Tools for Paying Medical Bills Don’t Help Health Consumers Manage Their Financial Health

Health Populi

FEBRUARY 24, 2020

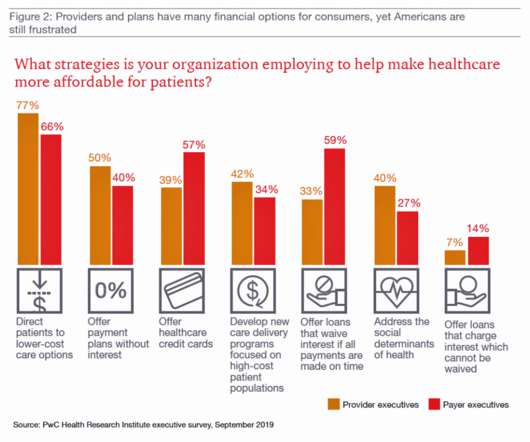

There’s a gap between the supply of digital health tools that hospitals and health systems offer patients, and what patients-as-consumers need for overall health and wellbeing. This chasm is illustrated in The future of the digital patient experience , the latest report from HIMSS and the Center for Connected Medicine (CCM).

Let's personalize your content