Part 1 of 3 Part Series

If your company is still struggling to find a reporting solution to manage leases, you are not alone.

As of January 1, 2019 IFRS 16 is the international accounting standard for lease reporting replacing IAS 17. Companies following IFRS requirements should have already implemented a solution to ensure reporting compliance. Yet, the reporting tool to manage and calculate leases may not be ideal. Solutions such as Excel files, emails, SharePoint or multiple applications may be cumbersome, time-consuming and difficult to use.

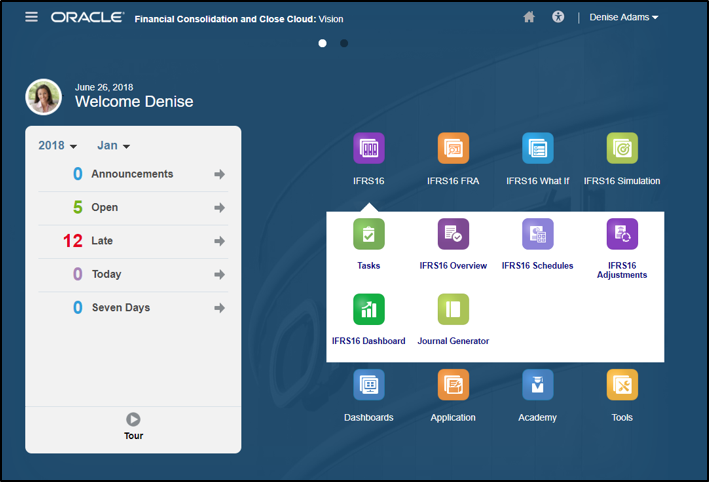

Reviewing all possible reporting tools is nearly an impossible task for one person to accomplish. In this three part blog series, I will review Oracle’s Financial Consolidation and Close Cloud (FCCS) with their IFRS 16 solution for lease reporting and management.

In Part 1, I will evaluate the application as an out-of-the-box solution provided by Oracle. However, a good Oracle Partner can customize during implementation to your company’s specific requirements. Stay tuned for Part 2, in which I will review the schedules and calculations, and finally Part 3 for a review of the journal generator. All screen shots included in this blog post are from an Oracle provided demo.

Guide to Oracle Cloud: 5 Steps to Ensure a Successful Move to the Cloud

Explore key considerations, integrating the cloud with legacy applications and challenges of current cloud implementations.

Leveraging Cloud Capabilities

FCCS is Oracle’s Cloud Application for consolidation and close procedures. This benefits companies enabling anyone to access lease details. Oracle’s IFRS 16 solution is a lease repository, but also calculates the schedules required to generate monthly journals. The IFRS 16 solution leverages FCCS’ consolidating capabilities to create the required schedules using Supplemental Data Management (SDM).

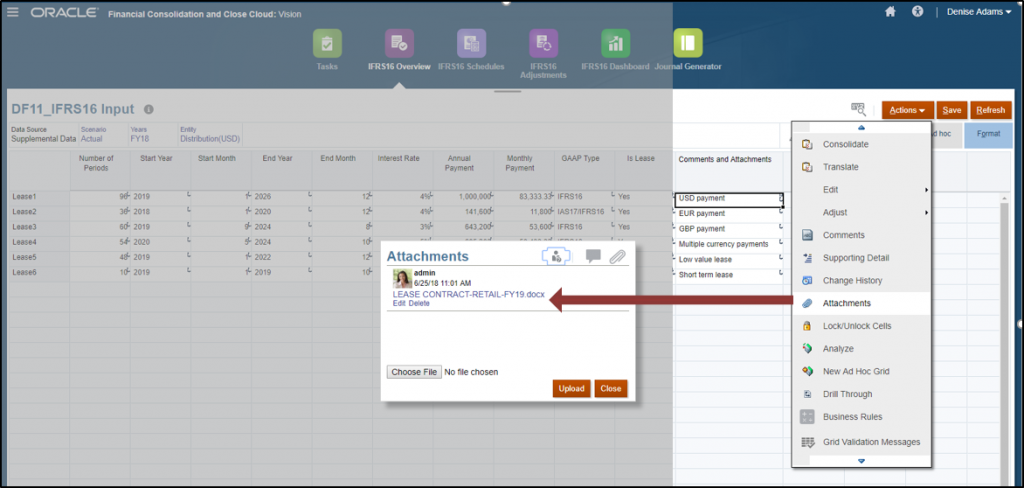

The IFRS 16 solution stores all the core lease information such as number of periods, start year/period, end year/period, interest rate, annual payment and monthly payment within FCCS directly. Another great benefit is that the lease contract can be stored within the application. All information pertaining to the lease resides in one location.

Testing proved that the out-of-the-box solution works with a standard dimensionality application. The consolidation action runs the rules that calculate the schedules. The system rules do not function with an extended dimensionality FCCS application. The IFRS 16 solution and calculations works with standard dimensionality FCCS application.

Supplemental Data Management

As mentioned earlier, SDM captures additional attributes of a lease within FCCS. SDM calculates the schedule by contract period using one of the custom dimensions. The Oracle demo used the following lease attributes: Contract ID, Contract Code, Payment, Payment Type, Payment Method, Asset Code, and Asset Name to list a few attributes. It should be noted that these attributes can be tailored to your company or updated headers in alignment to company terminology.

The next step is to review the schedules and calculations.