Subscribe if you want to be notified of new blog posts. You will receive an email confirming your subscription.

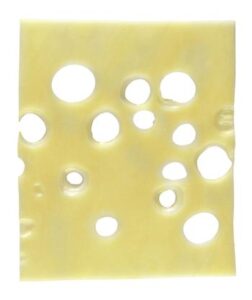

Swiss Cheese Health Insurance? “Benefits Adequacy” Moves To Front & Center

Ending insurance discrimination against the sick was a central goal of the nation’s health care overhaul, but leading patient groups say that promise is being undermined by new barriers from insurers. The Washington Post

In the past year, network adequacy has been one of the hot button issues for Qualified Health Plans (QHPs) in the Federal health insurance exchange. Network adequacy has focused on access to care providers and the narrow networks used by many health plans.

In the next year, the big issue will be around benefits adequacy, i.e., lack of coverage and high out-of-pocket expenses incurred due to high deductibles, co-pays, exclusions, etc. My shorthand for this is “Swiss cheese health insurance—so, so many holes.”

The Canary in the Coal Mine Letter

The canary in the coal mine is a recent letter signed by 333 patient advocacy groups (“the Letter”) to HHS Secretary Sylvia Burwell. (When’s the last time you saw a letter endorsed by 333 organizations!)

The Letter describes three concerns around benefits adequacy, “especially (for) those with chronic health conditions”. Here are excerpts:

1) Limited Benefits: …select plans do not include all the medications that enrollees may be prescribed to address their health care needs. Plans are further restricting access to care by imposing utilization management policies, such as prior authorization, step therapy and quantity limits…. Additionally, there is no requirement for plans to cover new medications and plans can remove medications during the plan year….These design elements appear to affect certain patient populations disproportionately – many of the same populations that were subject to pre-existing condition restrictions prior to ACA implementation.

2) High Cost-Sharing: …some plans are placing extremely high co-insurance on lifesaving medications, and putting all or most medications in a given class, including generics, on the highest cost tier. This creates an undue burden on enrollees who rely on these medications. … enrollees in the Marketplace are being subject to plans that impose 30%, 40% and even 50% co-insurance per prescription. Such high co-insurance is shocking enrollees and will lead to reduced medication adherence and medical complications as people are unable to afford to begin or stay on medications. Some plans are also imposing high deductibles for prescription medications and high cost-sharing for accessing specialists.

3) Transparency and Uniformity: Individuals must have access to easy-to-understand, detailed information about plan benefits, formularies, provider networks, and the costs of medications and services. Unfortunately, individuals cannot access this information easily through an interactive web tool such as a plan finder or benefit calculator that matches an individual’s prescriptions and provider needs with appropriate plans…

The Letter closes by asking for specific actions:

Actions should include enforcing the ACA non-discrimination provisions, prohibiting restrictive formularies and inadequate provider networks; addressing high cost-sharing, including inappropriate use of coinsurance; and improving plan transparency so that consumers can make informed decisions.

The Washington Post article presents the health insurance response to the Letter:

The insurance industry trade group America’s Health Insurance Plans says there’s no discrimination because patients have many options on the insurance exchanges. Gold and platinum plans feature lower cost-sharing, but have higher premiums. Standard silver plans generally require patients to pay a greater share of medical bills, but some have fairly robust drug coverage.

Commentary

This issue of benefits adequacy is destined to become a really big deal. The advocacy group letter simply scratches the surface. I see a lot of complexity underneath:

- There are 20,000+ new health plans in the Federal exchange. How many of these allegedly are out of compliance? How much?

- It’s likely that the network adequacy issue will spill over onto health plans beyond the Federal exchange, particularly those in newly established private health insurance exchanges.

- Expect the states to become deeply involved. At least five states already have enacted laws limiting drug copayments.

- There are thorny legal issues to work through. For example, have health plans violated ACA limitations on denials and exclusions for pre-existing conditions?

- Many unique clinical conditions will need to be considered. For example, the Letter included endorsements from groups advocating for cancer, kidney disease, epilepsy, AIDS, mental health, and many others.

- In the last year, the network adequacy issue made front page headlines in the The New York Times, The Wall Street Journal, CNN, AP, Forbes, The Washington Post and numerous regional news outlets. Many of these articles described heart breaking stories of individuals and families. We should anticipate the same front-page scrutiny for the benefits adequacy issues.

The issues here are tough and not amenable to easy, quick solutions.

Secretary Burwell has agreed to respond to the Letter, and I’d expect her initial response to be something like: “You raise some important points and we promise to look into this more deeply.”

My personal take: There’s a lot of smoke here. The issues around benefits adequacy are definitely worth investigating. Let’s dig out the details.

“You can’t keep your doctor AND you get Swiss cheese health insurance.” That’s NOT a very uplifting tagline for the newly insured.

This work is licensed under a Creative Commons Attribution-Share Alike 3.0 Unported License. Feel free to republish this post with attribution.

[…] posted on e-CareManagement Blog […]