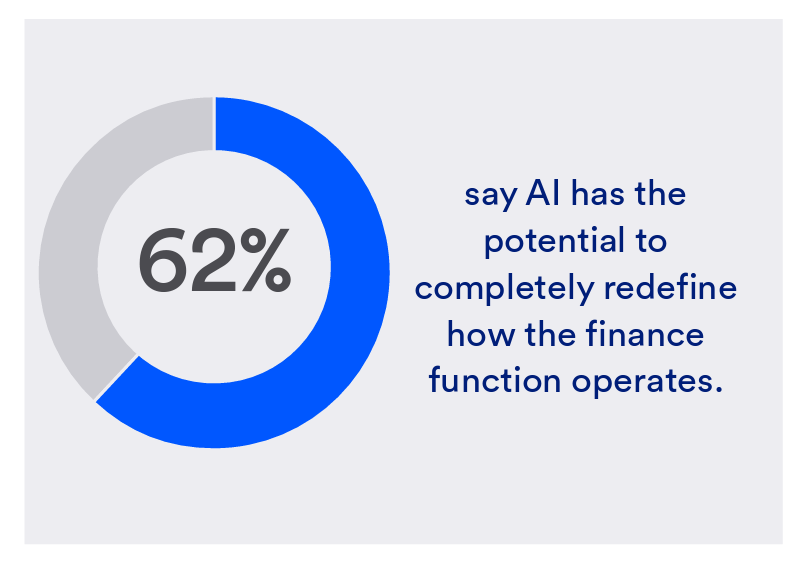

One half-of health care financial leaders plan to invest in technology to cut costs — and most believe that AI has the potential to re-define the entire finance function as they look to Leading the transformation, a study conducted by U.S. Bank among U.S. health finance leaders thinking about emerging technologies.

U.S. Bank fielded a survey among 200 senior health care financial leaders in the U.S., 30% of whom were group CFOs, 20% regional/divisional CFOs, 25% senior managers, and the remaining various flavors of financial managers. All respondents were responsible for at least $100 million in annual revenue; 20% worked in a health care enterprise generating between $2 billion and $5 billion a year.

When asked about the best way to cut costs in their operations, 47% of health care finance leaders said it would be to “invest in technology.”

