With temperatures over 90 degrees in Brussels today, In Chez S-Kahn, we’ve got fans running, iced coffee brewing, and ice cream on our minds. Thanks to McKinsey, there’s a new report informing my perspective on the ice cream and yogurt market with a lens on wellness and values.

McKinsey advises us on How to stay cool as competition heats up in ice cream and yogurt.

In recessionary and stressful times, consumers often turn to small treats and low-cost luxuries. Ice cream and yogurt fit that bill for many people.

But McKinsey notes that people have concerns about health and ingredients, along with sustainability and corporate responsibility.

Sales for both products are growing globally, but in “different directions,” McKinsey observes. In some markets, consumers are buying more premium ice cream; in other places, consumers are favoring more nondairy options.

One-fifth of consumers traded down for ice cream and yogurt int he past year, and around 13% traded up, spending more for the product.

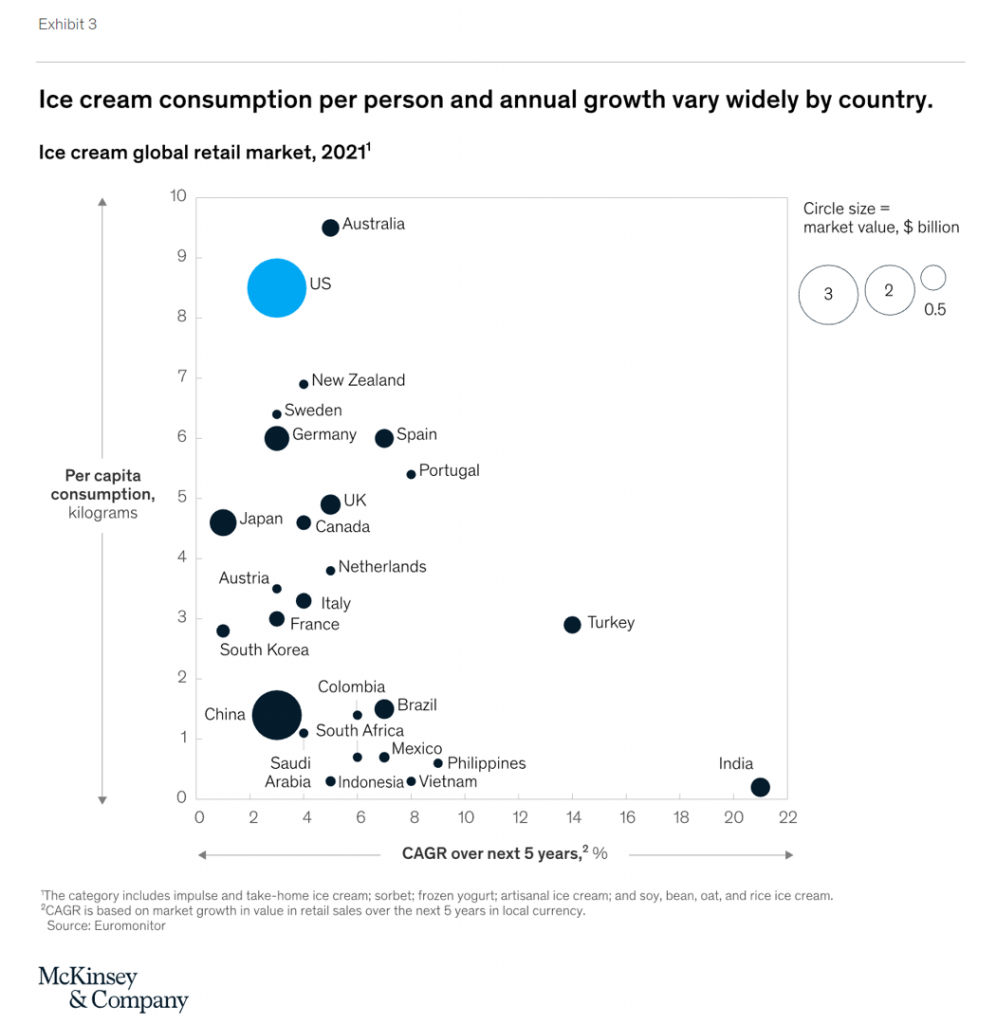

Who consumes the most ice cream on Planet Earth?

This bubble chart suggests that people who speak English tend to eat more ice cream on a per capita basis, in terms of retail sales in the U.S., Australia, and New Zealand (a small market value but high per capita consumption).

But China, at the lower end of per capita consumption, has an ice cream market value approaching the U.S. multi-billion dollar size — driven by population.

McKinsey polled 10,000 consumers between 2015 and 2022 to gauge consumers’ behaviors with ice cream and yogurt. Those looking for better taste and more natural or organic products traded up; those trading “down” sought lower prices at the same level of quality.

