While providers have shown some receptivity for telemedicine over the last decade, (e.g. beaming in specialists for acute consultations in rural areas) they’ve been less eager to adopt telehealth – generally defined as video-based visit platforms to connect patients and doctors to replace an in-person visit with a virtual one. Many have pointed to the writing on the wall:

- Reimbursement policy continues to progress, plan by plan and state by state

- Consumerism has arrived, and patients can now ping a doctor to see them in less than 3 minutes, or go to their local pharmacy or standalone urgent care clinic

- By next year, over half of US employers are expected to offer coverage for virtual visits in their benefits programs

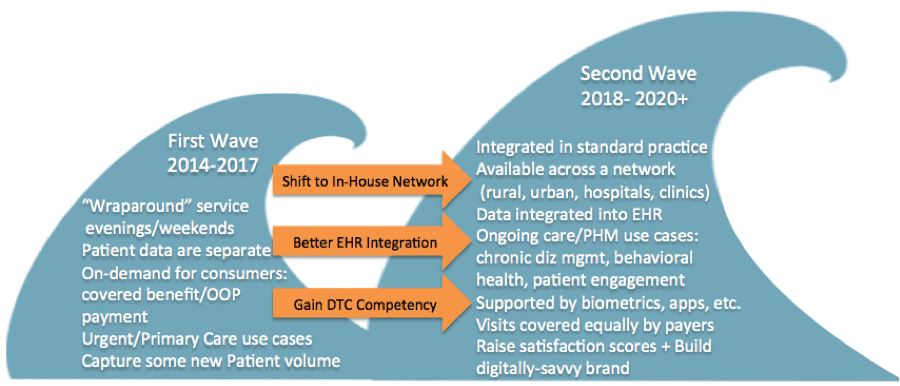

The notion seems to be that traditional office practices, facing competition from new sources, will eventually incorporate video-based care en mass. Cultural resistance by the provider arm will slowly recede, driven by new generations of tech-savvy med school grads and the supply and demand economics of a shrinking workforce and a growing patient population. Yet this evolution, by nature, will not happen overnight, meaning that what we’re seeing today by providers is very much a “first wave” of adoption.

A Limited Value Proposition in First Wave of Telehealth

As providers tiptoe towards virtual visits, they’ve largely sought to supply wraparound care to extend office hours to their patients on evenings and weekends. Today’s common use cases (coughs, colds, rashes, eye infections, UTI’s etc.) are relatively fungible; they’re not as dependent on a pre-existing relationship with a doctor, or access to a complete clinical record. Not coincidentally, this approach largely reflects today’s standard vendor offering, with a “leased” network of unaffiliated virtual doctors, and a separately maintained medical record with little in the way of structured data interchange. From what we saw at ATA, most telehealth “EHR Integration” out there refers mostly to a slick UI layer, with little or no actual clinical data transfer.

Figure: The First Wave of Telehealth Adoption by Providers

Though vendors are angling to sign provider clients, such present efforts pose serious challenges to the long-term viability of the leased network model. In an ACO style model, hiring a rental network of unaffiliated doctors whose visit summary notes cannot be easily added to patients’ central records seems like a non-starter. Looking towards such emerging systems of value-driven care delivery, what role will telehealth ultimately play? Groups like KP and Cleveland are using their own docs, aware that mastering this new channel of care delivery is in their best long-term interests.

While best suited for non-emergent use cases today (a logical starting point), virtual visits will eventually move beyond urgent care use cases by offering the chronically ill masses more convenient access to ongoing care. In theory, virtual visits can improve efficiency by reducing unnecessary in-person visits. They can promote ongoing self-care for high-risk populations if coupled appropriately with remote patient monitoring devices, disease management apps, group visits, and so on. From a business vantage point, developing a tech-savvy brand will become a selling point – check out United Health’s latest commercial.

Bottom Line: A Consumer-Driven Model of Care

For all the shortcomings of today’s provider-focused telehealth models, the one area where vendors can provide immediate value and support to office practices is helping them figure out the brave new world of DTC. Facing new digital or retail competition, primary care practices will need to move beyond a wraparound model and articulate a true value proposition for their patients, more akin to an Iora or ChenMed models. For vendors this could mean expanding their service offerings (Seattle-based Carena has been teaching customers about online marketing, targeting mothers and families), or serving as the middleman between a delivery system’s own physician network and a more consumer-friendly access point (Healthspot’s latest pilot, with Cleveland Clinic and Rite Aid.)

Whatever the approach, it is clear that today’s telehealth models are only the beginning. The technology is already improving: HealthSpot’s Xerox partnership offers data accessibility across platforms, while American Well’s Healthkit integration pulls patient data into a clinician-friendly view. Given the pace with which things have progressed over the last three years, we expect virtual visits to be embedded into day-to-day practice in dozens of urban health delivery systems by the end of the decade, if not before then. While provider culture has proven tricky to change, telehealth’s success ultimately boils down to enabling better access than we have today.

Note: For Chilmark Advisory Service (CAS) Subscribers, this month’s Domain Monitor will delve deeper into the state of telehealth models for the provider market, comparing efforts by leading vendors and analyzing the specific challenges of today’s technology and business models.

0 Comments

Trackbacks/Pingbacks