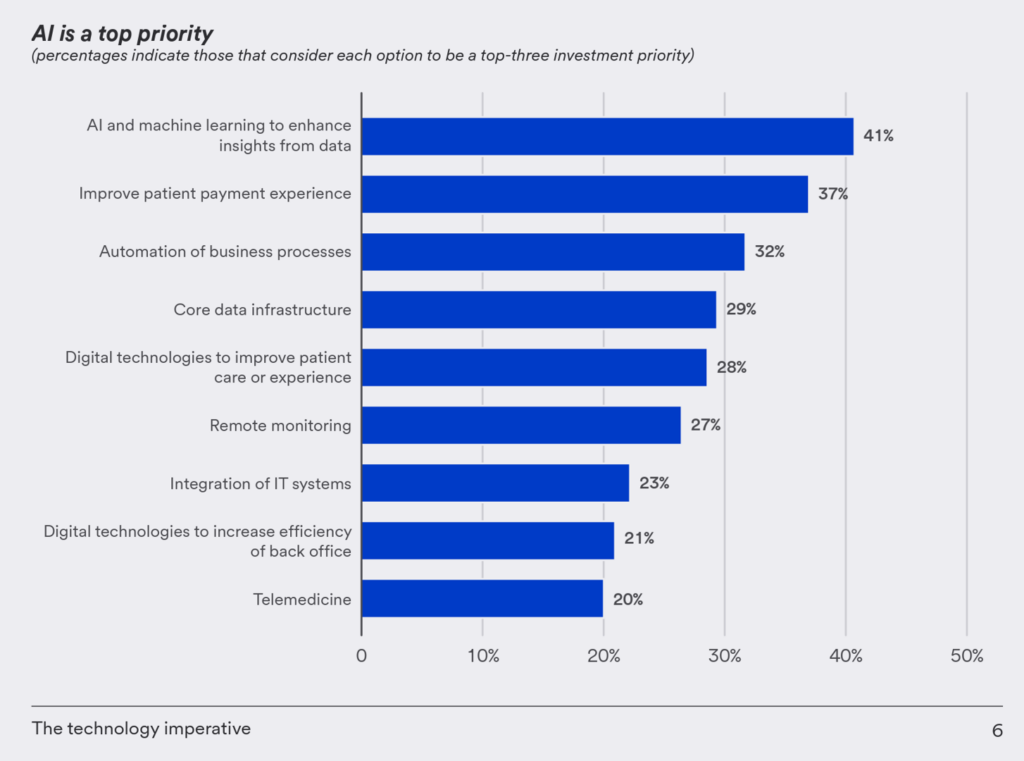

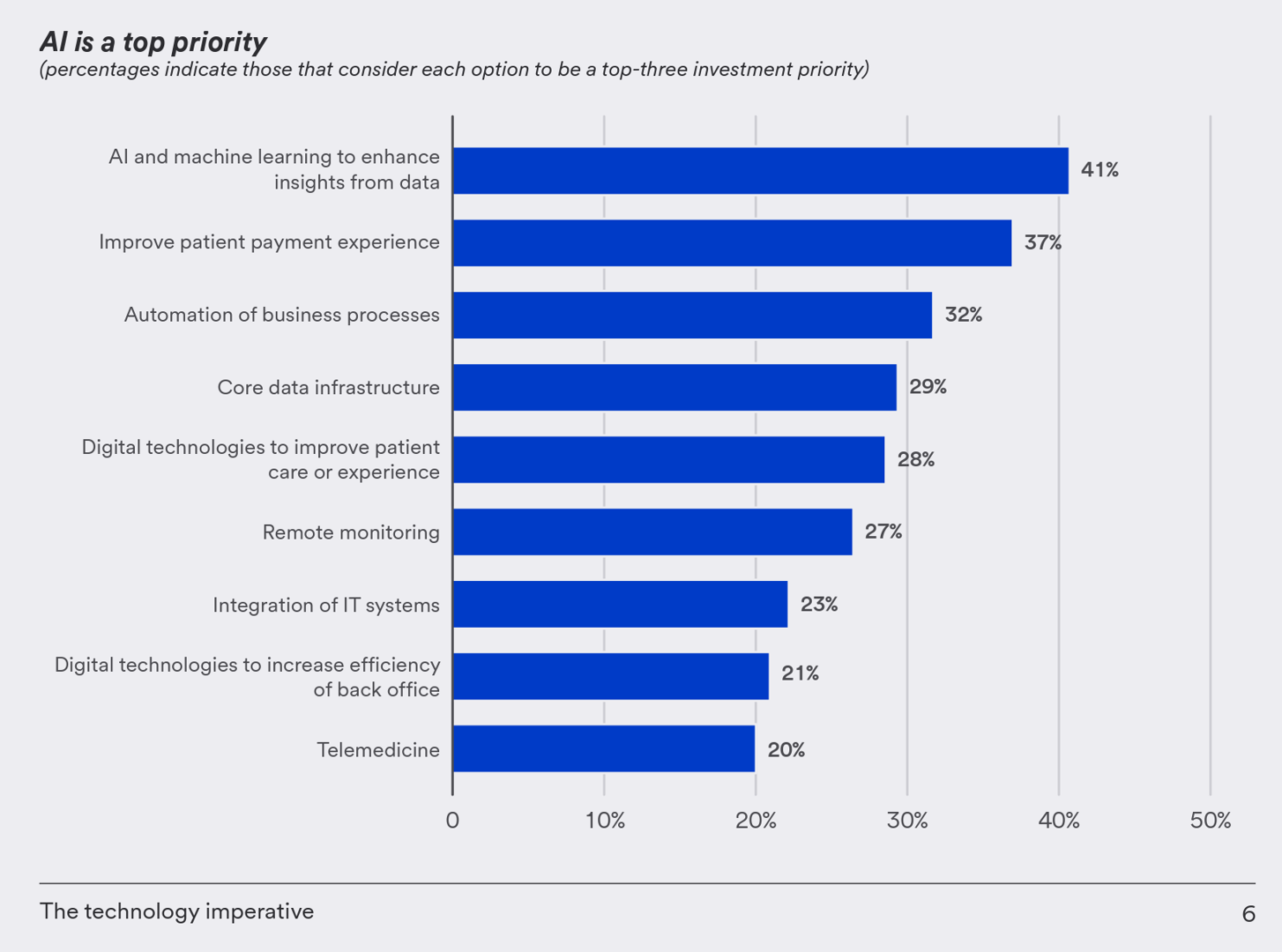

And across all technologies assessed in this study, it was AI and machine learning that the health care finance execs pointed to as a top-three investment priority, followed by improving the patient experience (among 37%), and automating business processes (32%).

“It is not hard to see why AI is on their agenda,” U.S. Bank explained in the report. “It’s already being used in healthcare settings to improve patient outcomes,” pointing to Johns Hopkins’ adoption of an AI-based system that was built to detect sepsis hours earlier than usual protocols, and shown to reduce patient mortality by 20%.

Another way to reduce costs of administration in health care operations is to move from paper to electronic formats — long overdue in the eyes of patients who are increasingly dealing with medical bill paying as payers for out-of-pocket expenses.

