The pace of digital health investments quickened in the first half of 2020, based on Rock Health’s look at health-tech financing in mid-year.

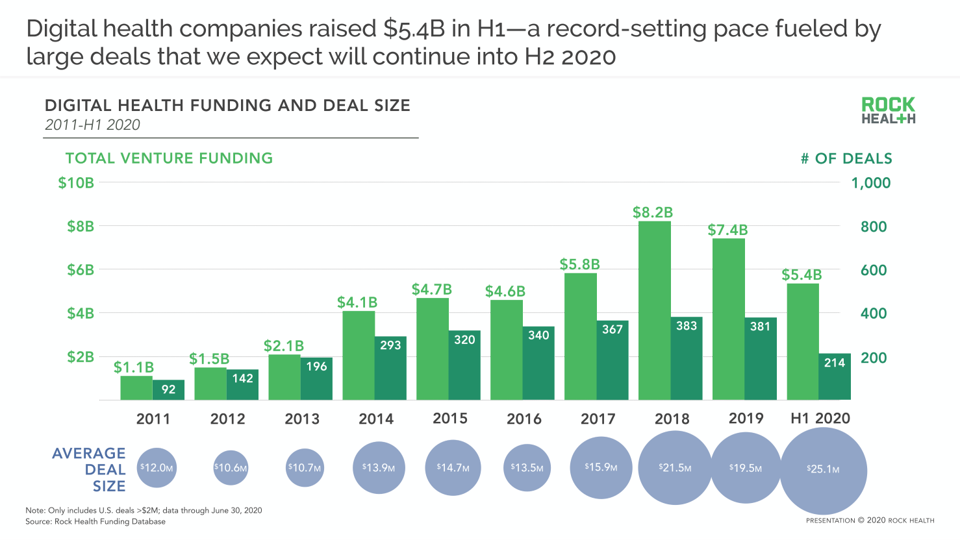

Digital health companies garnered $5.4 billion in the first half of the year, record-setting according to Rock Health. Underneath this number were very big deals, shown by the size of the blue bubbles in the first graphic from the report. Note that in H1 2020, the average deal size exceeded $25 mm.

Digital health companies garnered $5.4 billion in the first half of the year, record-setting according to Rock Health. Underneath this number were very big deals, shown by the size of the blue bubbles in the first graphic from the report. Note that in H1 2020, the average deal size exceeded $25 mm.

Among the largest deals valued at over $100 mm were ClassPass (raising $285 mm), in the business of virtual fitness classes; Alto Pharmacy, a digital prescription service ($250 mm); AmWell, the telehealth company ($194 mm); Element Science (wearable defibrillators, $146 mm); and, Insitro (rising $143 mm, for AI drug discovery).

Another company I’ve followed closely over the past few years was for Outset Medical, the connected dialysis system company, raising $125 mm. I’ve written about Outset Medical here in Health Populi: Home is the New and Future Medical Home for Dialysis.

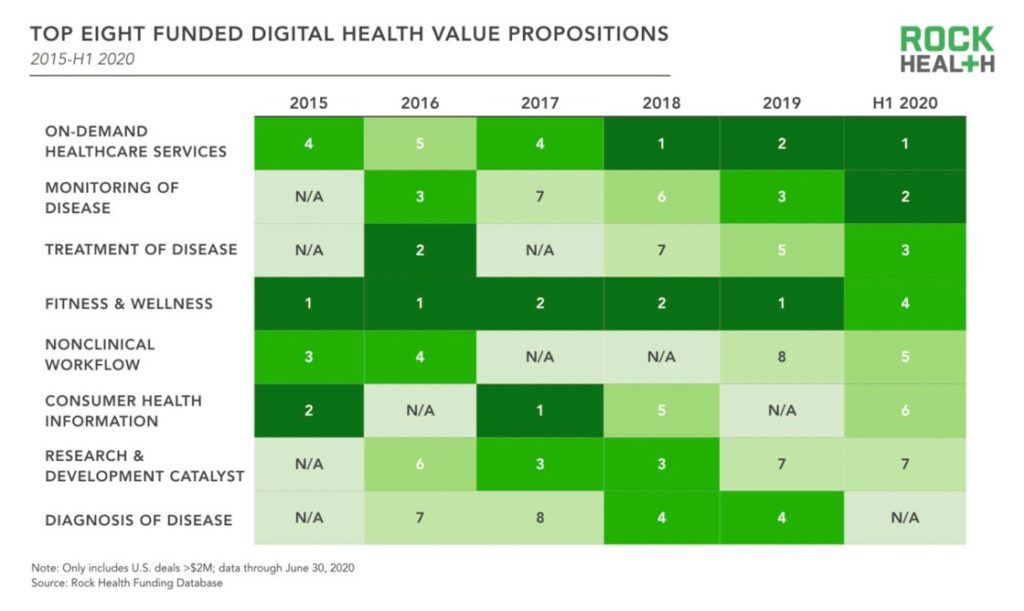

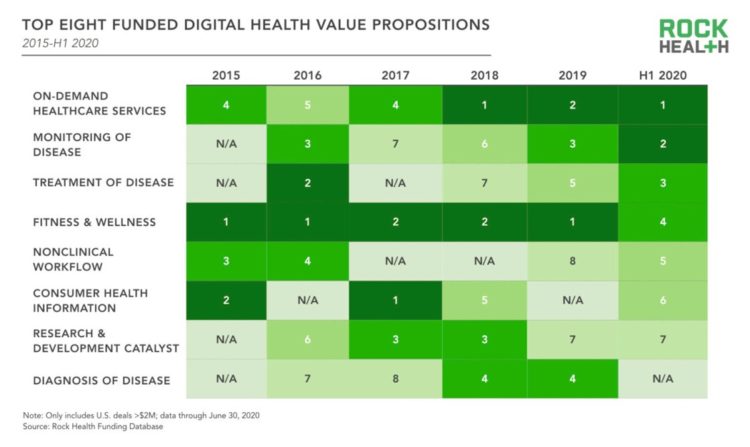

Rock Health assessed eight “digital health value propositions:”

