Subscribe if you want to be notified of new blog posts. You will receive an email confirming your subscription.

Amazon is Uniquely Positioned to Deploy Platform Envelopment Strategies in Healthcare: 7 Leverage Points (Part I)

by Vince Kuraitis, JD/MBA and Randy Williams, MD

Last week Amazon announced that “Amazon Care’s virtual health services are now available nationwide—and in-person services will be rolled out in more than 20 new cities this year.” We observe Amazon methodically developing services initially for its own employees and other employers, and potentially positioning itself to serve mass consumer markets.

How is Amazon doing this? Platform “envelopment” is one of the most powerful tactics in the platform strategy playbook. In Part I of this series, we define the term, briefly describe Amazon’s expansion into healthcare, and describe seven of Amazon’s leverage points for employing envelopment strategies. In Part II, we’ll compare Amazon’s ability to leverage these envelopment strategies with companies in five other healthcare sectors.

We’re not privy to Amazon’s long-term healthcare strategy. We want to be clear that what we’re describing is our view of Amazon potential, based on our understanding of what we read and hear.

What is Platform “Envelopment”

The term “envelopment” derives from military strategy. It’s a flanking maneuver — an attack to the side or rear that avoids the enemy’s frontal strengths.

The term “platform envelopment” describes how one digital platform attacks an adjacent market. In plain English, platform companies can leverage an existing user base and existing capabilities into new markets.

Platforms attacking and expanding into neighboring markets is not new. The term platform “envelopment” was defined first in a 2006 Harvard Business Review article and more completely in a 2011 article in the Strategic Management Journal. Here’s a more technical description of the term “envelopment”:

Platform providers that serve different markets sometimes have overlapping user bases and employ similar components. Envelopment entails entry by one platform provider into another’s market by bundling it’s own platform’s functionality with that of the target’s so as to leverage shared user relationship and common components.

Amazon is familiar with the envelopment playbook. For example, Amazon Marketplace allows 3rd party sellers to offer products to online shoppers. Amazon Marketplace accounts for nearly 60% of Amazon’s retail sales.

For the curious, the Appendix at the end lists many other examples of platform envelopment. You’ll be familiar with many.

Amazon in Healthcare

Amazon already has expanded into many diverse areas in healthcare. CBInsights provides an excellent summary and analysis in The Big Tech in Healthcare Report. They note three areas of focus:

Building a Health Services Business for Consumers and Employers. Consumerization of healthcare is creating opportunities for new entrants to outshine industry incumbents with more convenient services. Amazon is all in, with telehealth, pharmacy, and diagnostics offerings for consumers and employers.

Growing Enterprise Sales with AWS for Health. Industry incumbents are partnering with public cloud leaders to transform medical care. Amazon is working hard to make AWS a toptier contender in the industry cloud market.

Building Consumer Demand for Amazon Devices. Consumer devices, like wearables and smart speakers, are finding a home supporting many health focused use cases. Amazon sees opportunities for its and smart speakers and wearables.

A recent article in Managed Healthcare Executive provides more detail about Amazon’s role in healthcare.

Amazon’s Leverage Points for Platform Envelopment

“Technology companies will figure out healthcare…

before healthcare will figure out tech.”

–Shayan Vyas, MD/MBA; SVP Teladoc Health

Amazon has the potential to employ envelopment strategies that other tech or healthcare incumbents can’t easily bring to the table. Let’s take a closer look at some of Amazon’s leverage points:

1) A Huge User Base. Amazon Prime has over 200 million members. Their website receives over 213 million unique visitors a month. As an incumbent platform, Amazon already has network effects and doesn’t have to deal with the chicken/egg problem endemic to start-up platforms.

We wouldn’t be surprised one day to see Amazon offering Prime members a price of $10 for their first telehealth visit. Or a “free” first telehealth visit. Or ongoing telehealth services as a benefit of an expanded Amazon Prime Plus? The possibilities are vast.

2) A Loyal User Base. The previous point is a quantitative measure of Amazon’s user base. We also believe it’s important to qualitatively distinguish Amazon’s reputation for strong relationships and customer experience. From Chain Store Age:

According to the 2019 Amazon Consumer Behavior Report from Feedvisor, customer loyalty to Amazon is at an all-time high. Almost nine in 10 (89%) of more than 2,000 surveyed U.S. consumers, and nearly all surveyed current Prime members (96%) are more likely to buy products from Amazon than other e-commerce sites.