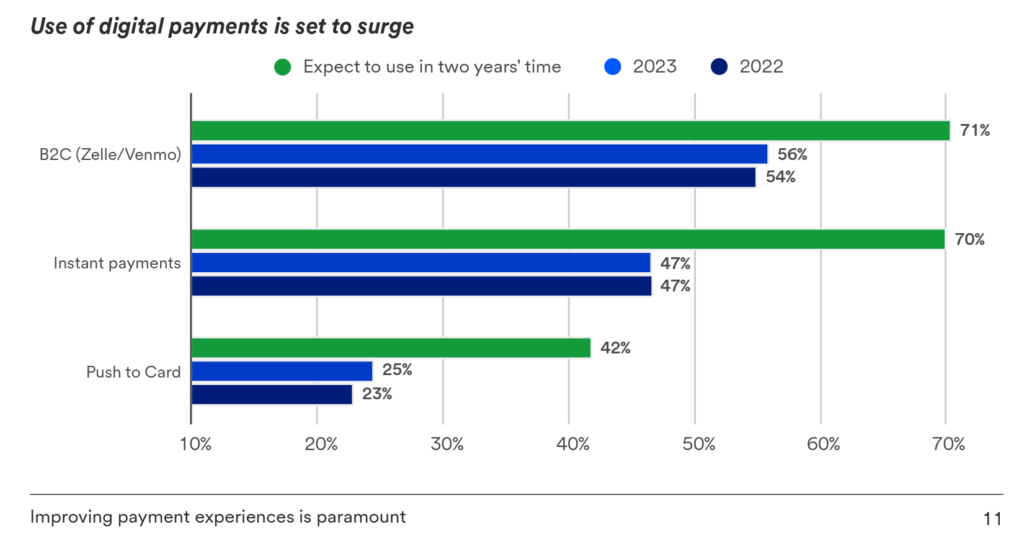

The report explored the health care financial leaders’ perspectives on the use of digital payments, which align with many consumers’ experiences in bill-paying and personal financial transactions conducted in other industries with which people deal on a daily basis.

U.S. Bank found that 54% of the organizations polled already use B2C payment methods like Venmo and Zelle — a higher rate than found in other industry sectors in U.S. Banks experience. The chart here illustrates U.S. Bank’s expectation that the “use of digital payments is set to surge” by 2025.

Health Populi’s Hot Points: The patient’s financial experience in the U.S. is bound up with how they perceive their clinical experience — well beyond the proverbial dates on magazines in clinic waiting rooms (think before pandemic!). Empathy must be baked into a patient’s journey from parking lot to bed or encounter, to bedside (or webside) manner to billing and payment.

“The relationship between healthcare provider, patient and insurance payor is a complex one,” the U.S. Bank noted in its assertion that improving payment experiences is paramount.

In addition to implementing popular B2C digital payment on-ramps like Venmo and Zelle, health care providers and plans can implement instant payments and push to card modes, as well, educating and assuring patients about the safety of using these newer forms of paying.

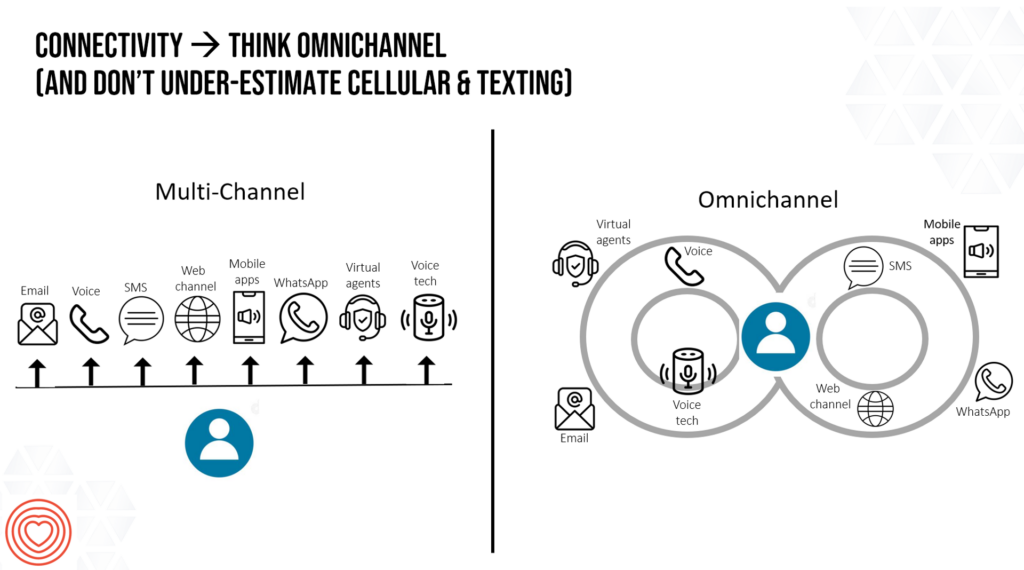

AI can help here, too. Consumers as medical bill payers seek omnichannel engagement with health care the way people do other retail touchpoints, whether banking, booking travel, or ordering groceries.

Thinking omnichannel in health care requires a platform approach putting the patient-as-payor at the center of communications and transactions as shown on the right side of the connectivity chart. Whether texting or online bill pay, digital payment via phone app or mailing a check via postal service….the financial experience is bundled into the overall health care experience. This approach respects the patient where she is, and that’s part of an empathetic approach to design.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.