Rock Health assessed eight “digital health value propositions:”

- On-demand health care

- Disease monitoring

- Disease treatment

- Fitness and wellness

- Nonclinical workflow

- Consumer health information

- Research and development catalyst, and

- Diagnosis of disease.

Among these eight segments, the hottest categories of digital health investment in the first six months of 2020 were on-demand health care (like telehealth and virtual care), monitoring of disease, treatment, and fitness/wellness.

s

The COVID-19 pandemic has fostered both ubiquitous mental health challenges for people isolating and physically distancing from others, and the growing awareness that the U.S. healthcare system lacks sufficient behavioral health supply to care for the nation’s health citizens.

The COVID-19 pandemic has fostered both ubiquitous mental health challenges for people isolating and physically distancing from others, and the growing awareness that the U.S. healthcare system lacks sufficient behavioral health supply to care for the nation’s health citizens.

Thus, behavioral health has emerged as a key segment for new investment and innovation, Rock Health asserts in the third chart here from the report. In the top over $100 mm mega-deals struck the first half of 2020, Mindstrong Health raised $100 mm in May to further build out its platform for therapy and psychiatry.

Note that investment in digital behavioral health ventures for the first half of 2020 was greater than total investment in the category for the entire 2019 year.

Rock Health also notes that the most active investors in H1 2020 were provider and biopharma organizations versus pure-play financial companies. Healthcare providers participated in one-third of the corporate investor transactions, followed by biopharma (20% of deals among corporates), traditional tech (16% of deals), and payers (13% of the corporate deals done).

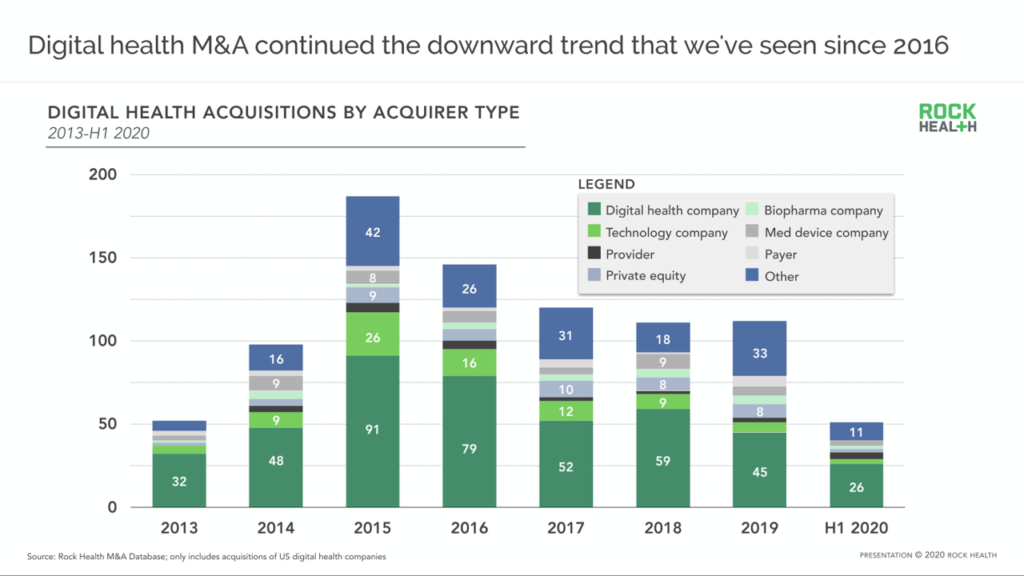

Health Populi’s Hot Points: Pre-COVID19, health care was already vertically integrating enabling services to streamline and build out platforms to enhance delivery and enchanting service design. While M&A in digital health has slowed down, it’s useful to identify some of the deals conducted in the H1 2020 to see how vertical integration is scaling and shaping up.

Health Populi’s Hot Points: Pre-COVID19, health care was already vertically integrating enabling services to streamline and build out platforms to enhance delivery and enchanting service design. While M&A in digital health has slowed down, it’s useful to identify some of the deals conducted in the H1 2020 to see how vertical integration is scaling and shaping up.

Three examples that Rock Health points out are:

- Teladoc, acquiring InTouch Health, a global virtual care provider

- Lululemon buying Mirror, enlarging its footprint in wellness (athleisure clothing) into hardware, services and fitness data; and,

- Optum announcing intent to purchase AbleTo, the digital behavioral health platform

Each of these deals illustrates the fact that scaling and platform building are the new black in health care…and that virtual and digital health are, just, health care channels. We’re officially in the omnichannel health care era now, ushered in by necessity via the coronavirus pandemic.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.