There one more nuance here that distinguishes Amazon from many of its competitors. When Amazon’s users visit their website, most are coming with a predisposition to “buy”. That’s different than how users relate to many other digital platforms — we go to Google to search for information, we go to Facebook to interact with our friends, we use Apple’s hardware to access a diverse range of information and apps. We see Amazon customers “predisposition to buy” as a long-term advantage in developing monetization tactics for healthcare offerings.

3) Provision of Hybrid Clinical Care. A Big Tech or Big Retail company providing in-person clinical is a demanding strategic boundary to cross — and Amazon has crossed that boundary. Not all, but most Big Tech and Big Retail companies will balk at the complexity and cost of this challenge. Amazon’s expansion announcement noted that “in-person services will be rolled out in more than 20 new cities this year.”

4) Deep Pockets. Amazon’s market capitalization currently is $1.6 trillion. The company has had a “retain and invest” growth strategy — a preference to reinvest funds into back into the company rather than recognizing profit.

5) A National and International Footprint. In the U.S., Amazon has a substantial physical presence — warehouses, cargo planes, delivery trucks, Whole Foods stores, and more. Echo and Alexa already serve 80+ countries, and Amazon has major international plans underway. Can you imagine Echo and Alexa as core components of a virtual care platform? Can you imagine Amazon clinics co-located with Whole Foods stores? We can.

6) One-Stop-Shopping for Employers? Employers are being bombarded with a range of healthcare point solutions. They’re fed up. Employers would prefer to deal with fewer healthcare vendors — and Amazon has the potential to consolidate suppliers and offer a differentiated comprehensive solution.

In Stratechery, tech strategist Ben Thompson spelled out how Amazon might expand comprehensive offerings to employers:

What would make more sense to me is that, having first built an interface for its employees, and then a standardized infrastructure for its health care suppliers, is that Amazon converts the latter into a marketplace where PBMs, insurance administrators, distributors, and pharmacies have to compete to serve employees. And then, once that marketplace is functioning, Amazon will open the floodgates on the demand side, offering that standard interface to every large employer in America.

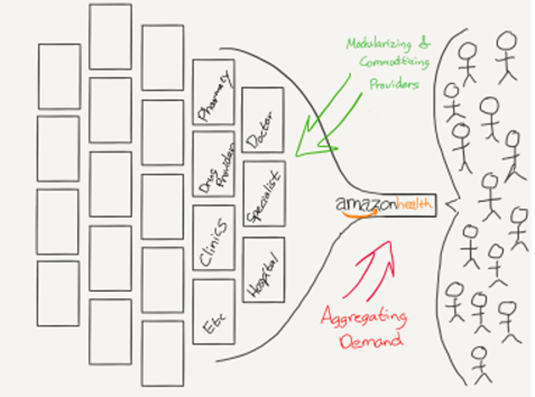

7) Digital Front Door for Healthcare? 74% of U.S. consumers begin their product searches on the Amazon.com site. Anyone care to estimate how many healthcare searches will begin at Amazon 5 or 10 years from now? Ben Thompson again depicted what an Amazon front door for healthcare might look like:

In Part II of this series, we’ll write more about the power of platform envelopment strategies. We’ll take these seven leverage points and compare Amazon’s ability to deploy envelopment strategies with companies in five other sectors of healthcare:

- Virtual care platforms

- Other Big Tech

- Retail Pharmacy

- Other Big Retail

- Regional health systems

Can Amazon be successful in healthcare?

“There is no more patient company than Amazon”

–Ben Thompson, Stratechery

Click here to read Part II in this series.

Appendix

Additional examples of platform envelopment:

- Amazon is Uniquely Positioned to Deploy Platform Envelopment Strategies in Healthcare: 7 Leverage Points (Part I)

- Amazon is Uniquely Positioned to Deploy Platform Envelopment Strategies in Healthcare: 7 Leverage Points (Part II)

This work is licensed under a Creative Commons Attribution-Share Alike 3.0 Unported License. Feel free to republish this post with attribution.