“CVS wants to be your therapist, too,” the Wall Street Journal reported on 31st August, discussing the plans of retail stores, Big Box and pharmacies, adding mental health services to their growing health/care portfolios.

The coronavirus spawned an epidemic inside and beyond the pandemic throughout the U.S.: very clear and widespread mental and behavioral health impacts that have become a new and transparent normal in America.

Enter CVS Health, joining retail health competitors such as Walgreens and Walmart, both of which have been growing services to help consumers access help to deal with anxiety, depression, and stress.

The first chart comes out of my book, Health Citizenship: how a virus opened hearts and minds. I identify five key health consumer shocks coming out of the COVID-19 pandemic, including personal digital transformation, DIY-everything (that can be done by oneself), financial stress, the home evolving as our health hub, and shown here, mental health and stress.

The first chart comes out of my book, Health Citizenship: how a virus opened hearts and minds. I identify five key health consumer shocks coming out of the COVID-19 pandemic, including personal digital transformation, DIY-everything (that can be done by oneself), financial stress, the home evolving as our health hub, and shown here, mental health and stress.

It’s not that America didn’t have a mental health crisis entering the year 2020. It’s that the public health crisis extended that crisis to more people, and also made it more obvious, helping to erase the taboo that has long prevented too many health citizens from seeking and taking advantage of professional help to deal with anxiety, depression, and stress.

From Fear-Of-Going-Out (FOGO) to feelings of isolation and loneliness, loss of jobs increasing financial instability, and growing risks of people experiencing violence at home during quarantine and lockdown, the need for mental health services grew on the demand side.

On the supply side, the likes of Walgreens and Walmart, and a fast-expanding list of digital health companies tightly focused on mental and behavioral health, joined the ranks of more mature companies in the space such as SilverCloud (acquired by Amwell in July), Ginger and Headspace merging, and Talkspace, whose profile and accessibility Olympian Michael Phelps has helped to bolster.

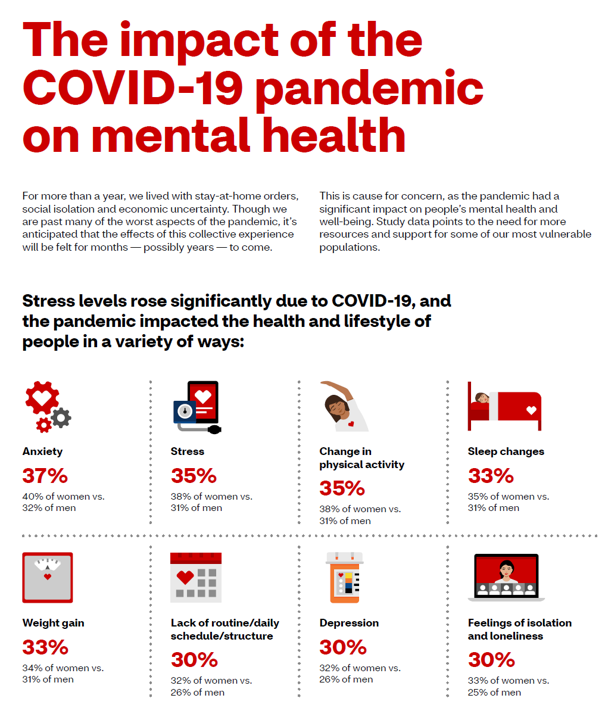

CVS Health’s recent consumer survey explicitly called out the impact of the pandemic on mental health. Note one of the company’s exhibits from their report here, which points out health and lifestyle effects from the pandemic such as sleep changes, weight gain, and changes in physical activity, each of which has re-shaped about 1 in 3 health consumers.

These effects impact people across age groups in different ways, with many older people and young people at-risk of isolation and loneliness. People in middle-years (say, those who fall into the Sandwich Generation responsibilities of caregiving) may feel greater stress financially, for time-splitting between caring for kids in school and aging parents, and home-keeping.

A feature of retail health services is price transparency, so CVS reportedly charges $129 for a mental health assessment and $69 for a 30 minute counseling session. [Compare this pricing with Walmart which, in a recent report I wrote up, charged $60 for an initial 60-minute work-up visit and $45 for 45 minutes of counseling].

