There is one health care public policy issue that unites U.S. voters across political party: that is the consumer-facing costs of prescription drugs.

With the price of medicines in politicians’ and health citizens’ cross-hairs, the pharmaceutical and biotech industries have responded in many ways to the Rx pricing critiques from consumers (via, for example, Consumer Reports/Consumers Union and AARP), hospitals (through the American Hospital Association), and insurance companies (from AHIP, America’s Health Insurance Plans).

With the price of medicines in politicians’ and health citizens’ cross-hairs, the pharmaceutical and biotech industries have responded in many ways to the Rx pricing critiques from consumers (via, for example, Consumer Reports/Consumers Union and AARP), hospitals (through the American Hospital Association), and insurance companies (from AHIP, America’s Health Insurance Plans).

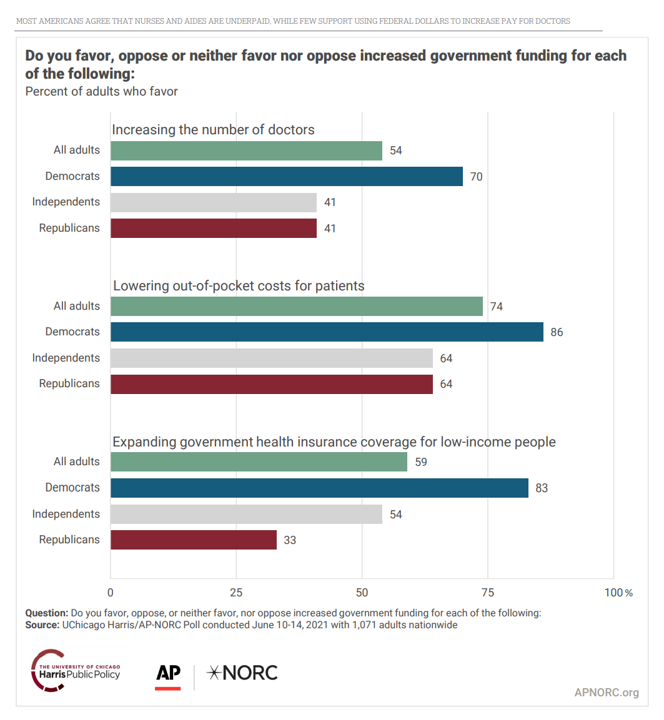

The latest poll from the University of Chicago/Harris Public Policy and the Associate Press-NORC Center for Public Affairs Research quantifies the issue cross-party, finding that 74% of U.S. adults favor increased government funding allocated to lowering the out-of-pocket costs for patients. That 3-in-4 Americans includes 85% of Democrats, 64% of Independents, and 64% of Republicans, as well.

Given our political chasms in the U.S. in this moment, here’s a huge consensus for Americans on a single issue in 2021. [The survey was fielded in June 2021 among 1,071 U.S. adults].

Putting numbers on the components of the cost of prescription drugs in America is a complicated undertaking, and I have worked on drug pricing projects in my “real job” as a management consultant/health economist. So research into the economic burden of drug utilization management identifying a $93 billion cost interests me.

Health Affairs’ August 2021 issue delivers a heavy dose of insights on prescription drugs this month, including one piece by Scott Howell and Perry Yin of Novartis, and James Robinson, health economist from UC-Berkeley. The piece contributes an important angle to the current debate on drug pricing in the U.S. which is happening on both Main Street and Wall Street, modeled and analyzed in Quantifying the Economic Burden of Drug Utilization Management On Payers, Manufacturers, Physicians, And Patients.

Health Affairs’ August 2021 issue delivers a heavy dose of insights on prescription drugs this month, including one piece by Scott Howell and Perry Yin of Novartis, and James Robinson, health economist from UC-Berkeley. The piece contributes an important angle to the current debate on drug pricing in the U.S. which is happening on both Main Street and Wall Street, modeled and analyzed in Quantifying the Economic Burden of Drug Utilization Management On Payers, Manufacturers, Physicians, And Patients.

“Drug utilization management exemplifies the escalating battle between payers seeking to contain costs and suppliers seeking to maximize sales and profits, with patients and clinicians caught in the middle,” as Alan Weil, Health Affairs’ Editor-in-Chief, defines the challenge.