Food shoppers are also more focused on health in the wake of the pandemic, which I’ve told you about perennially here in Health Populi. [FYI, here’s my most recent post on grocery stores as health destinations and healthy eating patterns post-COVID-19.]

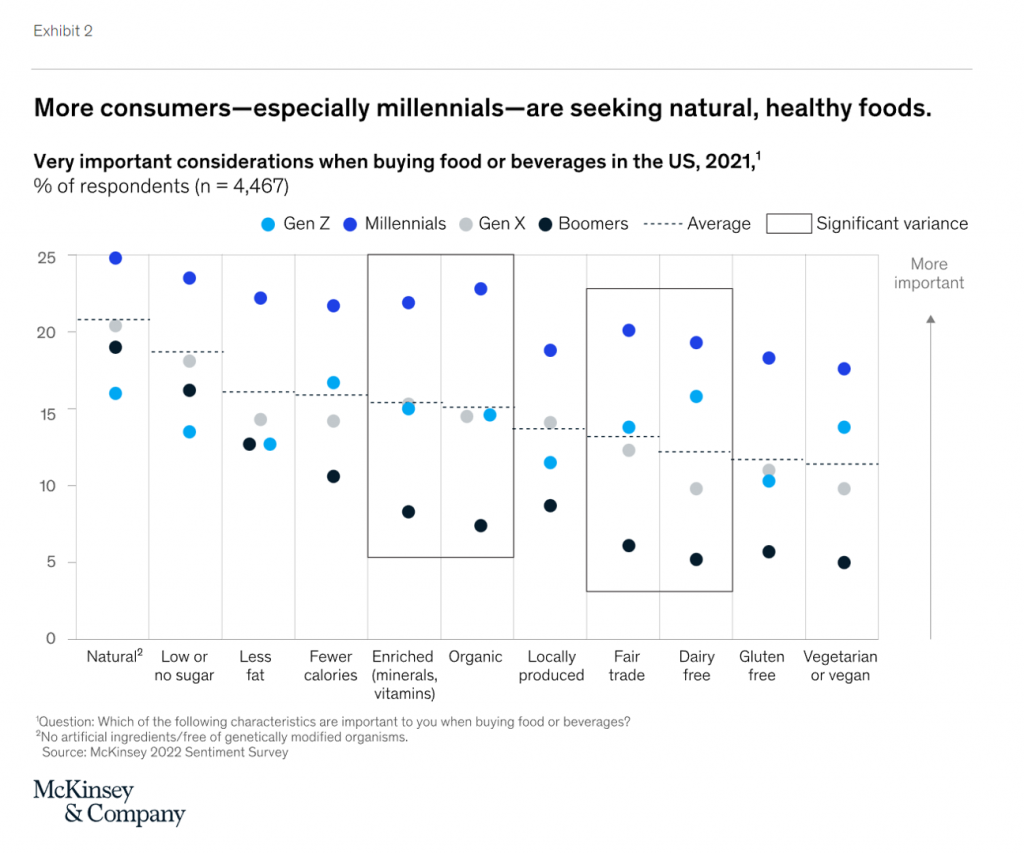

Focusing on consumers’ grocery store shopping, more people are seeking natural and healthy foods, the McKinsey study found. The dotted chart details consumers’ considerations when buying food and beverages int he U.S. by generational cohort.

Millennials and then Gen Z consumers are more likely to be on the lookout for natural, healthy foods: low or no sugar, less fat, fewer calories, enrichment with minerals, organic, local, gluten-free, vegan….these factors rank highest with GenZ consumers.

Boomers generally index the lowest demand for these considerations, roughlky on-par with Gen X consumers for “natural” foods — defined as foods having no artificial ingredients or free of genetically modified organisms in this survey.

“Ice cream grows as consumers splurge and focus more on health,” McKinsey bottom-lines the study….with indulgence growing the fastest as super-premium ice creams expanded by 13% annually.

Super-premium products include low-cart and low-fat ingredients, and the category now comprises 90% of all ice cream sold by the pint.

That demonstrates the relatively high-cost phenomenon for a small indulgence — a pint versus a quarter or half-gallon — as a splurge in tough times.

Health Populi’s Hot Points: “Shoppers are likely to be struggling with new and conflicting priorities every time they walk down the freezer aisle,” McKinsey calls out.

Are you talking to me, McKinsey?

Indeed, that is me and everyone else who delights in the joys of ice cream.

Whether gelato, soft-serve at your local Old School dairy bar, frozen yogurt, or a classic smooth vanilla (some faves pictured here), treat yourself to some ice cream in the midst of global stress, chaos, and anxiety.

Whether or not there’s a heatwave where you live, tuck into some ice cream therapy this weekend….it’s a little indulgence that goes a long way to help us celebrate sweet life, even if it doesn’t feel so sweet in the moment.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.