For payment, CVS Health will accept most insurance plans which may require copayments, coinsurance, and/or deductibles to be met by patients; or EAP programs which could require a preauthorization number.

CVS is offering mental health services as part of the HealthHUBs program, currently available in about 650 pharmacy storefronts.

Health Populi’s Hot Points: According to a recent story from NPR, CVS launched a pilot program in January 2021, operating in at least twelve stores in Houston, Philadelphia, and Tampa.

In this preliminary phase, CVS will focus on diverse communities lacking in mental health service supply.

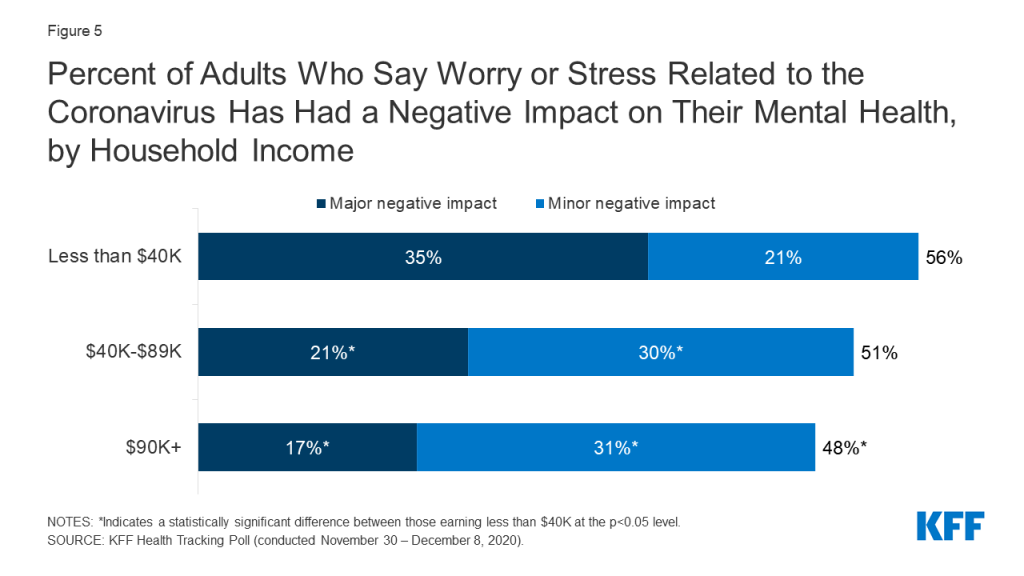

The Kaiser Family Foundation (KFF) conducted research into COVID-19′s impact on mental health, learning that 4 in 10 U.S. adults felt symptoms of anxiety disorder in January 2021 compared with only 1 in 10 between January-June 2019.

The Kaiser Family Foundation (KFF) conducted research into COVID-19′s impact on mental health, learning that 4 in 10 U.S. adults felt symptoms of anxiety disorder in January 2021 compared with only 1 in 10 between January-June 2019.

These symptoms of anxiety or depressive disorder during the pandemic hit more younger adults harder, ranging from 56% of people ages 18-24 compared with 49% of adults 25-49, 39% of adults ages 50-64, and 29% of people ages 65 and over.

Finally, KFF found that people in households having lost a job in the COVID-19 pandemic were over 50% more likely to have anxiety or depressive symptoms compared with those who had no household job loss. And, as the bar chart here details, people who experienced a negative impact on mental health in the COVID-19 pandemic were more likely to be in lower-income earning households than those earning $90,000 or more.

14 million Americans live in medically under-served areas. CVS Health appears to recognize the opportunity to serve people long-under-served by mental health providers — as has Walmart identified this unmet-need. We’re witnessing an era in the U.S. where private sector companies are expanding their health missions to do good and do well at the same time. Here in Health Populi, we called out the Dollar General’s expanding aisle space and mission to health and medical products and services (such as COVID-19 testing). Watch this space, for which the pandemic has inspired growing mission and, the companies and service-innovators hope, margin.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.