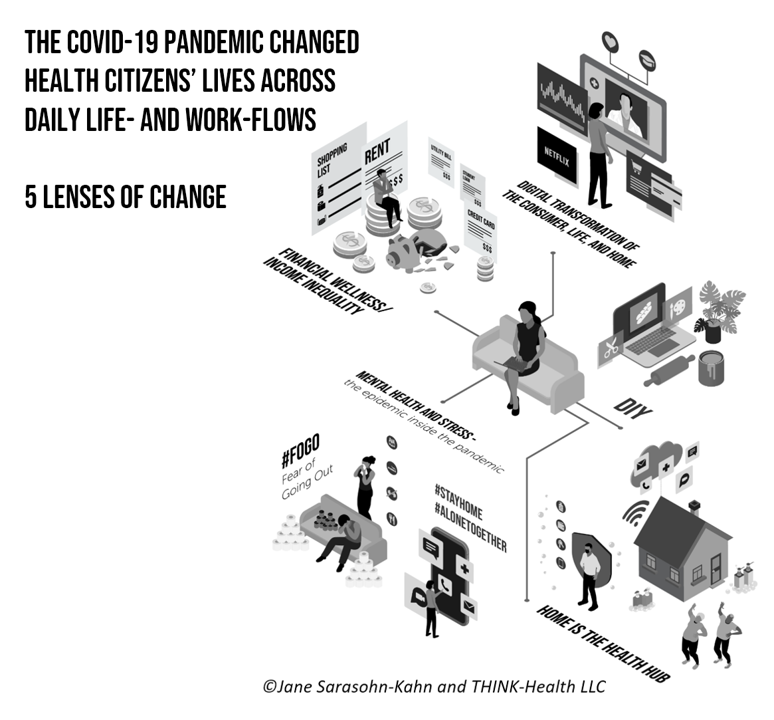

The coronavirus pandemic has re-shaped consumers across many life- and work-flows. When it comes to peoples’ relationship to consumer packaged goods (CPG), the public health crisis has indeed impacted consumers’ purchasing behaviors and definition of “value,” based on IRI’s latest analysis of CPG shifts in 2022 and 2023.

IRI has been tracking COVID-19’s impact on CPG and retail since the emergence of the coronavirus. In this Health Populi post, I’ll discuss the research group’s assessment of CPG shifts of consumer packaged goods through my lens on health/care, everywhere — especially, in this case, the home.

IRI convened a session this week to share the latest research for What’s Next for CPG Demand, Supply and Inflation? The company identified eight key CPG shifts forecasted to persist in 2023…these include,

- Increased at-home consumption

- Premiumization due to hybrid and remote work

- Gen Z and Millennial household formation

- Population shifts to the suburbs and South and Western U.S.

- Shift to digital grocery, .com, and Club channels

- Out of stock and reduced variety due to supply chain challenges

- High inflation and fewer promotions (due to pressure on retail store margins), and

- Demand for self-care, preventive nutrition and at-home consumption that makes health.

Let’s focus on that last shift, which converges with several of the others in IRI’s forecast.

The second graphic from IRI’s May 2022 Client Engagement work illustrates several aspects to self-care at home that’s holistic, covering food-as-medicine demand, home hygiene, well-being, health & beauty, and sustainability.

Post-COVID-19, consumer values are emphasizing convenience, indulgence and taste (we need treats sometimes!), and better-for-you ingredients and functional benefits.

Our definition of “convenience” is changing, IRI has found, as we search for “easy protein,” easy household cleaning, and quick-prep meals to enable us to cook at home, but streamline our workflow in the kitchen (and clean-up).

The third chart serves up examples of the manufacturers by category which IRI has divined exemplify winners in the post-COVID CPG marketplace.

Wearing our health and wellness lens, IRI’s data has shown broad-based category growth for wellness supplements since 2018, with a 10% growth rate per annum. IRI coins this post-COVID-19 preventive-health momentum, especially for functional supplements addressing stress, sleep, and hair loss. This has also been an opportunity for small CPG companies in the omni-channel retail ecosystem.

Hydration and fuel (for energy boosting) will continue to be important in the next couple of years, along with functional foods in new forms and formats (think: protein-enhanced pasta, energy and electrolyte-oriented beverages).

Immune support, metabolism, electrolytes, and cognitive function have been baked into these products, outpacing general growth for food and beverages at retail.

Health Populi’s Hot Points: Our homes have morphed into our health hubs, as we have undergone our personal brands of digital transformation, taking on more DIY tasks (baking, cooking, home renovation), and to be sure, self-care medical care.

We are, arguably, primary care providers for ourselves when we can take on those tasks…increasingly co-making health through virtual care digital front doors that telehealth ramped up during the pandemic.

An important policy insight article in the May 2022 issue of Health Affairs speaks about Home-Based Care Reimagined: A Full-Fledged Health Care Delivery Ecosystem Without Walls.

The pandemic provided an opportunity to reimagine a “distributed, highly coordinated, truly patient-centered care ecosystem that is centered in the home and community,” less focused on typical facility- and institution-based care, the authors describe.

In their model, Ritchie and Leff bake in data and health services research evidence-based best practices, logistics, health care providers, mobile health technologies, chain pharmacies, and community-based social services and caregivers.

I would hasten to add and advocate for the local, regional, or national ecommerce grocery chain into this ecosystem.

Note that Amazon recently expanded SNAP enrollees’ access to food for virtually all beneficiaries throughout the U.S. to the platform; food security eroded and persists in this endemic era of COVID-19 converging with inflation for food and higher prices for housing.

The grocery store as health destination grew in importance and consumer-love during the pandemic. This is an opportunity not to be wasted, especially as the major grocery chains have significant health-and-beauty shelf space, healthier and fresh food options, pharmacies and pharmacists, nutritionists, and a keen interest in serving up health and wellness in their communities. They have also expanded their ecommerce platforms, able to deliver food and products to people at home (think: older people unable to drive, or people homebound due to disability).

I encourage you to review the Health Affairs piece as it discusses the promising hospital-to-home movement with clarity and specifics…especially appreciating an ecosystem that, in the authors’ words, “optimizes support and minimizes harm” through person-centered care, respect for and attention to caregivers, services tailored to peoples’ needs, and medical and social integration.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.