Over the past month we’ve been sharing our framework for helping health systems rethink their approach to investment in delivery assets, built around a functional view of the enterprise. We’ve encouraged providers to take a consumer-oriented approach to planning, starting by asking what consumers need and working backward to what services, programs and facilities are required to meet those needs. That led us to break the enterprise into component parts that perform different “jobs” for the people they serve. We think of each of those parts as a “business”, located at either the market, regional or national level depending on where the best returns to scale are found (and on the geographic scale of any particular system). So far we have described how a consumer-oriented health system should be organized at the market level, with expanded access and senior-care businesses providing lower-cost care in an outpatient setting for many services that were previously delivered in an acute-care hospital, and how the profile of the local hospital needs to change in response.

This week we shift our attention to health system services that can be scaled at the regional level, starting with specialty care, the medical and surgical specialty services that comprise many hospital service lines. Today nearly every community hospital is a “jack of all trades” with the same portfolio of services: obstetrics, cardiac care, orthopedics, and cancer care are the marquee service lines. Incentives, both market-based and internal to the health system, have encouraged this. Hospitals build services aimed at capturing the same handful of profitable (and usually procedurally-focused) DRGs. And many health systems reward local hospital leaders on the profitability of the hospitals they run, creating no incentive for those leaders to shift profitable volume to other hospitals in the system, and often resulting in redundant, inefficient, and sub-scale specialty care services.

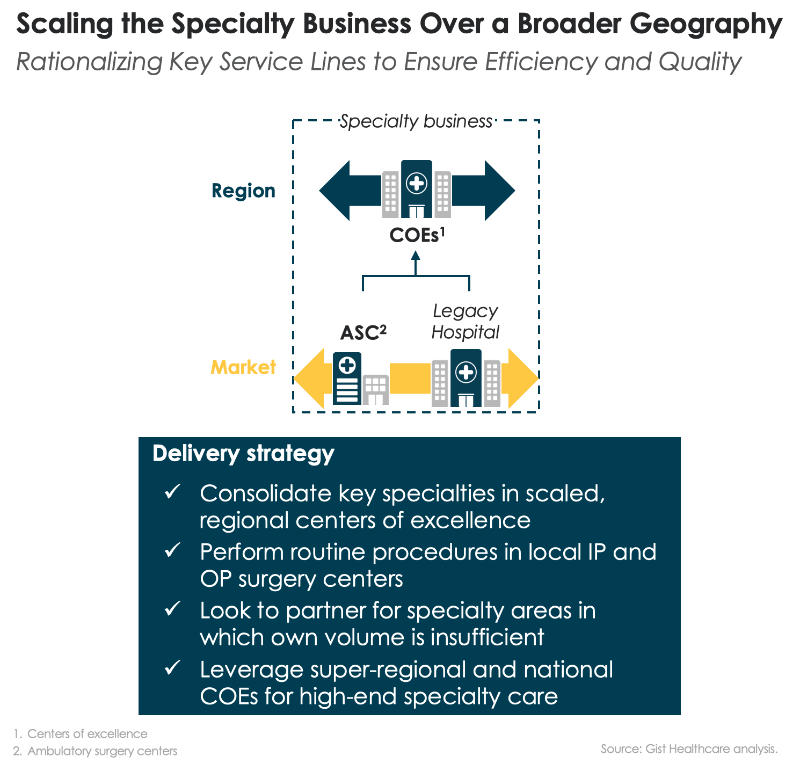

We believe many specialty care services could be improved by moving care “up and out” of the community hospital. As we described before, a large portion of routine surgical care could be moved “out” of the hospital to lower-cost outpatient centers, supported by short-stay capabilities and expanded home health. At the same time, more complex specialty care should move “up” in the health system and be concentrated in regional “centers of excellence”, where expensive talent and expertise can be scaled, and systems can aggregate the volume needed for highly-efficient operations that lower the cost of delivering complex specialty care.

While the center of excellence model is not new, it’s often little more than a marketing slogan. Few systems have deployed it for operational efficiency, redirecting specialty care patients to high-volume-centers—and shuttering their low-volume or sub-standard local programs. Even fewer have invested in the infrastructure needed to effectively coordinate care between a regional center and local providers: telemedicine for effective provider collaboration and consultation, effective information sharing, and strong local care management support. One question inevitably arises: will patients travel for care? As individuals bear a larger portion of the cost of care, they do seem to be willing to travel longer distances in pursuit of better value. Understanding how the consumer “travel radius” changes with higher levels of financial accountability, and how that radius differs among services, ought to rank high on the priority list of systems looking to determine what business to consolidate at regional centers.