The following is a guest article by Jake Sattelmair, EVP and General Manager at Wellframe, a HealthEdge company

The following is a guest article by Jake Sattelmair, EVP and General Manager at Wellframe, a HealthEdge company

Healthcare costs are on the rise in the United States, posing significant challenges for individuals, employers, and health plans. Factors such as an aging population, an increased prevalence of chronic conditions and rising costs for medical technology and prescription drugs have all contributed to the surge in healthcare expenses. Unfortunately, these increased costs are passed on to patients, making healthcare increasingly unaffordable and inaccessible for many.

According to the Average Cost of Health Insurance report, the projected average healthcare insurance premium for a 40-year-old on a silver plan purchased through the Marketplace in 2023 will be $560 per month, a 4% increase from the previous year. The rise in average monthly premiums for silver plans in 2023 will affect states such as Georgia, Colorado, Wyoming, Alaska, and New Mexico the most. Moreover, employers are expecting significant increases in healthcare costs over the next three years, with 7 out of 10 anticipating moderate to significant hikes in what they pay for healthcare benefits.

However, there are ways for health plans to support their members in managing their health and healthcare expenses. Health plans can provide resources, such as preventive care and digital tools, to help members stay healthy and minimize their healthcare expenses. It’s important for health plans to communicate these resources effectively, so that members are aware of the options available to them. In these challenging financial times, it’s crucial for health plans to support their members with empathy and understanding.

The Power of Care Management for Chronic Conditions

Chronic conditions, such as diabetes and hypertension, both cost the healthcare system hundreds of billions each year, and can be costly for individuals to manage over time. Health plans can help their members manage chronic conditions by offering care management programs, which provide support and resources to individuals with chronic conditions. These programs can include regular check-ins with healthcare providers, educational resources on managing the condition, and support for lifestyle changes that can help manage the condition.

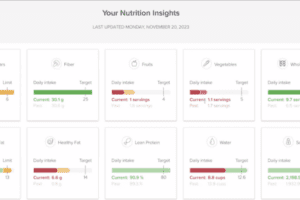

By providing care management programs, health plans can help their members better manage their conditions and avoid more costly complications down the road. Many care management programs include digital tools, which can help members access benefits information, see what preventive information they have access to and how much it costs, and better manage their conditions. Optimal care management is about facilitating communication and delivering relevant and timely health information, and that is where digital tools excel.

Digital Technology Allows Instant Management of Health Needs

Telehealth services, including virtual consultations with healthcare providers and care teams, have become increasingly popular in recent years. Telehealth services are an affordable and convenient way for individuals to receive healthcare services without leaving their homes. Health plans can help their members manage their healthcare costs by offering telehealth services, which can reduce the need for costly in-person visits. Telehealth services can be particularly beneficial for individuals with chronic conditions, who may require regular check-ins with their healthcare providers.

Digital health apps and platforms have also emerged as a powerful way to help manage healthcare expenses. Platforms like these can provide members with easy access to their health information, and may also offer features such as reminders for taking medication, tracking symptoms, and setting health goals. Digital tools have even been shown to help improve health outcomes, such as easing transitions from hospital care settings to in-home condition management. By using easily-accessible digital tools available on the devices they use every day, members can stay on top of their healthcare needs and avoid costly healthcare expenses down the road.

Meeting Members where They Are, with Empathy and Understanding

Healthcare can be complex, overwhelming and expensive, which often stirs up feelings of unease in many members. It’s clear that health plans have a crucial role to play in helping their members manage their healthcare expenses. By providing a range of resources and support, health plans can help their members stay healthy and minimize their healthcare costs. However, it’s not just about what resources are offered, but also how they are communicated and delivered to members. That is why health plans should always avoid jargon when possible, in order to avoid confusing members with unnecessary health terminology.

Health plans can advocate for members and give them the support they need by communicating resources in a way that is clear, accessible and tailored to the member’s individual needs. This may involve offering resources in different formats, such as videos, illustrations, written materials or even one-on-one consultations with care teams, to suit different learning styles. It’s also important for health plans to use targeted messaging to ensure that members are aware of the resources that are most relevant to them.

Countering Rising Health Costs with Care and Communication

Sadly, healthcare costs in the United States will continue to rise for the foreseeable future. However, health plans can provide a range of resources and support to help their members manage and reduce their healthcare expenses. From promoting preventive care and chronic condition management to offering telehealth services and digital health support, health plans can provide their members with the resources and support they need to stay healthy and minimize their healthcare expenses.

By communicating these resources effectively and providing support with empathy and understanding, health plans can help their members navigate these challenging times and manage their healthcare costs. Ultimately, by working together, individuals, employers, and health plans can help make healthcare more accessible and affordable for everyone.