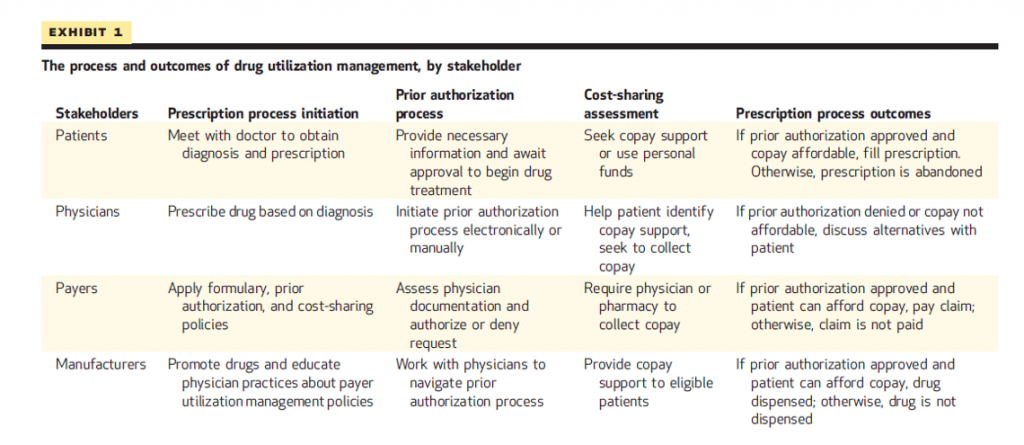

To get to that $93 billion cost, the researchers identified the key stakeholders impacted by drug utilization management programs, the components of the programs that affect each constituent.

First, meet the stakeholders: they are patients, physicians (prescribers, which today can go beyond doctors per se to include nurses, nurse practitioners, pharmacists, and others depending on state licensure), payers, and manufacturers of the drugs.

Note in Exhibit 1 from the article the process and outcomes of UM programs for each of the stakeholders. Every one of the processes generates a cost.

In this study, the researchers identified the following costs by stakeholder:

- For patients, out-of-pocket expenses, including payments for deductibles, copayments, and coinsurance amounts

- For physicians, the cost of time spent interactive with payers on UM programs, including both the prescriber’s time and staff time

- For payers, the cost of administering the prior authorization process, and

- For prescription drug manufacturers, several cost line items: providing or maintaining administrative support services, direct financial assistance (like copay cards), and donating drugs to insured patients via patient assistance programs.

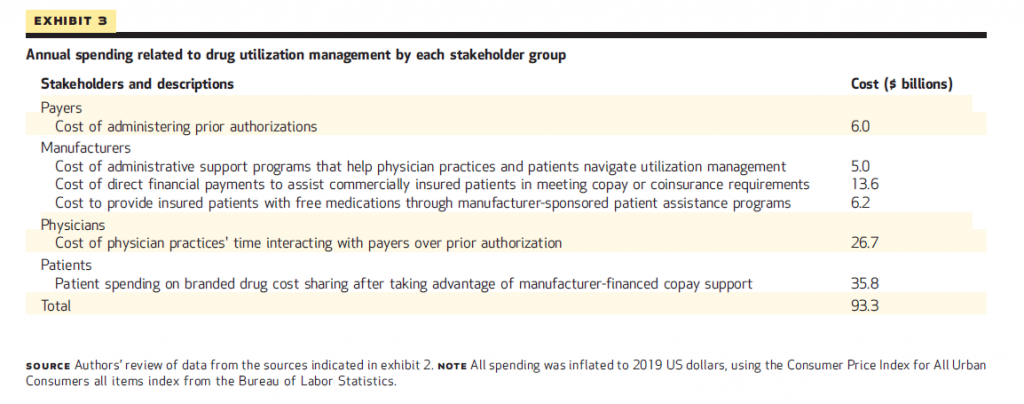

Exhibit 3 shows these costs for each stakeholder, totaling $93 billion.

Exhibit 3 shows these costs for each stakeholder, totaling $93 billion.

These are, in order of magnitude:

- $35.8 bn for patient spending on branded drug cost-sharing after accounting for manufacture-financed support

- $26.7 bn for the cost of physician practice time interactive with payers about prior authorization

- $13.6 bn for manufacturers covering the cost of direct financial payments to commercially-insured patients to meet copays or coinsurance amounts,

with an addition $17 bn for additional cost categories based on the methodology and stakeholder segmentation.

