In 2018, spending on branded prescription drugs will fall in wealthy countries, while spending on specialty drugs will increase, resulting in flat medicines spending.

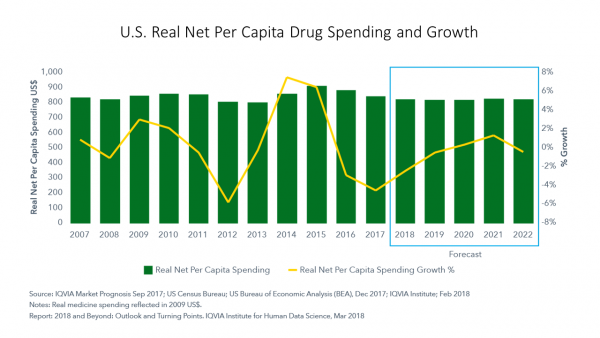

In the U.S., net spending on medicines will fall in 2018 and remain flat at about $800 per person, according to forecasts in 2018 and Beyond: Outlook and Turning Points, from the IQVIA Institute for Human Data Science.

“Concerns about existing medicine costs have captured significant attention,” the introduction warns, setting the stage for slowing growth. Key factors for slow growth include payor concerns about budgets and the consideration of value when deciding on access for new specialty drugs – which are typically high-cost products compared with traditional pharma medicines.

87% of the $69 billion of net growth in medicines spending came from the U.S. over the past five years. This, in contrast with other developed countries who tend to manage prescription drug costs more aggressively and/or directly through single-payer financing systems or reference pricing regimes.

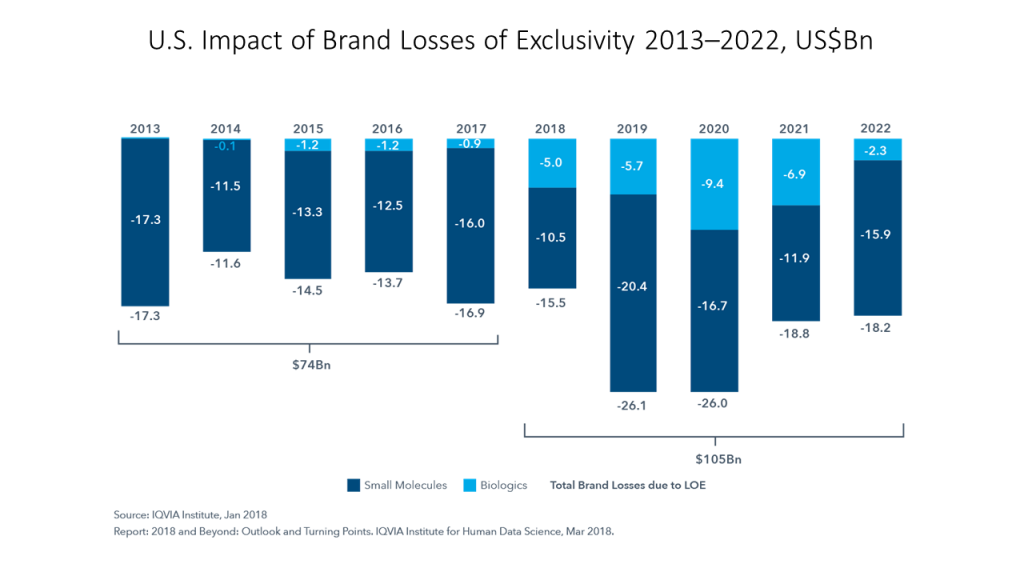

Spending will moderate  in part due to the loss of exclusivity for some major Rx products — that is, the loss of patent protection, with entrants of generics and biosimilar competition.

in part due to the loss of exclusivity for some major Rx products — that is, the loss of patent protection, with entrants of generics and biosimilar competition.

Specifically, $19 billion worth of biotech spending will find biosimilar competition starting in 2018 for the first time. This year is the largest single-year change to-date, IQVIA points out, and is the beginning of a wave of biosimilars like ones we’ve seen for generic drugs going off-patent in the past fifteen years.

Some of the biosimilars expected include big-names like Humira for autoimmune diseases like arthritis, plaque psoriasis, and Crohn’s disease (worth about $18 bn); Lantus for diabetes (about $11 bn); Enbrel, used similarly to Humira ($10 bn); and, Remicade which, like Humira and Enbrel, is prescribed to deal with arthritis and inflammation (accounting for about $8 bn).

IQVIA sees the U.S. as an outlier with brand net spending growth of 1% to 4% compared with other developed markets remaining flat or declining due to their aggressive management of access to new products.

In the context of this flat-growth scenario, medicines makers are adopting some innovative approaches to development including incorporating the use of real-world evidence which is being fostered by the FDA; bundling the use of digital health tools with medicines in the growing era of digital therapeutics; and, recognizing the growth of telehealth which could enhance patient engagement and result in improved outcomes, such as medication adherence support.

Health Populi’s Hot Points: The big wild card in forecasting what prescription drug spending will look like in the U.S. is just how aggressive Dr. Alex Azar at the Department of Health and Human Services, and Dr. Scott Gottlieb at FDA, want to be regarding drug pricing. In the past year, it’s been pricing, not volume, that’s drive medicines price growth in America, as I explained here in Health Populi. While we note, “It’s the prices, stupid” applying to inpatient hospital costs, it’s also true that price, not utilization, has underpinned the recent growth in prescription drug spending in the U.S.

A new report from The Commonwealth Fund was published today as I was uploading this post about healthcare prices in the U.S. continuing to drive up healthcare spending. The report pointed especially to hospital and pharmaceutical prices.

However, IQVIA expects that short-term drug spending in America will moderate based on patent expirations and the arrival of some very popular therapies for auto-immune conditions.

President Trump made clear on the campaign trail and in his interview with TIME magazine as Person of the Year that pharmaceutical companies’ pricing needed to be reined in using government pressure. We don’t know yet what form that will take, but there is some indication that Dr. Azar is has his sights on some form of prescription drug pricing program, perhaps beginning with Medicare Part B. As we know from the Trump Administration in power for the past fourteen months, we must keep our collective eye on this ball on a daily basis. For now, IQVIA’s forecast must be heeded by pharma along with the rest of the healthcare ecosystem: we all need to learn to do more with less.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.