The overall policy implication is that the U.S. drug pricing and access system is economically and politically unsustainable, the authors conclude, relying on high list prices for medicines and “onerous barriers” to patients’ ability to access needed drugs.

The overall policy implication is that the U.S. drug pricing and access system is economically and politically unsustainable, the authors conclude, relying on high list prices for medicines and “onerous barriers” to patients’ ability to access needed drugs.

Their policy prescription is to construct a system based on the exchange of value-based price for value-based access to medicines that prescribers prescribe based on clinical, rather than financial, criteria.

This would reduce administrative burdens that are a source of waste in the U.S. health care system from which other nations and governments are not burdened.

And don’t forget about consumers, who in this economic model bear the largest share of the economic burden of utilization management, nearly $36 bn — more than one-third of the $93 bn tallied in the study for all four stakeholders in the process.

Health Populi’s Hot Points: While U.S. health consumers, prescribers, and pharma manufacturers wait on regulation and policy to sort out health politics between now and the 2022 mid-term elections, the private sector (and State Medicaid programs) move at their will and make decisions based on current market conditions and certainties. In the prescription drug world, the definition of “direct-to-consumer” takes on another flavor this week as UnitedHealthcare launched a program to go DTC with medicines.

Health Populi’s Hot Points: While U.S. health consumers, prescribers, and pharma manufacturers wait on regulation and policy to sort out health politics between now and the 2022 mid-term elections, the private sector (and State Medicaid programs) move at their will and make decisions based on current market conditions and certainties. In the prescription drug world, the definition of “direct-to-consumer” takes on another flavor this week as UnitedHealthcare launched a program to go DTC with medicines.

The macro-strategy for Optum is that, in their mission-words, “health care should be equally available to everyone, when and how they want it. In person, on the phone or online, quality health care is wherever you are,” their website informs us.

On its website, the Optum Store identified 4 ways using the service could make patients’ lives easier, including:

- Offering free prescription delivery in all 50 U.S. states in 5 days or less (or for a fee of $7.99 for 2-day delivery)

- Providing auto-refills for consumers transferring an Rx to Optum and opting-in to the option

- Charging low prices (from $3 for a prescription including free delivery)

- Integrating with the telehealth service Care on the Optum Store.

This last aspect is taking a strategic page out of the playbooks of Hims, Nurx, Ro, Truepill and other DTC-facing prescription drug + telehealth services that have proliferated in the U.S. during the pandemic’s growing roster of contact-less health care companies.

See this graphic from the Care on the Optum Store home page, and ask yourself: doesn’t this like like a Hims or Ro marketing message, pointing to birth control, erective dysfunction, mental health, and hair loss as health consumer-facing health issues for the targeted populations on which these companies focus?

We can marry up the Health Affairs prescription drug cost/UM story with the Optum/UnitedHealthcare DTC drug launch for the larger context of what U.S. health consumers are facing with respect to their out-of-pocket costs, their political perspectives on those costs, and why the retail pharmacy supply-side is fast-moving to meet patients’-as-consumers’ needs for accessing needed, prescribed medicines.

In the world of pharma, you’ve heard the word “blockbuster drug.” That is loosely defined as a product that generates at least $1 billion a year in sales.

Looking at the $93 bn economic burden of utilization management, we’re looking at the cost of about 93 blockbuster medicines. Just think what $93 billion could do to increase the value of access, health literacy for medication adherence, and other benefits to health consumers that reallocating wasteful spending could address.

At the same time, we note the growing health/care ecosystem that is direct-to-consumer and more generally speaking, health@retail. The COVID-19 pandemic has reshaped consumers to “make” more health in their homes and repurpose houses as health hubs. Prescription drugs, Optum/UnitedHealthcare realizes, is one of health consumers’ work-flows at home. To that point, Hims and Hers’ second quarter 2021 financial announcement talked about the companies’ growing their mental health service offering and becoming a “digital front door” for health consumers.

Watch this space as health plans morph into health/care delivery companies, pharmacies evolve into health care providers, and telehealth companies blur into pharmacy distribution channels.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.